Money supply increases by Rs2.3tr in Dec

MG News | February 01, 2022 at 05:20 PM GMT+05:00

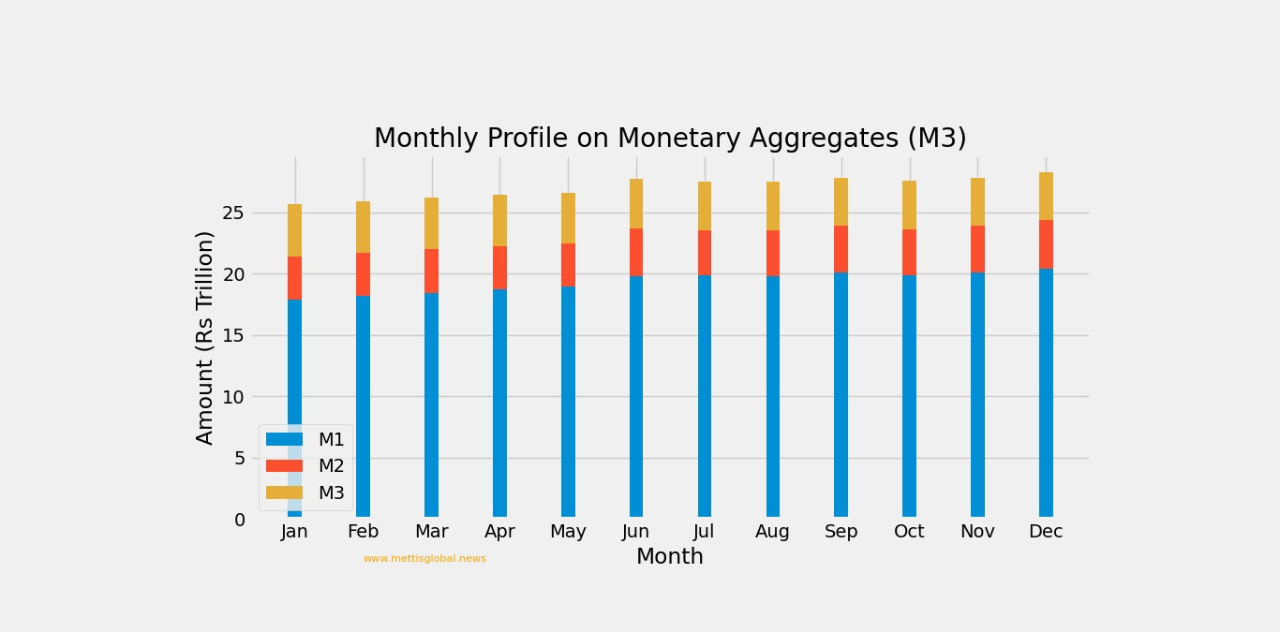

February 1, 2022 (MLN): The total money supply circulating within the economy during the sixth month of FY22 has been recorded at around Rs28.27trillion, according to provisional accounts on Monetary Aggregates for the month, maintained by the State Bank of Pakistan.

The money circulating within the economy until Nov’21 was Rs27.85tr whereas, until the corresponding month of last year, the figure was Rs25.97tr. This means that the money supply has increased by Rs2.3tr or 9% over the year and 2% over the month.

Having broken down the overall money supply into broad categories, the SBP data shows that a total of Rs6.96tr were circulated as notes while Rs13.4tr accounted for transferable deposits which comprise all deposits that are exchangeable on demand at par without penalty/restriction.

The currency circulated as notes which has been high in Pakistan relative to other developed and emerging economies because of the high informal economy rose by over Rs0.77tr or 12% over the year. Meanwhile, it is worth mentioning that in 2018 when the PTI government came into power, the total currency in circulation in the country was approximately Rs4.7tr. From then until the beginning of the Covid period in March 2020, this figure has surged to Rs5.6tr. In May 2020, notes in circulation crossed the Rs6tr mark, and since then it has consistently stayed above that mark. This reflects higher cash withdrawals by depositors to meet needs amid pandemics. Moreover, Cash distributing schemes amid Covid-19 as a relief measure can also be considered as a significant contributor to the surging circulation of currency.

Apart from this, other deposits constituted Rs3.9tr in Dec 2021, up by 7%YoY and 3% MoM. Other deposits represent all claims other than transferable deposits in national or foreign currency that are represented by evidence of deposits.

Similarly, coins in circulation increased slightly by 4% YoY to Rs8.9billion in Dec 2021. While, on monthly basis, it remained unchanged.

Furthermore, Rs194.6bn worth of deposits were held with post offices, down by 29%YoY and 3% MoM, while National Saving Schemes held Rs3.7tn, marking a decline of 9% YoY whereas, on a monthly basis, it remained stable.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,893.09 355.32M | 2.59% 4266.79 |

| ALLSHR | 100,888.78 687.85M | 1.91% 1889.56 |

| KSE30 | 51,723.30 154.72M | 2.74% 1380.77 |

| KMI30 | 236,793.15 125.14M | 3.40% 7778.72 |

| KMIALLSHR | 64,642.45 317.23M | 2.51% 1584.54 |

| BKTi | 49,503.80 58.63M | 0.97% 475.26 |

| OGTi | 32,753.55 16.04M | 2.00% 643.61 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile