PACRA upgrades entity ratings of SLGL to 'A+'

MG News | May 15, 2024 at 09:55 AM GMT+05:00

May 15, 2024 (MLN): Pakistan Credit Rating Agency Limited (PACRA) has updated the entity ratings of Secure Logistics Group Limited PSX: SLGL) from "A" to "A+" for the long-term and "A1" for the short-term with a stable outlook forecast.

SLGL shared the development in its notice to the Pakistan Stock Exchange (PSX) on Wednesday.

The company has executed substantial deleveraging through Pre-lnitial Public Offering (IPO) and IPO proceeds.

Subsequently, PACRA carried out a credit review.

"The company is pleased to announce that the review has resulted in an upgrading of SLGL's long-term credit rating from single A to A+," reads the notice.

According to PACRA's press release, Secure Logistics is an integrated logistic group with synergetic business lines of Logistics, Asset Tracking and Security Services.

Recently, the company successfully concluded its IPO and achieved a listed status on Pakistan Stock Exchange (PSX).

The primary purpose of IPO was (i)substantial deleveraging of the Balance Sheet through repayment of the debt (ii) expansion in distribution segment by addition of new Vehicles (iii) Investment in IT infrastructure along with the development of B2B third-party marketplace (iv) expansion of logistic services to the Regional markets through the TIR license, that would strategically position the company to capitalize on emerging opportunities within the region (v) establishment of sophisticated multiple warehousing facilities across the major logistical hubs / Special Economic Zones (SEZs) of the country.

During Q1 2024, the company also acquired ~75% stake in Sky Guard (Pvt) Ltd, (a security service provider company to enhance operations of security-related services in Gilgit Baltistan and Azad Jammu & Kashmir. Sponsors of SLGL have a clear vision about its future growth plans and intends to place SLGL as a tech enabled 3 PL player with regional coverage.

SLGL’s value proposition is also enhanced by its holding company structure and the formidable ownership arrangement which includes prominent local and international investors, its value proposition, and sustainable business fundamentals, all underpinned by well-established repute and relative market position.

The Board of SLGL is compliant with the code of corporate governance and comprised of highly skilled individuals with extensive yet diverse experience and independent oversight roles, whereas the operations of the company are managed by skilled professionals and complemented by robust internal control systems seamlessly integrated throughout the group.

During CY23 the company’s top line grew by ~25% mainly due to price inflation and an increase in capacity utilization, however, GP margins showed dilution and stood at ~23% (CY22 ~29%).

The logistic industry of the country is highly fragmented with a dominating large unorganized/informal segment, it also faces challenges due to soaring inflation, rupee devaluation, and high policy rates.

On the flip side, there exists a notably sluggish pace of technology adoption, hindering the infusion of innovation and efficiency.

However, the planned enhancements to existing road infrastructure and the establishment of new SEZs under CPEC projects are poised to serve as opportunities for the logistics industry.

Financial risk profile of the company is considered good with comfortable coverages, cashflows, and working capital cycle.

Capital structure is moderately leveraged as of CY23, but the postIPO substantial portion of borrowings have been paid off, and all future expansion would be funded by internally generated cashflows.

The ratings are dependent upon the improvement in business profile and successful implementation of business strategy, PACRA said.

A prudent financial performance in line with the financial projections, an effective liquidity profile, and maintaining financial discipline shall remain imperative.

Copyright Mettis Link News

Related News

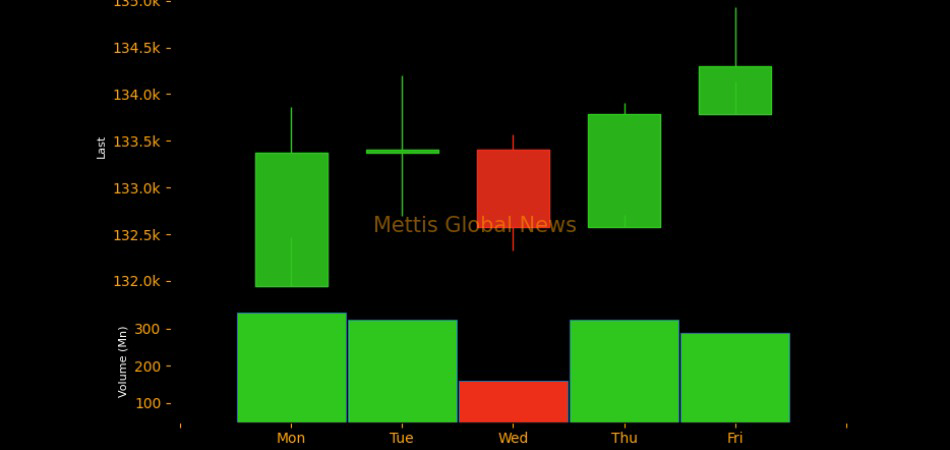

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|