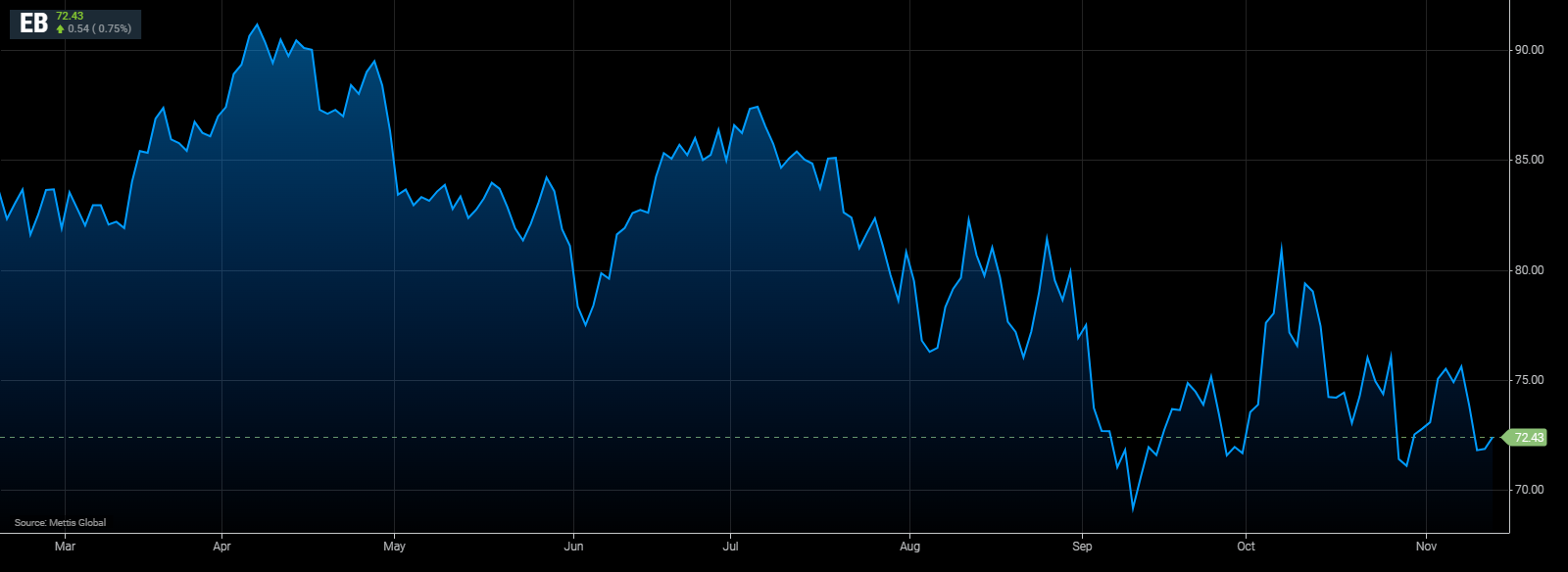

Oil steadies near Nov lows

By MG News | November 13, 2024 at 03:19 PM GMT+05:00

November 13, 2024 (MLN): Oil steadied near its lowest level this month, with the outlook for demand in focus after OPEC cut projections on China’s slowdown.

Brent crude traded near $72.41 a barrel, up by 0.72% on the day.

While West Texas Intermediate crude (WTI) was at $68.65 per barrel.

OPEC shaved demand-growth forecasts for a fourth consecutive month, yet the cartel remains more bullish than other market watchers, with many analysts warning of a glut next year, Bloomberg reported.

Crude has traded in a tight range since the middle of last month, with traders tracking trends in Chinese consumption, Middle East tensions, and the implications of Donald Trump’s re-election to the Oval Office.

After the monthly report from OPEC, the US will issue its short-term outlook later Wednesday, followed by the International Energy Agency’s view on Thursday.

“The absence of a more direct fiscal stimulus out of China has been casting a shadow on the oil demand outlook, coupled with the prospect of higher US oil production with a Trump presidency,” said Yeap Jun Rong, a market strategist with IG Asia Pte. In addition, OPEC+ plans to raise output, he said.

Reflecting the bearish outlook, timespreads have weakened. While they remain in a bullish backwardated structure — with nearby contracts above longer-dated ones — the gap has narrowed.

Among the most notable is WTI’s prompt spread, which hit the lowest since February earlier this week.

“The oil market appears to be heading for a sizeable surplus in 2025, driven by a combination of decelerating oil demand growth, still-robust non-OPEC supply growth, and OPEC’s ambition to start growing supply,”

Morgan Stanley analysts including Martijn Rats said in a report. The bank cut Brent forecasts, with the first-quarter 2025 outlook reduced $5.50 to $72 a barrel.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI