Oil prices rebound, eyeing strong quarterly finish

By MG News | March 28, 2024 at 09:45 AM GMT+05:00

March 28, 2024 (MLN): Oil prices bounced back on Thursday and are headed for a robust quarterly gain amid anticipations that OPEC+ supply reductions would tighten the global market.

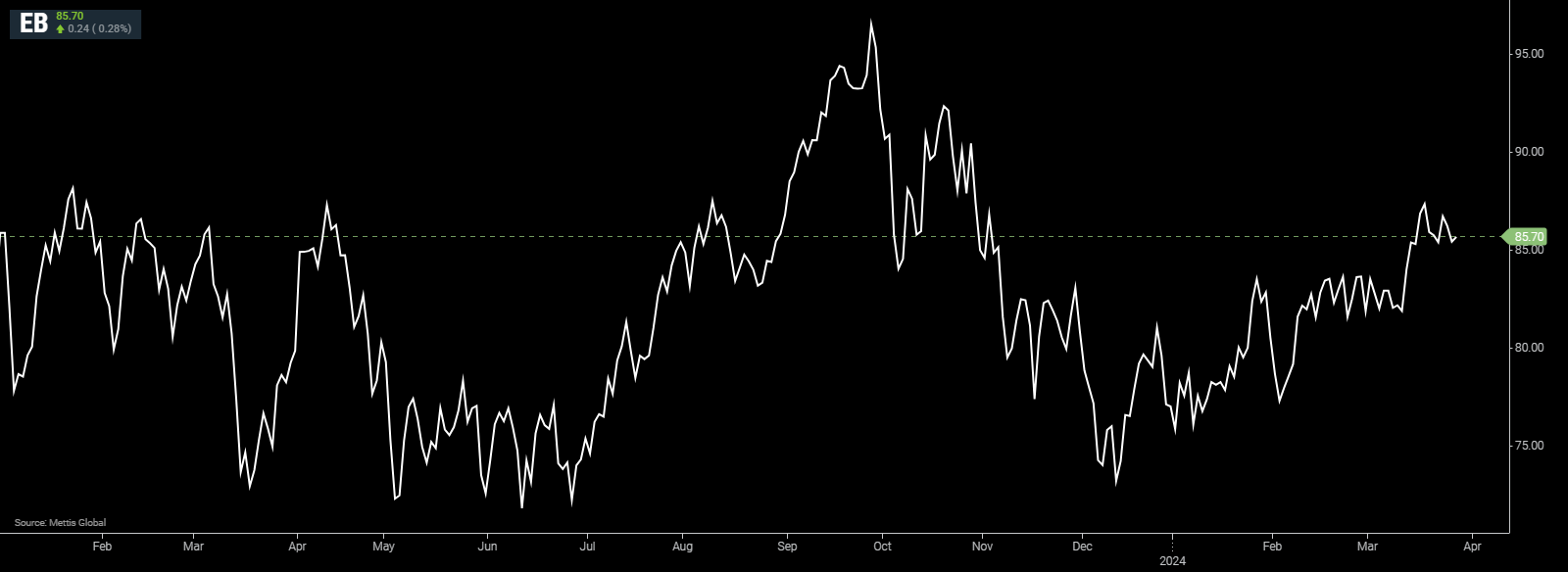

Brent crude traded near $85.7 per barrel, up by 0.28% on the day. It is up about 12% this quarter.

While West Texas Intermediate crude (WTI) was at $81.71 per barrel, up by 0.44% on the day. WTI has risen more than 14% this quarter.

OPEC+’s cuts of 2 million barrels a day have been extended to the end of June, underpinning expectations that global stockpiles will shrink, as Bloomberg reported.

Ahead of a review meeting next week, delegates saw no need to recommend any changes as quotas were proving effective, according to several officials.

Crude’s revival in the first quarter has also been aided by Ukraine’s drone strikes on Russian energy infrastructure, geopolitical tensions in the Middle East, and demand growth in Asian economies including India.

Still, an increase in US nationwide crude and gasoline stockpiles in data this week has undercut some of the tightness, with non-OPEC+ oil supply continuing to expand.

The bullish backdrop has spurred some banks to warn there’s scope for higher prices, depending on how events pan out.

While sticking with existing forecasts, JP Morgan Chase & Co. said this week there’s a path for Brent to hit triple-digits by September if the impact of Russia’s production cuts isn’t balanced out by other counter-measures.

There’s increased bullishness as “demand conditions remain firmer than expected in the US and China,” said Han Zhong Liang, investment strategist at Standard Chartered Plc.

China is looking “increasingly positive following recent data releases,” and the OPEC+ cuts are also limiting supply, he said.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 105,935.00 | 106,200.00 105,625.00 |

185.00 0.17% |

| BRENT CRUDE | 67.21 | 67.29 67.09 |

0.10 0.15% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.49 | 65.65 65.40 |

0.04 0.06% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI