Oil prices rise as U.S. continues strikes on Yemen's Houthis

MG News | March 17, 2025 at 10:29 AM GMT+05:00

March 17, 2025 (MLN): Oil prices traded higher on Monday after the United States vowed to keep attacking Yemen's Houthis until the Iran-aligned group ends its assaults on shipping.

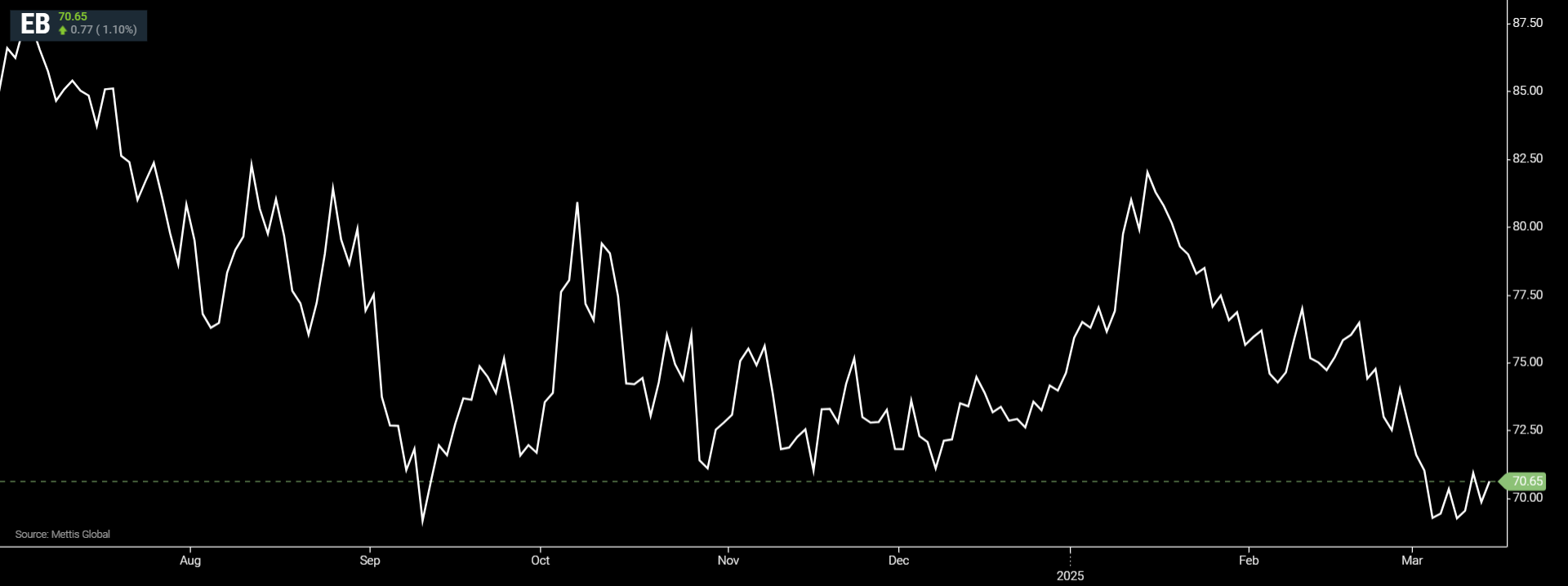

Brent crude futures increased by $0.77, or 1.1%, to $70.65 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.52, or 0.77%, to $67.7 per barrel by [10:25 am] PST.

The U.S. airstrikes, which the Houthi-run health ministry said killed at least 53 people, are the biggest U.S. military operation in the Middle East since President Donald Trump took office in January.

One U.S. official told Reuters the campaign might run for weeks.

Houthi attacks on shipping in the Red Sea have disrupted global commerce and set off a costly campaign by the U.S. military to intercept missiles and drones.

Oil prices rose slightly last week, snapping a three-week losing streak fed by concern over a global economic slowdown driven by escalating trade tension between the U.S. and other nations.

Both benchmarks pared some gains after rising more than 1% in early Asian trade as China reported a mixed start to the year.

Industrial output slowed in January-February, while retail sales growth accelerated slightly, government data showed on Monday.

The state council, or cabinet, unveiled what it called a "special action plan" on Sunday in a bid to boost domestic consumption and economic recovery amid a burst of U.S. trade tariffs against China, among key trading partners.

That effort has threatened to upset the global trade order.

Analysts at Goldman Sachs cut oil price forecasts, saying they expected the U.S. economy to grow slower than expected, due to the tariffs imposed on countries such as Canada, China and Mexico.

"We reduce by $5 our December 2025 forecast for Brent to $71/bbl (WTI to $67), our Brent range to $65 to $80, and our 2026 average forecast to $68 for Brent (WTI to $64)," the analysts said in a note.

Oil demand was expected to grow at a slower pace than previously expected, while supply from the Organization of Petroleum Exporting Countries and its allies (OPEC+) was expected to exceed forecasts, the Goldman analysts said.

U.S. consumer sentiment plunged to a nearly 2-1/2-year low in March and inflation expectations have soared amid worries that Trump's sweeping tariffs would boost prices and undercut the economy, as Reuters reported.

U.S. Federal Reserve officials meeting next week are expected to leave the benchmark overnight interest rate in the range of 4.25% to 4.50%, having reduced it by 100 basis points since September.

They are weighing the economic impact of the administration's policies.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,691.08 204.73M | -3.16% -5478.63 |

| ALLSHR | 100,605.79 452.28M | -3.22% -3347.16 |

| KSE30 | 51,327.62 101.29M | -3.23% -1715.27 |

| KMI30 | 234,255.58 78.63M | -3.57% -8675.81 |

| KMIALLSHR | 64,318.37 208.70M | -3.29% -2188.72 |

| BKTi | 49,641.17 44.27M | -2.78% -1417.38 |

| OGTi | 33,066.33 11.03M | -3.20% -1093.65 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|