Weekly Market Roundup

MG News | January 04, 2026 at 12:01 PM GMT+05:00

January 04, 2026 (MLN): The Pakistan Stock Exchange ended the week on a strong note, with the benchmark KSE-100 Index surging by 6,634 points, or 3.85% WoW, to close at 179,034.93, compared to 172,400.73 in the previous week.

Investor sentiment improved notably on the back of strengthening economic indicators, including rising industrial activity, easing inflation, and sustained growth across key sectors, while a 6% increase in OMC sales in December further boosted market momentum.

_20260104065354533_81e064.jpeg)

Market Capitalization

In terms of market capitalization, the total market

cap in rupee terms increased sharply to Rs5.26 trillion during

the week, up from Rs5.06tr in the previous week.

This represents an increase of approximately Rs195

billion, or 3.85% WoW, broadly in line with the index performance.

In dollar terms, market capitalization rose to $18.76bn from $18.07bn last week, showing an increase of around $699 million, or 3.87% WoW.

_20260104065256201_36c875.jpeg)

Consequently, USD returns for the week stood at 3.87%, significantly higher than the previous week’s return of 0.61%, indicating strong foreign-adjusted gains.

_20260104065245082_60fe96.jpeg)

On the macroeconomic front, SBP-held foreign

exchange reserves edged up by $12.6m WoW to $15.92bn, while total

liquid reserves stood at $21.01bn, showing overall stability in the

country’s external position.

Pakistan’s economy accelerated in Q1 FY26, with GDP (GVA)

expanding

3.71% YoY, driven by a sharp rebound in industrial activity (up

9.38%), while services remained stable and agriculture showed gradual

improvement despite continued weakness in crops.

On the external front, SBP stepped up its FX

intervention, purchasing $1.02bn

from the interbank market in September 2025, taking total net purchases in

FY26 to $1.47bn, though remaining below the corresponding level of last

year.

The Pakistani rupee appreciated marginally against

the US dollar, strengthening by 0.02% WoW to close at Rs280.11 per USD,

compared to Rs280.17 last week.

The currency stability provided mild support to foreign

investor returns during the week.

Index Movers

Sector wise performance remained broadly positive, with Commercial

Banks emerging as the dominant driver of index gains, contributing a

substantial 2,965 points, supported by strong buying interest in major

banking names.

Oil and Gas Exploration Companies added 1,180

points, while Fertilizer stocks contributed 851 points, showing

optimism around sector fundamentals.

Investment Banks, Investment Companies and Securities

Companies added 462 points, followed by Pharmaceuticals (+338

points) and Oil & Gas Marketing Companies (+254 points).

Other notable contributors included Technology &

Communication (+254 points), Automobile Assemblers (+224 points), Power

Generation & Distribution (+187 points), Property (+137 points),

Refinery (+69 points) and Insurance (+60 points).

On the downside, Cement stocks emerged as the largest

drag, shaving off 551 points, amid profit-taking in heavyweight names.

This was followed by Textile Composite (-59 points) and Real Estate Investment Trusts (-17 points), while marginal pressure was also observed in Miscellaneous, Paper & Board, and Synthetic & Rayon sectors.

Scripwise, United Bank Limited (UBL) emerged as the

single largest contributor, adding a hefty 1,538 points to the KSE-100

Index during the week.

This was followed by Oil & Gas Development Company

(OGDC), which added 524 points, Engro Holdings (ENGROH) with 435

points, and EFERT (+495 points).

Other notable contributors included Pakistan Petroleum

Limited (PPL), which added 379 points, Fauji Fertilizer Company (FFC)

with a contribution of 310 points, Meezan Bank (MEBL) adding 258 points.

Bank AL Habib

(BAHL) with 244 points, MCB Bank contributing 242 points, and Mari

Petroleum (MARI), which added 219 points to the KSE-100 Index.

Additional support came from Pakistan State Oil (PSO),

adding 210 points, Habib Bank Limited (HBL) with 180 points, Hub

Power Company (HUBC) contributing 148 points, Bank Alfalah (BAFL) adding

139 points.

Bank of Punjab (BOP) with 107 points, Systems Limited (SYS) adding 95 points and Pakistan Telecommunication Company Limited (PTC) contributing 91 points.

Sazgar Engineering Works

(SAZEW), which added 103 points, showing broad-based participation across

banking, energy, automobile, and technology stocks.

On the downside, selling pressure was concentrated in cement stocks, with DG Khan Cement (DGKC) emerging as the largest laggard, shaving off 178 points, followed by Lucky Cement (LUCK), which dragged the index down by 119 points.

Cherat Cement (CHCC) with a negative

contribution of 99 points, Maple Leaf Cement (MLCF) reducing the index

by 83 points, and Kohat Cement (KOHC), which trimmed 61 points.

Other notable drags included Pioneer Cement (PIOC) with a 20-point decline, Kohinoor Textile Mills (KTML) shaving off 46 points, National Bank of Pakistan (NBP) dragging the index down by 12 points.

Dolmen City REIT (DCR) with an 8-point negative contribution, and Kot Addu Power Company (KAPCO), which reduced the index by 7 points, collectively weighing on overall market performance.

_20260104065219742_ad2e61.jpeg)

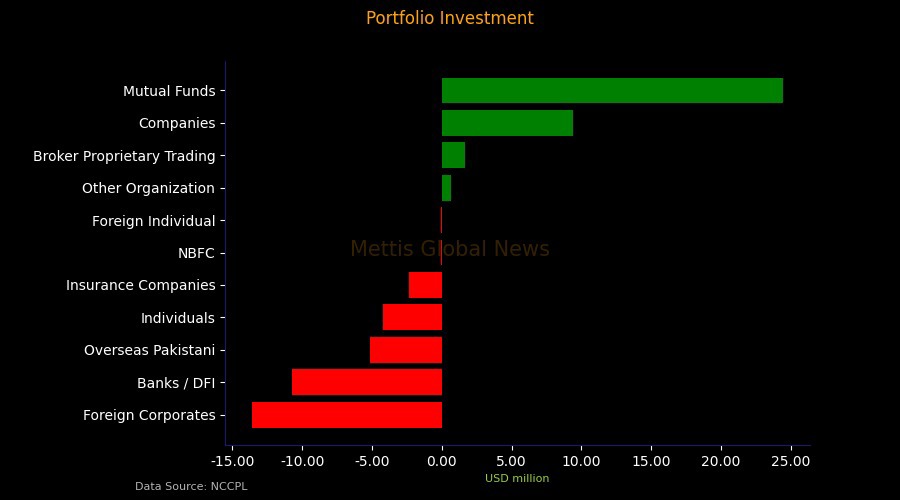

FIPI / LIPI Flows

From an investor flow perspective, foreign investors

remained net sellers during the week, with total FIPI outflows amounting

to $18.83m.

The selling was primarily driven by foreign corporates,

which recorded net selling of $13.62m, followed by overseas

Pakistanis with net outflows of $5.15m. Foreign individuals

also remained marginal net sellers.

In contrast, local investors absorbed the entire foreign

selling, as Local Institutional Portfolio Investors (LIPI) posted

net buying of $18.83m.

Buying was led by mutual funds, which emerged as the

largest net buyers with inflows of $24.46m, showing improved confidence

in the market outlook.

This was partially offset by net selling from banks/DFIs

(-$10.71m), individual investors (-$4.24m), insurance companies

(-$2.37m), and NBFCs, while companies and broker

proprietary trading provided modest support.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 179,034.93 513.44M | 1.52% 2679.44 |

| ALLSHR | 107,392.74 1,107.91M | 1.22% 1297.66 |

| KSE30 | 55,017.41 279.74M | 1.86% 1007.08 |

| KMI30 | 254,699.07 209.00M | 1.60% 4013.10 |

| KMIALLSHR | 69,477.96 622.48M | 1.19% 818.48 |

| BKTi | 50,802.42 123.06M | 2.40% 1189.90 |

| OGTi | 36,086.91 28.98M | 2.36% 830.36 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 93,820.00 | 93,970.00 91,595.00 | 3630.00 4.02% |

| BRENT CRUDE | 60.98 | 61.24 60.00 | 0.23 0.38% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | 0.55 0.64% |

| ROTTERDAM COAL MONTHLY | 98.15 | 98.15 97.40 | 1.25 1.29% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.48 | 57.73 56.56 | 0.16 0.28% |

| SUGAR #11 WORLD | 14.60 | 15.05 14.57 | -0.41 -2.73% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Foreign Exchange Reserves

Foreign Exchange Reserves