Oil prices steady amid Trump’s tariff uncertainty

MG News | January 23, 2025 at 03:58 PM GMT+05:00

January 23, 2025 (MLN): Oil prices were little changed on Thursday, maintaining the previous session's losses on uncertainty over how U.S. President Donald Trump's proposed tariffs and energy policies would affect global economic growth and energy demand.

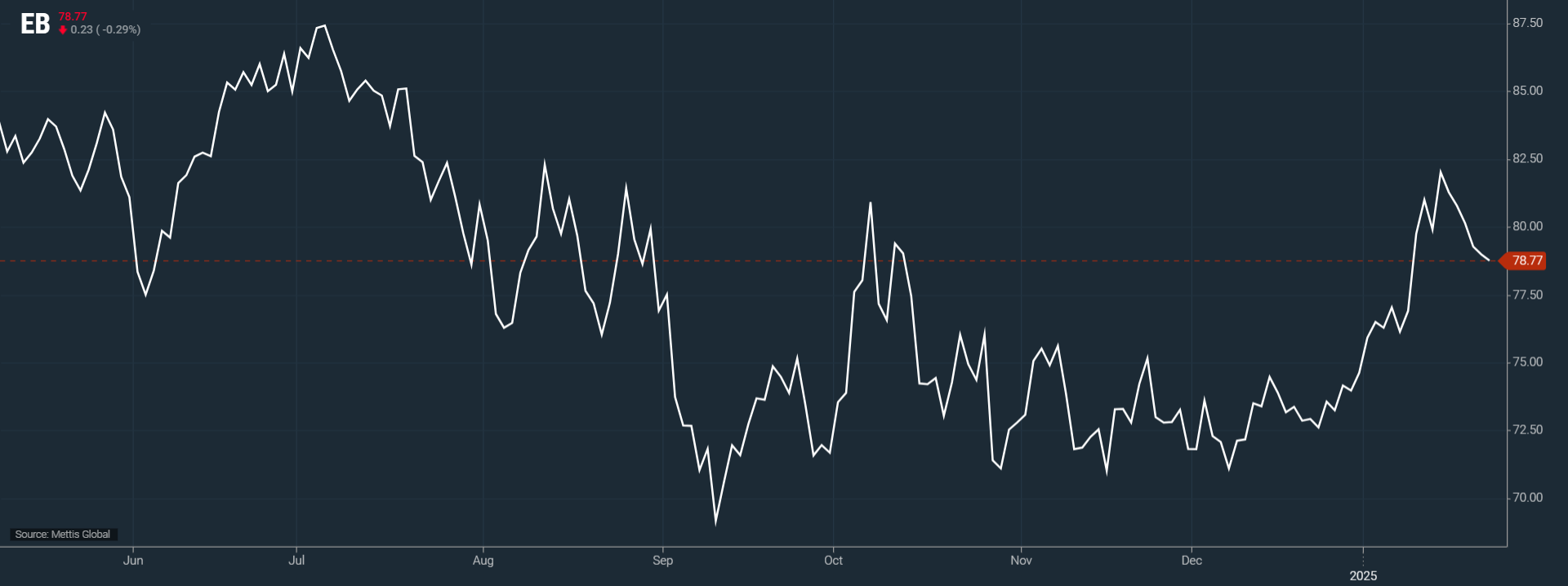

Brent crude futures decreased by $0.23, or 0.29%, to $78.77 per barrel.

West Texas Intermediate (WTI) crude futures fell by $0.13, or 0.17%, to $75.31 per barrel by [3:45 pm] PST.

"Oil markets have given back some recent gains due to mixed drivers," said Priyanka Sachdeva, senior market analyst at brokerage Phillip Nova.

"Key factors include expectations of increased U.S. production under President Trump's pro-drilling policies and easing geopolitical stress in Gaza, lifting fears of further escalation in supply disruption from key producing regions."

The broader economic implications of U.S. tariffs could further dampen global oil demand growth, she added.

Trump has said he would add new tariffs to his sanctions threat against Russia if the country does not make a deal to end its war in Ukraine, as Reuters reported.

He also vowed to hit the European Union with tariffs and impose 25% tariffs against Canada and Mexico.

On China, Trump said his administration was discussing a 10% punitive duty because fentanyl is being sent from there to the United States.

On Monday he declared a national energy emergency intended to provide him with the authority to reduce environmental restrictions on energy infrastructure and projects and ease permitting for new transmission and pipeline infrastructure.

There will be "more potential downward choppy movement in the oil market in the near term due to the Trump administration's lack of clarity on trade tariffs policy and impending higher oil supplies from the U.S."

OANDA senior market analyst Kelvin Wong said in an email.

On the U.S. oil inventory front, crude stocks rose by 958,000 barrels in the week ended Jan. 17, according to sources citing American Petroleum Institute figures on Wednesday.

Gasoline inventories rose by 3.23 million barrels and distillate stocks climbed by 1.88mn barrels, they said.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 179,034.93 513.44M | 1.52% 2679.44 |

| ALLSHR | 107,392.74 1,107.91M | 1.22% 1297.66 |

| KSE30 | 55,017.41 279.74M | 1.86% 1007.08 |

| KMI30 | 254,699.07 209.00M | 1.60% 4013.10 |

| KMIALLSHR | 69,477.96 622.48M | 1.19% 818.48 |

| BKTi | 50,802.42 123.06M | 2.40% 1189.90 |

| OGTi | 36,086.91 28.98M | 2.36% 830.36 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 93,490.00 | 93,970.00 91,595.00 | 3300.00 3.66% |

| BRENT CRUDE | 60.81 | 61.24 60.00 | 0.06 0.10% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | 0.55 0.64% |

| ROTTERDAM COAL MONTHLY | 98.15 | 98.15 97.40 | 1.25 1.29% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.31 | 57.73 56.56 | -0.01 -0.02% |

| SUGAR #11 WORLD | 14.60 | 15.05 14.57 | -0.41 -2.73% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Foreign Exchange Reserves

Foreign Exchange Reserves