Oil prices retreat as trade war fears overshadow Trump’s tariff pause

MG News | April 10, 2025 at 04:05 PM GMT+05:00

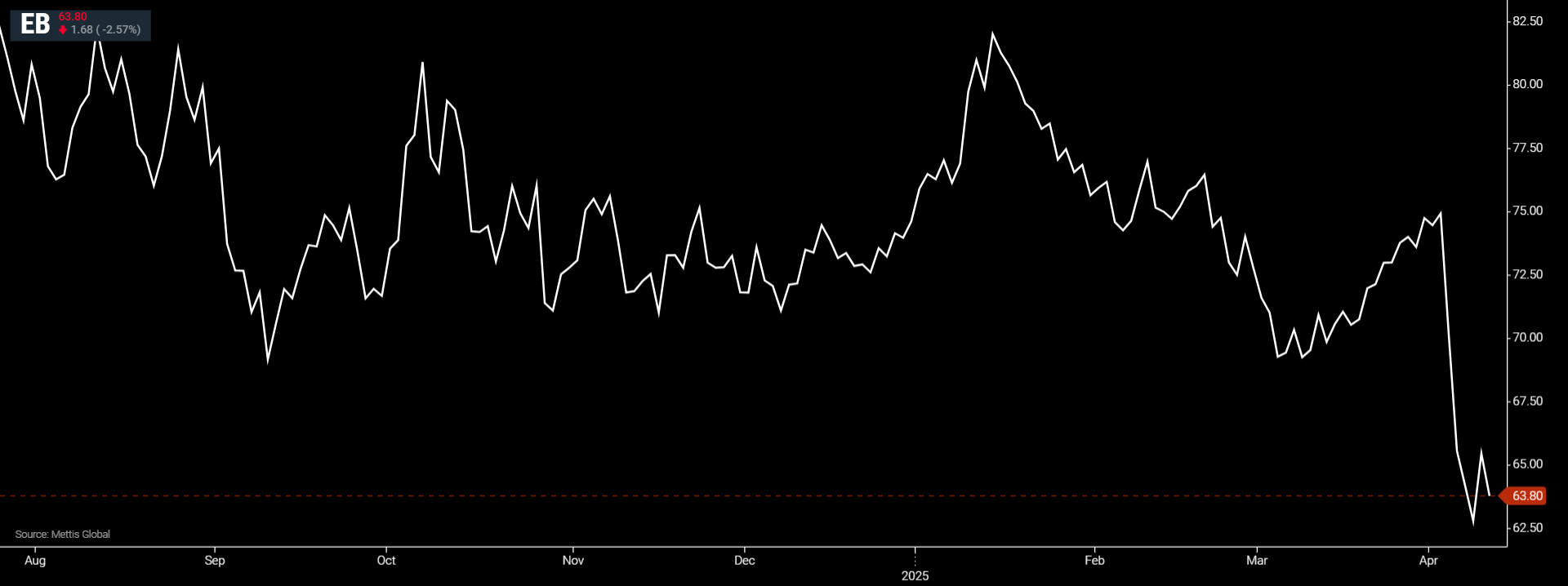

April 10, 2025 (MLN): Oil prices retreated nearly 3% on Thursday as fears of a deepening U.S.-China trade war and possible recession eclipsed earlier relief created by President Donald Trump's announced 90-day pause on sweeping tariffs against most countries.

Brent crude futures decreased by $1.68, or 2.57%, to $63.8 per barrel.

West Texas Intermediate (WTI) crude futures fell by $1.68, or 2.69%, to $60.67 per barrel by [4:00 pm] PST.

The retreat followed a volatile session on Wednesday, when crude benchmarks, which had tumbled as much as 7% earlier in the day, ended around 4% higher following Trump's announcement of a tariff pause.

However, the reprieve excluded China.

Trump increased tariffs on Chinese imports to 125% from 104%, deepening a trade standoff with the world's second-largest economy and a leading consumer of crude.

The trade war between the U.S. and China leaves significant uncertainty over oil demand growth with more risk to downside for prices, said Ashley Kelty, analyst at Panmure Liberum.

"Volatility remains high, and it remains tricky to see where oil prices may settle in near-term," said Kelty.

China also announced an additional import levy on U.S. goods, imposing an 84% tariff from Thursday.

Despite the tariff pause, Ole Hansen, head of commodity strategy at Saxo Bank, said the world was still facing the most severe trade barriers since the 1930s.

"With a lot of uncertainty still existing, the prospect for a major rebound in crude is not possible at this stage when the market has to deal with the risk of weakening demand and rising production from OPEC," said Hansen.

Analysts at ANZ Research warned that a deeper global slowdown could push prices lower still, as Reuters reported.

"In a worst-case scenario of a global recession (which is not our base case), there is scope for further weakness... for oil, we view $50/bbl as a likely support level," the analysts said.

Investors were eyeing mixed supply drivers as well.

The Keystone oil pipeline from Canada to the United States remained shut on Wednesday following an oil spill near Fort Ransom, North Dakota, while plans to return it to service were being evaluated, its operator South Bow said.

Elsewhere, the Caspian Pipeline Consortium resumed loading oil at one of two previously shut Black Sea moorings, it said on Wednesday, after a court lifted restrictions put on the Western-backed group's facility by a Russian regulator.

In the United States, crude inventories rose by 2.6 million barrels in the week to April 4, the Energy Information Administration said, nearly double the expectations in a Reuters poll for a 1.4m-barrel rise.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 160,373.65 49.89M | -0.52% -837.03 |

| ALLSHR | 95,862.48 84.45M | -0.24% -234.81 |

| KSE30 | 49,204.73 20.40M | -1.16% -577.01 |

| KMI30 | 228,874.06 23.57M | -0.75% -1723.04 |

| KMIALLSHR | 62,021.99 46.13M | -0.26% -161.28 |

| BKTi | 46,263.27 4.17M | -0.56% -259.94 |

| OGTi | 32,792.97 4.16M | 0.35% 114.75 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 71,100.00 | 71,645.00 70,600.00 | -430.00 -0.60% |

| BRENT CRUDE | 84.44 | 84.66 83.16 | -0.97 -1.14% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -9.60 -8.81% |

| ROTTERDAM COAL MONTHLY | 125.00 | 125.00 125.00 | 3.50 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 79.97 | 80.17 78.24 | -1.04 -1.28% |

| SUGAR #11 WORLD | 13.71 | 13.82 13.61 | -0.02 -0.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction