MPS Preview: SBP to hold the line on rates

Abdur Rahman | December 11, 2023 at 12:13 PM GMT+05:00

December 11, 2023 (MLN): The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) is widely expected to maintain its policy stance of keeping the interest rate unchanged at 22% amid early signs of improved economic conditions.

To gauge market sentiment, Mettis Global News conducted a survey regarding the upcoming central bank's monetary policy decision.

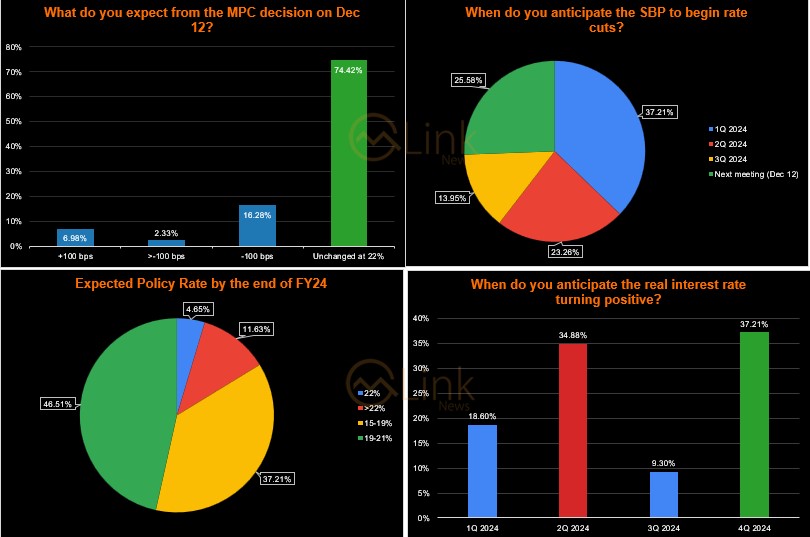

The survey results imply a status quo, with the majority of participants (74.4%) expecting the SBP to maintain the policy rate at 22%, while a minority (16.3%) anticipate a rate cut of 100 basis points (bps).

The survey results further revealed that market participants were most divided on when the central bank would begin cutting rates.

The majority (37.2%) believe the SBP will begin rate cuts in the first quarter of FY24, while 25.6% expect the central bank to start cutting rates in the upcoming meeting i.e., December 12, 2023.

Additionally, 23.3% of participants anticipate rate cuts beginning in the second quarter of FY24.

Furthermore, the majority (46.5%) of participants anticipate the policy rate to fall within the range of 19-21% by the end of FY24. Meanwhile, 37.2% of participants expect it to be within the 15-19% range, a cumulative cut of 300-700bps.

The survey revealed some interesting findings. Most participants (37.2%) do not believe that the real interest rate will turn positive until the fourth quarter of 2024, and 34.9% anticipate it to not turn positive until the second quarter of 2024.

This suggests that nearly 72% of the participants are hoping for the central bank to cut rates even before inflation drops below 22%, as per poll results.

Rate Cuts Still Premature

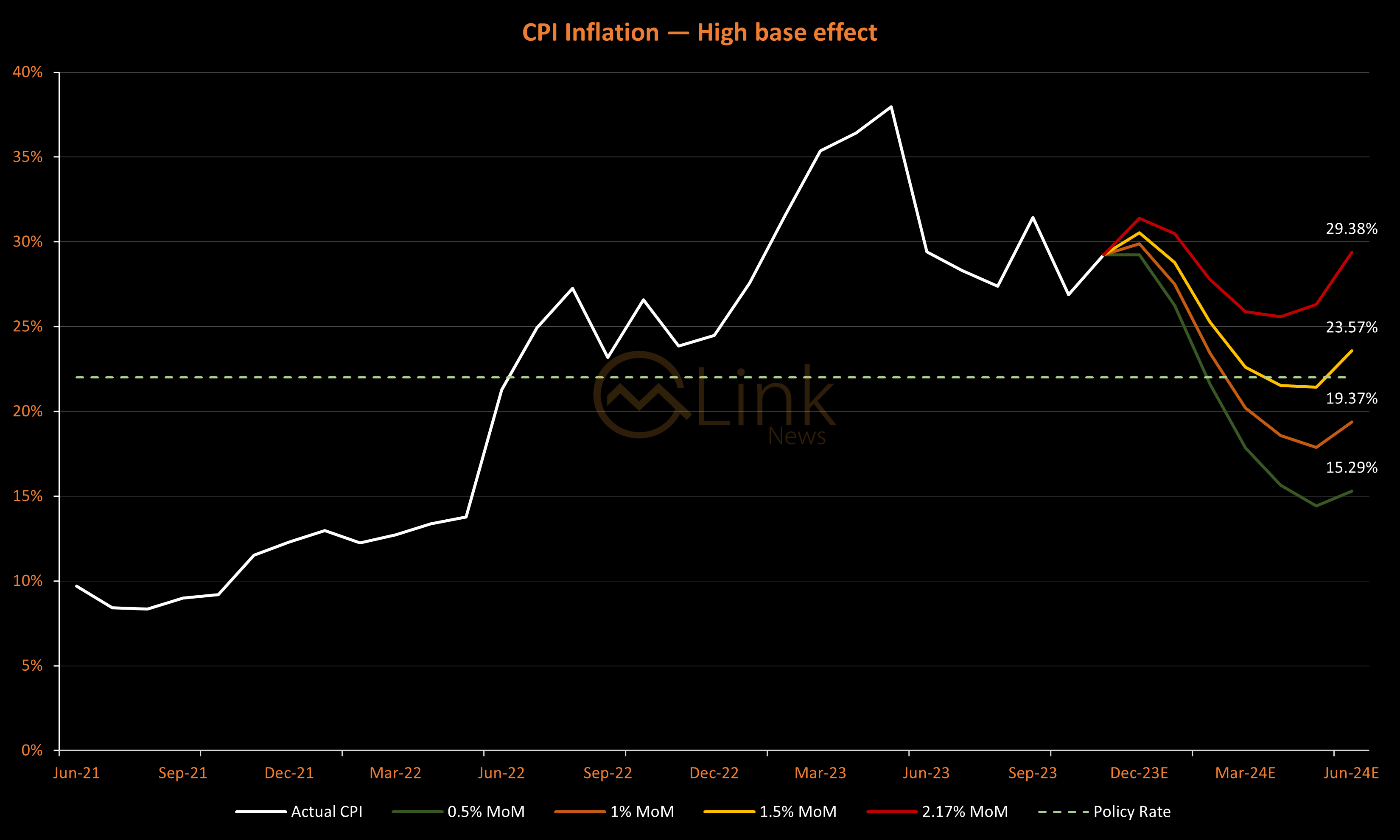

It is pertinent to note that even with a 1% MoM inflation (which is significantly lower than the 12-month average of 2.17% MoM), the real interest rates will not come into positive territory until March 2024.

This leaves little to no room for monetary easing, at least for now.

The following chart maps out the yearly inflation trajectory if 0.5%, 1%, 1.5%, and the 12-month average of 2.17% MoM is taken.

Improved Economic Conditions

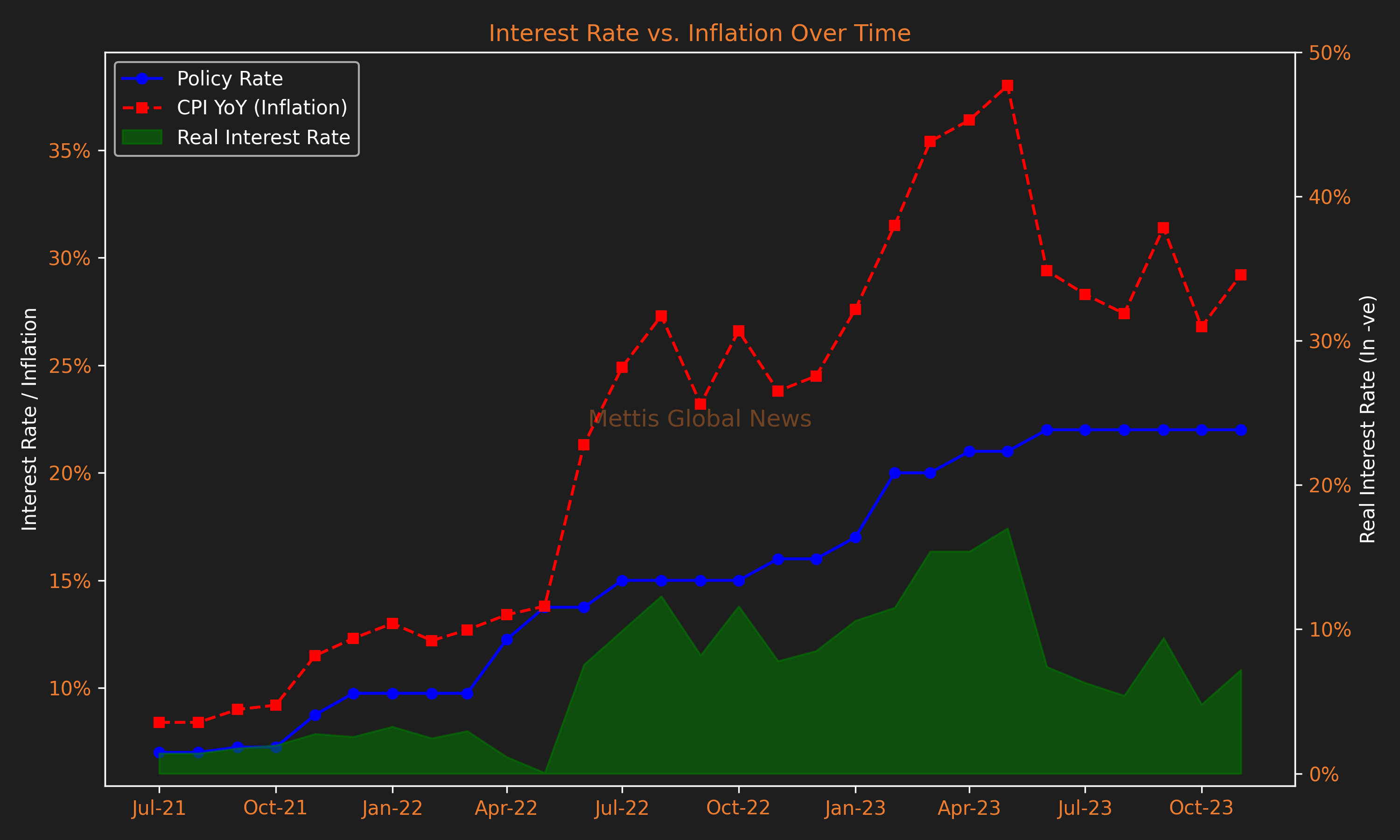

The country’s inflation which surged to a multi-decade high of 29.2% in FY23 is on a downward trend since its peak in May 2023.

Moreover, the country shows early signs of improvement in economic conditions following the expected inflows from the International Monetary Fund (IMF) and friendly countries, a relatively stable local currency, and a significant decline in international commodity prices.

The government-backed administrative measures have helped the Pakistani Rupee (PKR) to completely recover all year-to-date losses against the USD and strengthen significantly to ~284 per USD.

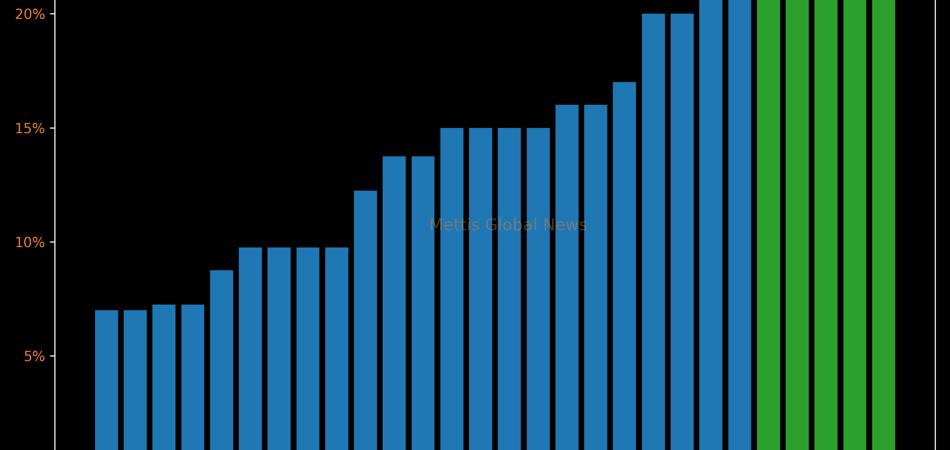

To recall, the central bank has kept the policy rate unchanged at 22% since June 2023, foreseeing a downward trend in inflation.

The central bank in its last meeting in October noted that the inflation is projected to maintain a downward trajectory, especially in the second half of the fiscal year.

On the economic activity front, the latest Large Scale Manufacturing Industries (LSMI) production data for the first quarter of FY24 showed a growth of 0.68% when compared with the same period of last year.

In addition, Pakistan’s Gross Domestic Product (GDP) grew 2.13% in 1QFY24, as compared to 0.96% in 1QFY23.

On the external front, the current account deficit in 4MFY24 was recorded at $1.06bn, showing a significant improvement of 66% YoY when compared to the deficit of $3.11bn in 4MFY23.

This has helped to stabilize the SBP’s FX reserves position amidst tepid external financing.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251003092603298_af0c50_20251010094012153_327c07.webp?width=280&height=140&format=Webp)

_20251226081441672_22beb3.webp?width=280&height=140&format=Webp)

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile