Oil prices drop amid disappointing growth figures in China

MG News | January 17, 2024 at 01:22 PM GMT+05:00

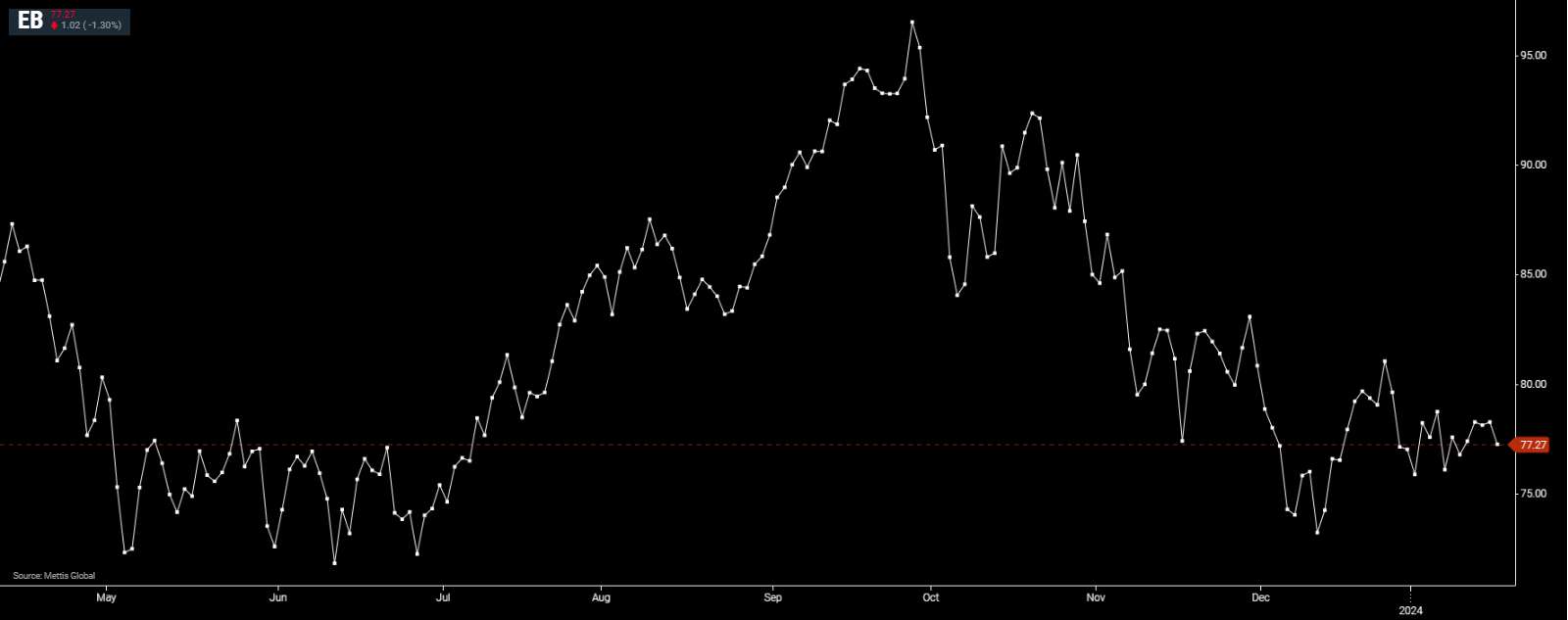

January 17, 2024 (MLN): Global oil prices dropped on Wednesday amid demand concerns, as China's growth in the fourth quarter of 2023, the world's second-largest crude user, fell short of analyst expectations.

Brent crude is currently trading at $76.94 per barrel, down by 0.66% on the day.

Meanwhile, West Texas Intermediate crude (WTI) is trading at $71.44 per barrel, down by 0.73% compared to the previous close.

China's economy in the fourth quarter expanded by 5.2% from a year earlier, which missed analyst expectations and calls into question forecasts that Chinese demand will propel stronger global oil growth in 2024, as Reuters reported

The Chinese economic growth figure "doesn’t end the headwinds over crude oil demand, the Chinese outlook for 2024 and 2025 is still bleak," said Priyanka Sachdeva, senior market analyst at Phillip Nova.

"(The) oil industry was backing the notion that despite a bumpy recovery, oil demand from China has been resilient and will likely reach record levels in 2024."

Despite the less-than-expected economic growth, China's oil refinery throughput in 2023 rose 9.3% from a year earlier to a record, indicating the country's oil demand is elevated if not at the pace that some analysts are expecting.

Some signs of steady Chinese demand have appeared as the country's refiners are actively booking oil cargoes for delivery in March and April to replenish stockpiles, lock-in relatively lower prices and in anticipation of stronger demand in the second half of 2024.

Additionally, the U.S. dollar hovered near a one-month high on Wednesday after comments from U.S. Federal Reserve officials lowered expectations for aggressive interest rate cuts.

The stronger greenback reduces demand for dollar-denominated oil for buyers paying with other currencies.

"Higher rates can lead to a weaker outlook for oil demand as economic activity tends to cool in a high-interest-rate environment leaving oil prices vulnerable," Sachdeva said.

The market continues to monitor the Red Sea situation though investor appear to be downplaying the threat of supply disruptions even as oil tankers are diverting their courses away from the waterway.

The U.S. on Tuesday mounted fresh strikes against Iran-aligned Houthi militants in Yemen after a Houthi hit a Greek vessel in the Red Sea.

"While oil benchmarks may not reflect the Red Sea attacks, the realised price for oil and oil products for consumers has increased given the disruption to trade flows through the Red Sea and Suez Canal," Vivek Dhar, director of mining and energy commodities strategist at the Commonwealth Bank of Australia, said in a note.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,535.00 | 118,705.00 117,905.00 | 915.00 0.78% |

| BRENT CRUDE | 72.77 | 72.82 72.74 | -0.47 -0.64% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.37 | 70.41 70.18 | 0.37 0.53% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|