OPEC+ supply talks drive oil prices higher

MG News | March 01, 2024 at 10:35 AM GMT+05:00

March 01, 2024 (MLN): Global oil prices gained on Friday as markets anticipated a decision from OPEC+ on supply agreements for the second quarter amid contrasting demand indicators from the U.S. and China, the major consumers.

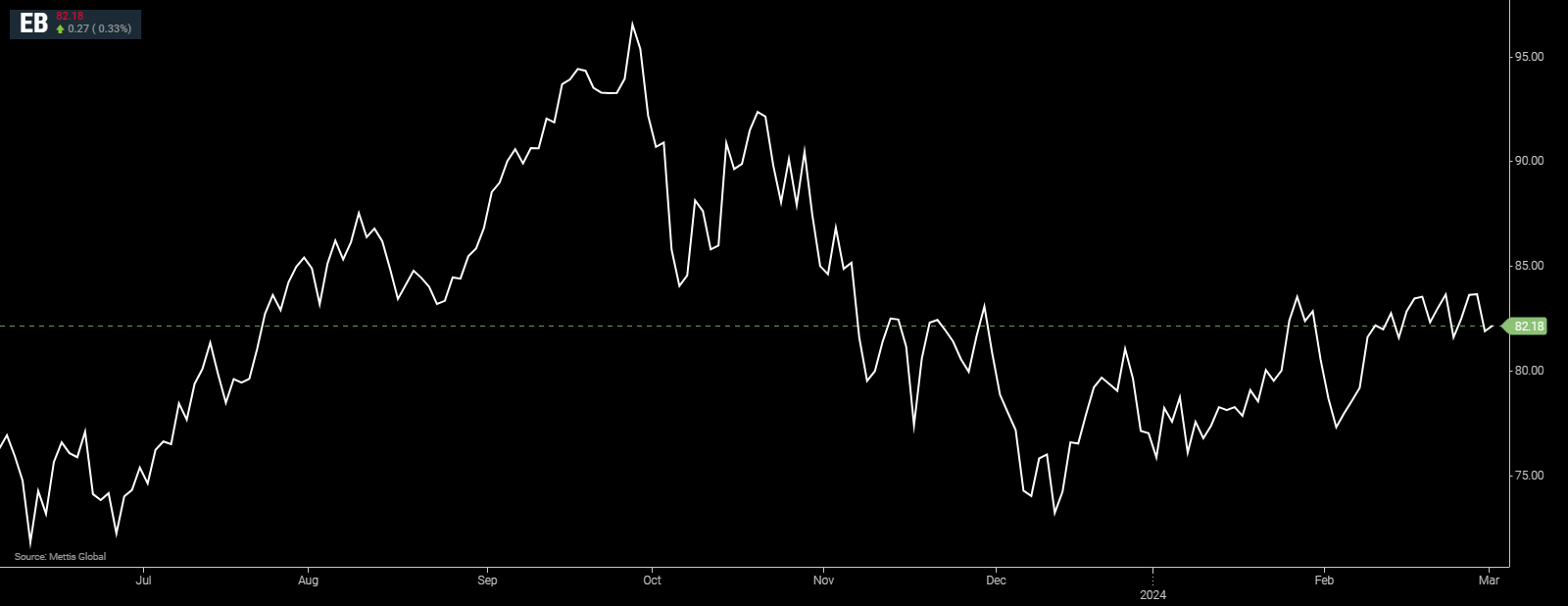

Brent crude is currently trading at $82.05 per barrel, up by 0.3% on the day.

While West Texas Intermediate crude (WTI) is trading at $78.07 per barrel, up by 0.27% compared to the previous close.

"Brent crude prices continued to trade sideways this week... Brent at $83/bbl has shown recent strength although fundamentals remain tilted to oversupply," said BMI analysts in a client note, as Reuters reported.

Increasing possibilities of Saudi-led OPEC+ continuing with the supply cuts beyond the first quarter, potentially till the end of 2024, will likely oil prices above US$80/bbl, said DBS Bank energy sector team lead Suvro Sarkar.

Supporting prices, the Federal Reserve's preferred inflation gauge, the U.S. personal consumption expenditures (PCE) index, showed January inflation in line with economists' expectations, keeping a June interest rate cut on the table. This in turn could lower consumer costs and spur fuel buying activity.

However, a mixed bag of February purchasing managers' index (PMI) data from China, the world's top oil consumer, capped price gains.

China's manufacturing activity in February contracted for a fifth straight month, an official factory survey showed on Friday, raising pressure on Beijing policymakers to roll out further stimulus measures as factory owners struggle for orders.

The official non-manufacturing purchasing managers' index (PMI), which includes services and construction, however, rose to 51.4 from 50.7 in January, the highest since September.

"Demand side we concur that 2Q will have hiccups and we are projecting Brent to average lower in 2Q24 compared to 1Q24, before rebounding in 2H24 on the back of the potential rate cut scenario, which should boost fund flows towards riskier assets," said DBS Bank's Sarkar.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,275.00 | 118,355.00 117,905.00 | 655.00 0.56% |

| BRENT CRUDE | 73.47 | 73.63 71.75 | 0.96 1.32% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.24 | 70.33 70.18 | 0.24 0.34% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|