Murree Brewery reports around 60% YoY profit surge in 1HFY25

.png)

MG News | February 21, 2025 at 11:55 AM GMT+05:00

February 21, 2025 (MLN): Murree Brewery Company Limited (PSX: MUREB) recorded a significant 59.97% year-on-year (YoY) increase in profitability for the 1HFY25, posting a profit after tax of Rs1.84 billion [EPS: Rs66.64], compared to Rs1.15bn [EPS: Rs41.66] in the same period last year (SPLY).

The company declared an interim cash dividend of Rs12 per share (120%) for the six-month period ended December 31, 2024.

This is in addition to the interim dividend of Rs5 per share (50%) already paid.

The company’s net turnover grew by 22.29% YoY, reaching Rs13.15bn in 1HFY25 compared to Rs10.76bn in SPLY.

The cost of sales also increased by 16.95% YoY to Rs9.47bn, leading to a 38.57% YoY rise in gross profit, which stood at Rs3.68bn.

Despite an increase in selling and distribution expenses (+15.13% YoY) and administrative expenses (+11.88% YoY), operating profit surged by 53.03% YoY, reaching Rs2.42bn in 1HFY25.

Net finance income witnessed a remarkable increase of 100.58% YoY, rising to Rs538.44mn from Rs268.44mn in SPLY, primarily driven by a 99.84% surge in finance income.

On the tax front, the company incurred an income tax expense of Rs1.11bn, marking a 59.87% YoY increase compared to Rs697.65mn in SPLY.

As a result, Murree Brewery’s profit before tax reached Rs2.95bn, reflecting a 59.93% YoY increase, while profit for the period surged to Rs1.84bn, strengthening the company’s financial position.

Earnings per share (EPS) jumped to Rs66.64, marking a 59.96% increase compared to Rs41.66 in the same period last year.

| Financial Results For The Half Year Ended December 31, 2024 | |||

| Dec-24 | Dec-23 | %Change | |

| NET TURNOVER | 13,157,321 | 10,759,514 | 22.29% |

| COST OF SALES | (9,476,681) | (8,103,293) | 16.95% |

| GROSS PROFIT | 3,680,640 | 2,656,221 | 38.57% |

| Selling and Distribution Expenses | (720,748) | (626,022) | 15.13% |

| Administrative Expenses | (383,940) | (343,170) | 11.88% |

| Other Expenses | (195,124) | (147,530) | 32.26% |

| Other Income | 39,431 | 42,064 | -6.26% |

| OPERATING PROFIT | 2,420,259 | 1,581,563 | 53.03% |

| Finance Costs | (4,495) | (3,245) | 38.52% |

| Finance Income | 542,933 | 271,689 | 99.84% |

| NET FINANCE INCOME | 538,438 | 268,444 | 100.58% |

| PROFIT BEFORE TAX | 2,958,697 | 1,850,007 | 59.93% |

| Income Tax Expense | (1,115,318) | (697,651) | 59.87% |

| PROFIT FOR THE PERIOD | 1,843,379 | 1,152,356 | 59.97% |

| Earnings per share - basic and diluted (Rupees) | 66.64 | 41.66 | 59.96% |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,300.00 | 109,815.00 108,295.00 | -475.00 -0.44% |

| BRENT CRUDE | 67.41 | 67.46 67.36 | -0.07 -0.10% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.94 | 64.04 63.89 | -0.07 -0.11% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

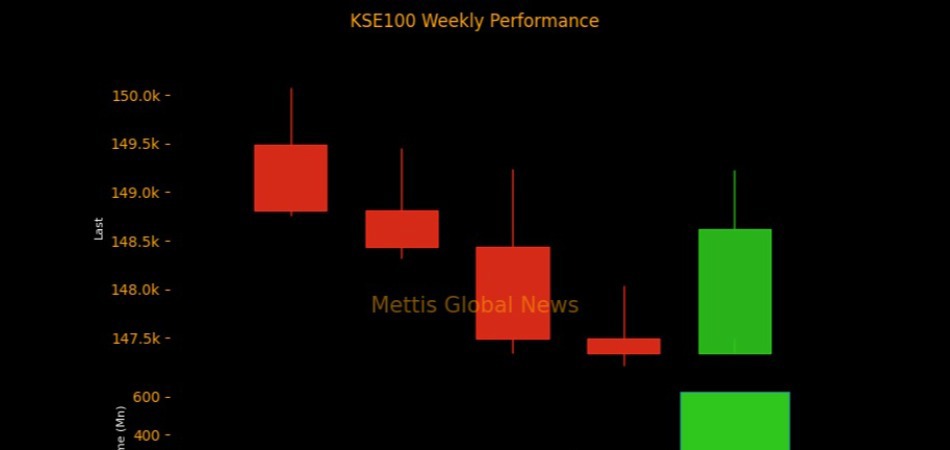

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI