Oil prices mark 1st monthly gain since September amid Middle East tensions

MG News | January 31, 2024 at 11:55 AM GMT+05:00

January 31, 2024 (MLN): Global oil prices persisted in their decline on Wednesday as demand worries rose after weak economic data in China, the world's biggest crude importer.

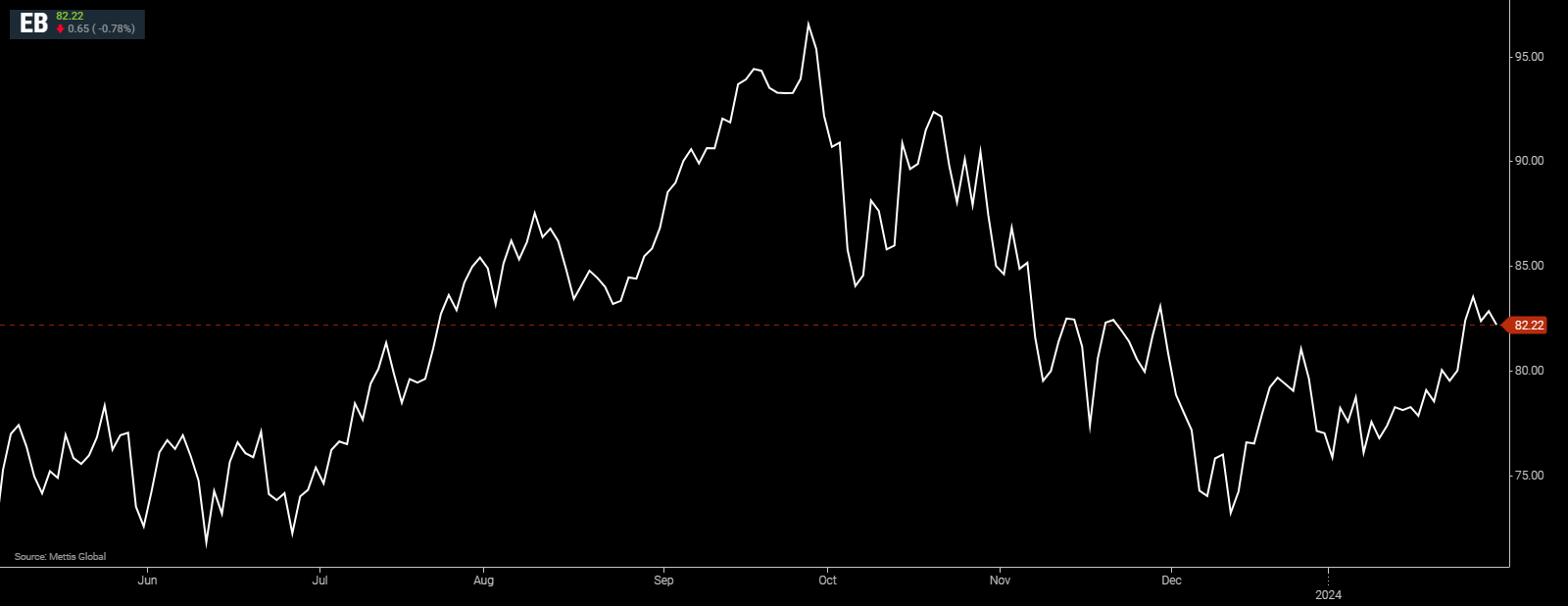

Brent crude is currently trading at $82.15 per barrel, down by 0.18% on the day.

While West Texas Intermediate crude (WTI) is trading at $77.46 per barrel, down by 0.22% compared to the previous close.

It is crucial to note that the commodity is on track to record a monthly gain after three consecutive months of losses, with both benchmarks currently up by 6.92% and 8.55%, respectively.

Manufacturing activity in China, the world's second-largest economy and oil consumer, contracted for a fourth straight month in January, an official factory survey showed on Wednesday, suggesting economic momentum was flagging at the start of 2024, as Reuters reported.

Forecasts from several analysts, including from the Organization of the Petroleum Exporting Countries (OPEC), see oil demand growth in 2024 driven primarily by Chinese consumption and signs of a slowing economy there undercut those outlooks.

"The Chinese manufacturing sector remains under pressure amid a weak domestic recovery and poor external demand," said Lynn Song, chief economist at ING bank, in a note.

However, both oil benchmarks are set to rise this month as the Israel-Hamas war has expanded to a naval conflict in the Red Sea between the U.S. and Iran-aligned Houthi militants that has disrupted oil and natural gas tanker shipping routes and added to delivery costs.

Other Iranian militant groups in the region have also struck U.S. forces in Iraq, Syria and Jordan.

Both Brent and WTI are set to rise over 7% in January.

Still, the widening Middle East conflicts have not halted actual output and the concerns about lower oil demand growth have mitigated the gains from the geopolitical concerns.

"The main issue with turning outright bullish on crude oil here is the technical picture remains bearish and is yet to catch up with recent events," including a deadly drone attack on U.S. troops near the Jordan-Syria border last week, said Tony Sycamore, a market analyst with IG.

U.S. President Joe Biden said he had decided how to respond to the attack without giving further details, but added that he wanted to avoid a wider war in the Middle East.

In the Israel-Palestinian conflict, Hamas said on Tuesday it had received and was studying a proposal for a ceasefire to the fighting in Gaza.

It appeared to be the most serious peace initiative since the war's first and only brief ceasefire which fell apart in November.

But Sycamore said the market was concerned that a Gaza ceasefire would not necessarily halt the Houthi's attacks in the Red Sea.

U.S. inventory data from the American Petroleum Institute (API) were mixed.

Crude stockpiles dropped by 2.5 million barrels in the week ended January 26, according to market sources citing API figures.

Gasoline inventories gained 600,000 barrels, and distillate stocks fell by 2.1 million barrels.

U.S. government data on oil inventories is due later on Wednesday.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,390.00 | 119,430.00 117,905.00 | 1770.00 1.50% |

| BRENT CRUDE | 72.33 | 72.82 72.29 | -0.91 -1.24% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.96 | 70.41 69.91 | -0.04 -0.06% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|