Oil market steady with focus on Iran, China

MG News | May 19, 2025 at 02:07 PM GMT+05:00

May 19, 2025 (MLN): Oil prices were little changed on Monday with investors eyeing the outcome of Iran-U.S. nuclear talks and key economic data due from China to assess the impact on its commodities demand following trade tensions with the United States.

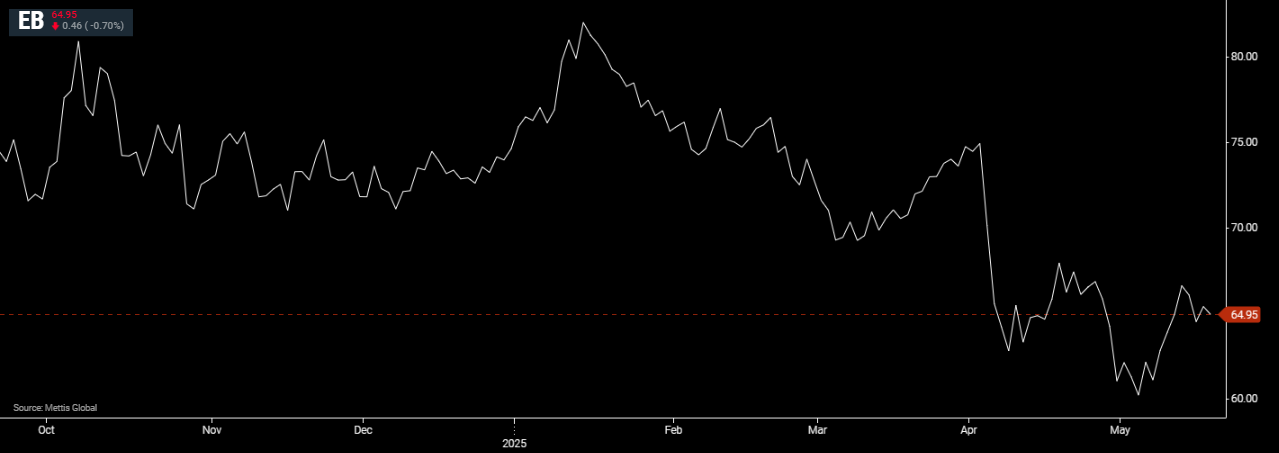

Brent crude futures decreased by $0.46, or 0.7%, to $64.95 per barrel.

West Texas Intermediate (WTI) crude futures fell by $1.02, or 1.63%, to $61.47 per barrel by [2:05 pm] PST.

Both contracts rose more than 1% last week after the U.S. and China, the world’s two biggest economies and oil consumers, agreed to a 90-day pause on their trade war during which both sides would sharply lower trade tariffs.

China is due to release a slew of data, including industrial output, later on Monday.

“Any sign of weakness could weaken sentiment that was boosted by the U.S. pause on Chinese tariffs,” ANZ analysts said in a note.

The uncertainty over the outcome of Iran-U.S. nuclear talks also supported oil prices,as CNBC reported.

U.S. special envoy Steve Witkoff said on Sunday that any deal between the United States and Iran must include an agreement not to enrich uranium, a comment that swiftly drew criticism from Tehran.

“There was a lot of hope being built into those talks,” IG market analyst Tony Sycamore said.

“Realistically, Iran was unlikely to ever willingly agree to peacefully give up its nuclear ambitions, which it has always maintained as being non-negotiable.

More so after the collapse of its proxies, which have acted as a buffer in the past between itself and Israel,” he said, without specifying who he was referring to.

In Europe, tensions between Estonia and Russia rose after Moscow detained a Greek-owned oil tanker on Sunday after it left an Estonian Baltic Sea port.

In the U.S., producers cut the number of operating oil rigs by 1 to 473 last week, the lowest since January, Baker Hughes said in its weekly report, as they continued to focus on cutting spending that could slow U.S. oil output growth this year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,695.00 | 119,275.00 117,905.00 | 1075.00 0.91% |

| BRENT CRUDE | 72.41 | 72.82 72.34 | -0.83 -1.13% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.04 | 70.41 69.97 | 0.04 0.06% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|