Oil prices rebound after OPEC+ cuts weigh in

By MG News | December 06, 2023 at 11:00 AM GMT+05:00

December 06, 2023 (MLN): Global oil prices edged up on Wednesday after four consecutive sessions of losses as markets weighed the effectiveness of OPEC+ cuts on supplies.

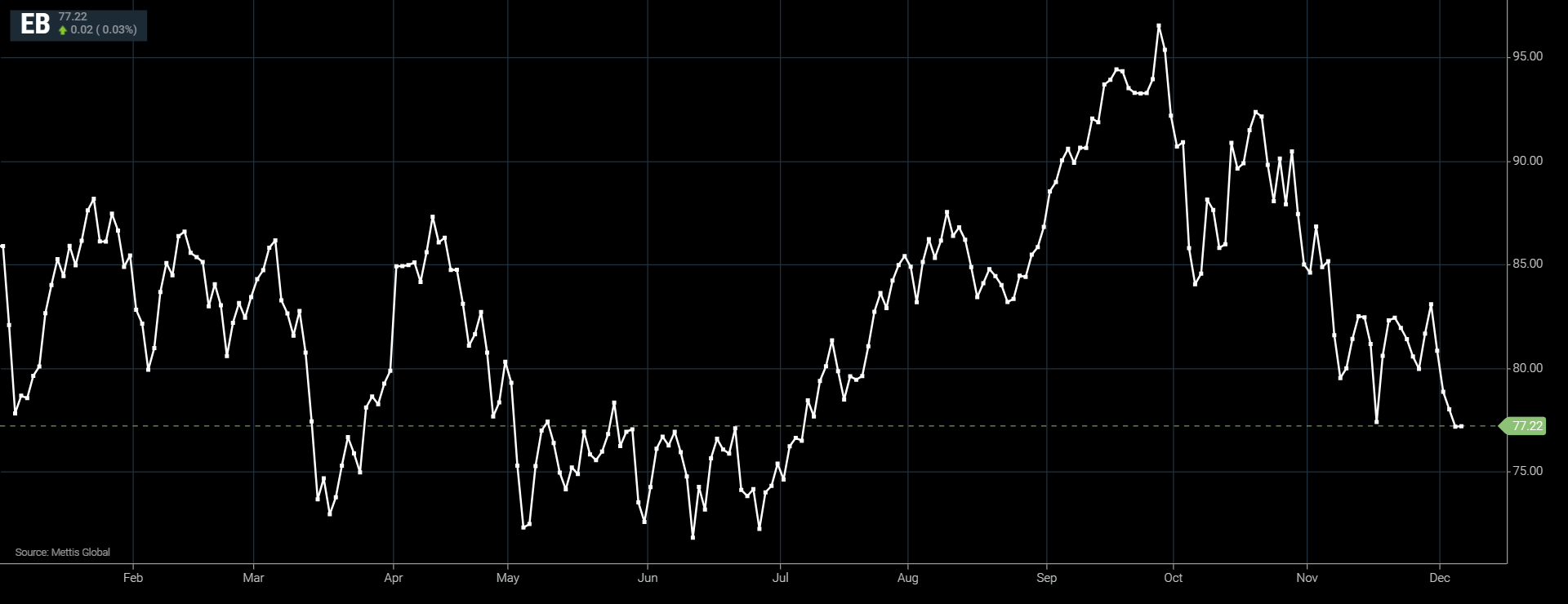

Brent crude is currently trading at $77.15 per barrel, up by 0.29% on the day.

While West Texas Intermediate crude (WTI) is trading at $72.37 per barrel, up by 0.31% on the day.

It is important to mention that both benchmarks closed yesterday’s session at their lowest level since July 06, 2023.

The Organization of the Petroleum Exporting Countries and allies such as Russia (OPEC+) have agreed on voluntary output cuts of about 2.2 million barrels per day (bpd) for the first quarter of 2024 late last week, as Reuters reported.

Those reductions include an extension of Saudi and Russian voluntary cuts of 1.3 million bpd.

"The only positive news over the last couple of days has been Saudi and Russian officials stating that the OPEC+ cuts could be extended or deepened depending on market situations prevailing" in the first half of 2024, said Suvro Sarkar, energy sector team lead at DBS Bank. "Beyond this ... we do not see any positive catalysts for the oil price in the near term."

Worries about a spillover effect from the Israel-Hamas conflict on supplies provide some respite to earlier price declines, analysts say.

"Additionally, fears of a potential escalation in the Israel-Hamas conflict came back into play after the U.S. held Iran responsible for an attack on U.S. vessels," said Phillip Nova's senior market analyst, Priyanka Sachdeva.

However, some analysts remained bearish on price movements.

"This may just be a short-term technical rebound, and the strength is very weak," said CMC Markets' Shanghai-based analyst Leon Li.

"At present, oil prices have entered a bearish trend. We have already seen an increase in inventories in the U.S. and il prices are likely to fall below the $70 a barrel mark," he added.

Concerns over China's economic health, which could limit overall fuel demand in the world's No. 2 oil consumer, also weighed.

On Tuesday, rating agency Moody's lowered the outlook on China's A1 rating to negative from stable, citing "increased risks related to structurally and persistently lower medium-term economic growth and the ongoing downsizing of the property sector".

China will release preliminary trade data, including crude oil import data, on Thursday.

Weighing further on fundamentals, crude oil and fuel inventories in the U.S. rose in the week to December 01, according to market sources citing American Petroleum Institute figures on Tuesday.

Crude stocks increased by 594,000 barrels, the sources said on condition of anonymity. Gasoline stockpiles gained by 2.8 million barrels, while distillate inventories rose by nearly 1.9m barrels.

U.S. government data on inventories is due on Wednesday.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,686.66 280.01M |

0.26% 342.63 |

| ALLSHR | 81,305.25 897.01M |

0.35% 281.26 |

| KSE30 | 39,945.45 114.02M |

0.09% 37.19 |

| KMI30 | 190,698.05 148.61M |

0.61% 1163.05 |

| KMIALLSHR | 55,074.15 495.43M |

0.53% 290.50 |

| BKTi | 34,568.40 28.73M |

-1.07% -372.33 |

| OGTi | 28,739.35 22.59M |

1.57% 443.29 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 110,185.00 | 110,525.00 110,055.00 |

-230.00 -0.21% |

| BRENT CRUDE | 68.77 | 68.89 68.71 |

-0.03 -0.04% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

-0.75 -0.76% |

| ROTTERDAM COAL MONTHLY | 108.45 | 109.80 108.45 |

-0.55 -0.50% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 67.05 | 67.18 66.99 |

0.05 0.07% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance

CPI

CPI