Oil prices rebound after dramatic plunge driven by demand concerns

MG News | December 07, 2023 at 10:33 AM GMT+05:00

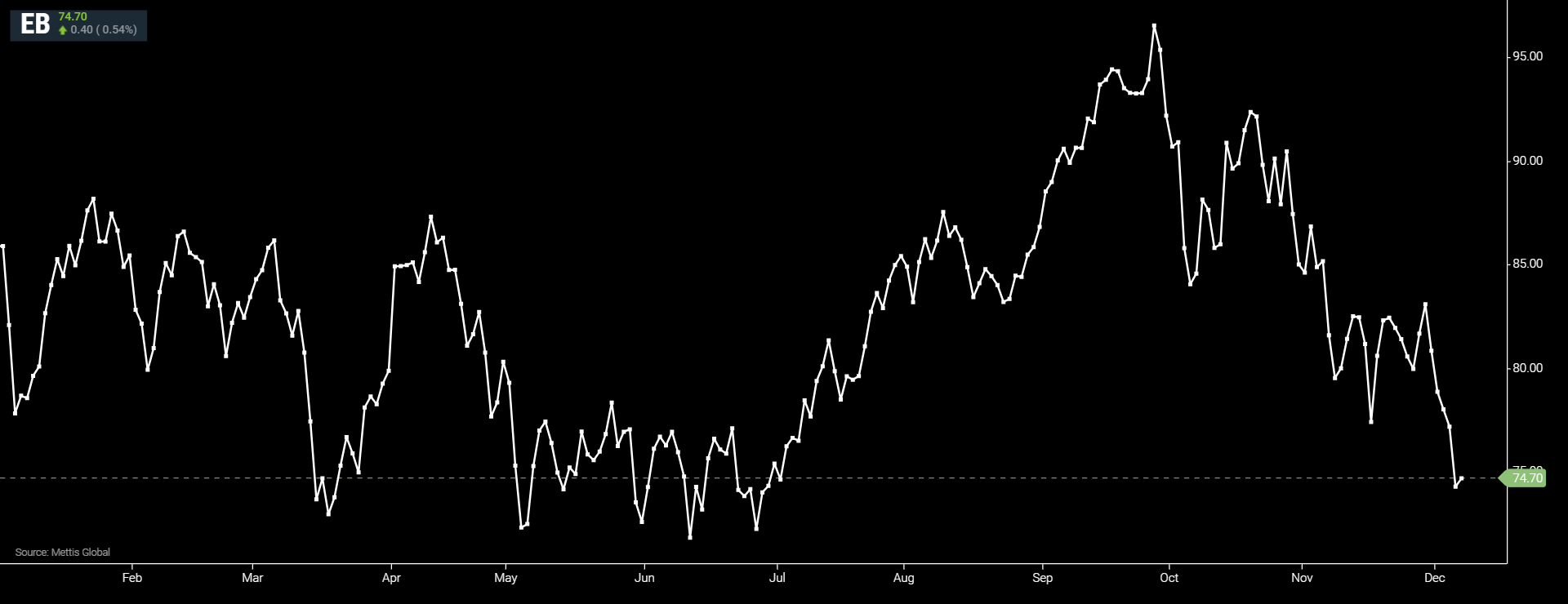

December 07, 2023 (MLN): Global oil prices rebounded on Thursday after plunging to their lowest point in over five months in the previous session as investors remained concerned about weak demand in the U.S. and China.

Brent crude is currently trading at $74.73 per barrel, up by 0.71% on the day.

While West Texas Intermediate crude (WTI) is trading at $69.91 per barrel, up by 0.76% on the day.

It is worth noting that yesterday's session marked the fifth consecutive day of losses for both oil benchmarks.

"Oil markets may have been oversold," which could mean the recovery is a "short-term rebound," said Tina Teng, a markets analyst with CMC Markets, in a note, as Reuters reported.

In the previous session, the market was "spooked" by data showing U.S. output remains near record highs even though inventories fell, analysts at ANZ said in a note.

Some of the bearishness was also a result of higher product fuel inventories, the ANZ analysts said.

Gasoline stocks rose by 5.4 million barrels in the week to 223.6 million barrels, the EIA said on Wednesday, far exceeding expectations for a 1-million-barrel build.

A market moving back into contango suggests there is less worry about the current supply situation and encourages traders to put barrels in storage.

Oil prices have fallen by about 10% since the Organization of the Petroleum Exporting Countries and allies, together called OPEC+, announced a combined 2.2m barrels per day voluntary output cuts.

"Oil markets seem to completely sideline producer's cartel maneuvers aimed at keeping oil prices elevated," said Priyanka Sachdeva, analyst from Phillip Nova, in a note.

Kuwait and Algeria also reaffirmed their support and commitment to the voluntary cuts.

"The sign of easing inflation is (also) feeding into fears of a global economic slowdown and in turn dented demand for fuel globally," Sachdeva said.

Chinese customs data showed that crude imports in November fell 9% from a year earlier, as high inventory levels, weak economic indicators, and slowing orders from independent refiners weakened demand.

While total imports dropped on a monthly basis, China's exports grew for the first time in six months in November, suggesting the manufacturing sector may be beginning to benefit from an uptick in global trade flows.

Rating agency Moody's put Hong Kong, Macau, and swathes of China's state-owned firms and banks on downgrade warnings on Wednesday, just one day after it slapped a downgrade warning on China's sovereign credit rating.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,955.00 | 119,275.00 117,905.00 | 1335.00 1.14% |

| BRENT CRUDE | 72.33 | 72.82 72.30 | -0.91 -1.24% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.95 | 70.41 69.92 | -0.05 -0.07% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|