Oil rises on US stockpile drop, optimism for china's economic recovery

MG News | January 25, 2024 at 11:24 AM GMT+05:00

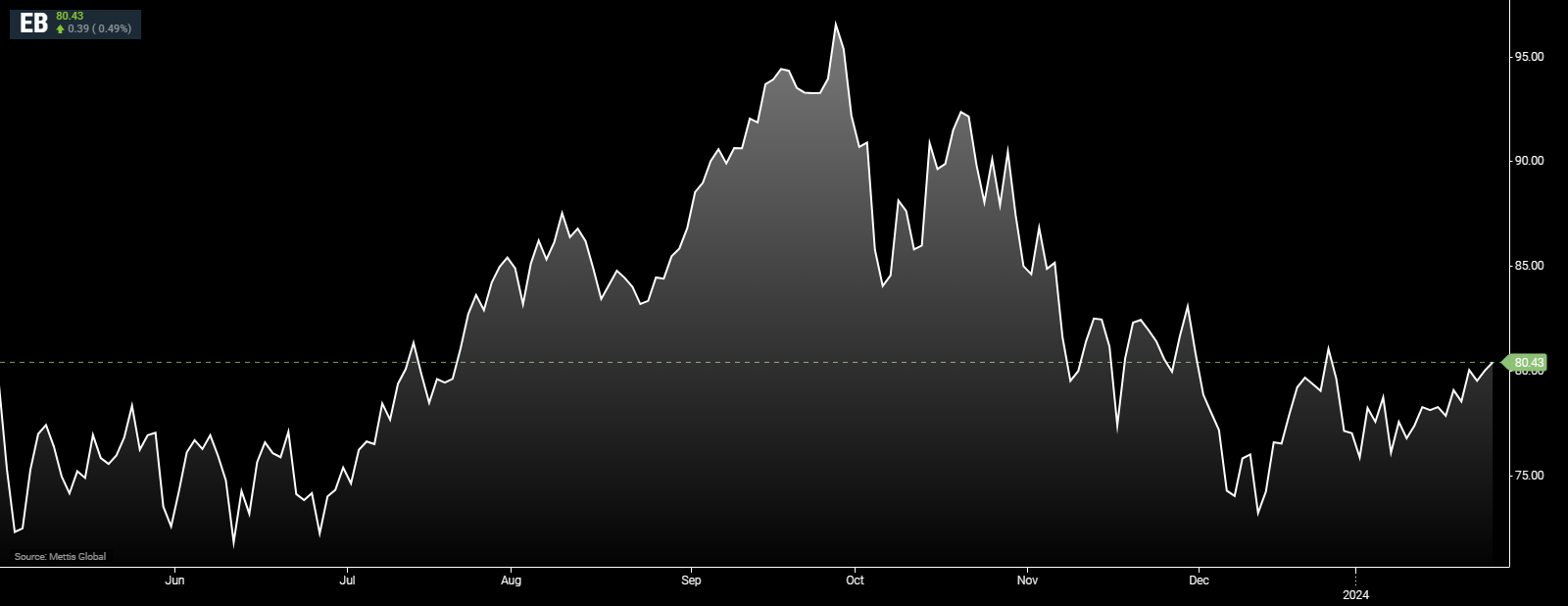

January 25, 2024 (MLN): Global oil prices rose on Thursday, buoyed by a larger-than-expected drop in U.S. crude stockpiles and optimism about China's economic recovery following a cut in banks' reserve ratio.

Brent crude is currently trading at $79.98 per barrel, up by 0.2% on the day.

Meanwhile, West Texas Intermediate crude (WTI) is trading at $75.43 per barrel, up by 0.22% compared to the previous close.

"A significant drop in the U.S. oil inventories and expectations of China's economic recovery and more stimulus measures supported oil prices," said Toshitaka Tazawa, an analyst at Fujitomi Securities, as Reuters reported.

"Tensions in the Middle East were also behind buying," he added.

U.S. crude stockpiles tumbled by 9.2 million barrels last week, the Energy Information Administration said.

The draw was driven by a stark drop in U.S. crude imports, opens new tab as winter weather shut in refineries and kept motorists off the road.

U.S. crude output fell from a record-tying 13.3 million barrels per day (bpd) two weeks ago to a five-month low of 12.3 bpd last week after oil wells froze during an Arctic freeze.

Oil prices also drew support from hopes for China's economic recovery.

China's central bank announced a deep cut to bank reserves on Wednesday, in a move that will inject about $140 billion of cash into the banking system and send a strong signal of support for a fragile economy and plunging stock markets.

China also said on Wednesday it is widening the uses for commercial property lending by banks in its latest effort to ease a liquidity crunch facing troubled real estate firms.

Meanwhile, geopolitical tensions in the Middle East remained in focus, though price gains were capped as risk premiums have already been priced in, said Priyanka Sachdeva, senior market analyst at brokerage firm Phillip Nova.

"There is no actual damage done to crude oil supplies ... it's mere anticipation that the Red Sea contagion will lead to further disruption in oil flow from the producing region," said Sachdeva, adding that this anticipation has been adequately priced in.

"Oil investors do need a concrete catalyst to propel prices any further which honestly seem (to be) missing for now, Sachdeva said.

In the latest tensions, the U.S. military carried out more strikes in Yemen early on Wednesday, destroying two Houthi anti-ship missiles that were aimed at the Red Sea and were preparing to launch, the U.S. military said.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,605.00 | 118,705.00 117,905.00 | 985.00 0.84% |

| BRENT CRUDE | 73.47 | 73.63 71.75 | 0.96 1.32% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.35 | 70.37 70.18 | 0.35 0.50% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|