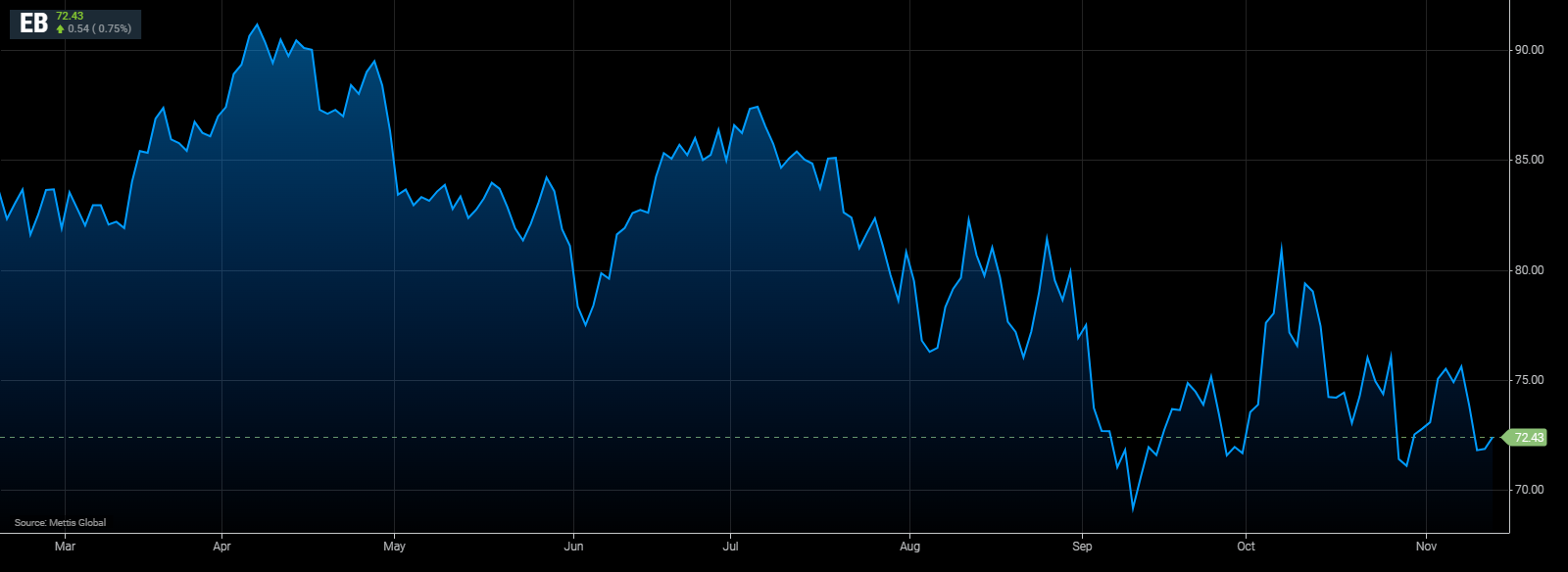

Oil steadies near Nov lows

MG News | November 13, 2024 at 03:19 PM GMT+05:00

November 13, 2024 (MLN): Oil steadied near its lowest level this month, with the outlook for demand in focus after OPEC cut projections on China’s slowdown.

Brent crude traded near $72.41 a barrel, up by 0.72% on the day.

While West Texas Intermediate crude (WTI) was at $68.65 per barrel.

OPEC shaved demand-growth forecasts for a fourth consecutive month, yet the cartel remains more bullish than other market watchers, with many analysts warning of a glut next year, Bloomberg reported.

Crude has traded in a tight range since the middle of last month, with traders tracking trends in Chinese consumption, Middle East tensions, and the implications of Donald Trump’s re-election to the Oval Office.

After the monthly report from OPEC, the US will issue its short-term outlook later Wednesday, followed by the International Energy Agency’s view on Thursday.

“The absence of a more direct fiscal stimulus out of China has been casting a shadow on the oil demand outlook, coupled with the prospect of higher US oil production with a Trump presidency,” said Yeap Jun Rong, a market strategist with IG Asia Pte. In addition, OPEC+ plans to raise output, he said.

Reflecting the bearish outlook, timespreads have weakened. While they remain in a bullish backwardated structure — with nearby contracts above longer-dated ones — the gap has narrowed.

Among the most notable is WTI’s prompt spread, which hit the lowest since February earlier this week.

“The oil market appears to be heading for a sizeable surplus in 2025, driven by a combination of decelerating oil demand growth, still-robust non-OPEC supply growth, and OPEC’s ambition to start growing supply,”

Morgan Stanley analysts including Martijn Rats said in a report. The bank cut Brent forecasts, with the first-quarter 2025 outlook reduced $5.50 to $72 a barrel.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 183,388.12 482.64M | 2.43% 4353.18 |

| ALLSHR | 109,534.46 1,063.77M | 1.99% 2141.73 |

| KSE30 | 56,504.78 227.07M | 2.70% 1487.37 |

| KMI30 | 260,715.19 187.09M | 2.36% 6016.12 |

| KMIALLSHR | 70,695.40 542.66M | 1.75% 1217.44 |

| BKTi | 52,541.91 101.96M | 3.42% 1739.49 |

| OGTi | 36,650.16 10.26M | 1.56% 563.25 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 92,900.00 | 93,970.00 91,595.00 | 2710.00 3.00% |

| BRENT CRUDE | 60.04 | 61.24 59.75 | -0.71 -1.17% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | 0.55 0.64% |

| ROTTERDAM COAL MONTHLY | 98.15 | 0.00 0.00 | 0.15 0.15% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.60 | 57.73 56.31 | -0.72 -1.26% |

| SUGAR #11 WORLD | 14.67 | 14.70 14.60 | 0.07 0.48% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Foreign Exchange Reserves

Foreign Exchange Reserves