Loans from IMF, other partners sufficient for Pakistan to meet external obligations: S&P

MG News | August 30, 2019 at 10:46 AM GMT+05:00

August 30, 2019: S&P Global Ratings on August 29, 2019, affirmed its 'B-' long-term and 'B' short-term sovereign credit ratings on Pakistan. The outlook for the long-term rating is stable. It also affirmed its 'B-' long-term issue rating on Pakistan's senior unsecured debt and sukuk trust certificates.

The stable outlook reflects its expectations that donor and partner financing will ensure that Pakistan is able to meet its external obligations over the next 12 months, and that external, fiscal, and economic metrics will not deteriorate materially beyond our current projections.

S&P may lower the ratings if Pakistan's fiscal, economic, or external indicators continue to deteriorate, such that the government's external debt repayments come under pressure. Indications of this would include GDP growth below its forecast, or external or fiscal imbalances higher than what it expected.

Conversely, it may raise the ratings on Pakistan if the economy materially outperforms its expectations, strengthening the country's fiscal and external positions more quickly than forecast.

The ratings on Pakistan reflect subdued expectations for the country's economic growth, heightened external indebtedness and liquidity needs, and an elevated general government fiscal deficit and debt stock. While Pakistan has secured financial aid from the IMF and numerous other international partners to address its immediate external financing needs, fiscal and external imbalances will remain elevated over the near to medium term.

Institutional and economic profile: Economic outlook subdued amid financial, fiscal stress

- Subdued domestic sentiment, a negative fiscal impulse, and difficult external conditions will weigh on economic growth over the medium term.

- Pakistan's very low income level remains a rating weakness.

- Inadequate infrastructure and security risks continue to be structural impediments to foreign direct investment and sustainable economic growth.

The economic slowdown results from a paucity of growth drivers. In particular, real investment contracted sharply by 8.9% in the fiscal year ended June 2019, the worst performance since fiscal 2011. Prospects for a rapid recovery in investment are limited owing to the fading impulse from China-Pakistan Economic Corridor (CPEC) related projects, along with cautious sentiment in the private sector.

Nevertheless, the government has begun to implement more powerful economic reform measures, in line with its agreement to a US$6 billion, 39-month extended funding facility with the IMF. Chiefly, these include fiscal reforms aimed at increasing the government's revenue mobilization, as well as the introduction of and commitment to a more flexible, market-determined exchange rate regime. The government's fiscal 2020 budget, announced in July, aims to boost revenue by 1.7% of GDP this fiscal year, primarily through improvements to the government's sales and income tax regimes.

The ratings on Pakistan remain constrained by a narrow tax base and domestic and external security risks, which continue to be high. Although the country's security situation has gradually improved over the recent years, ongoing vulnerabilities weaken the government's effectiveness and weigh on the business climate.

Pakistan's economy has begun a period of structural adjustment which entails slower real GDP growth as officials address significant external and fiscal imbalances. In view of the negative impulse stemming from the government's nascent fiscal reforms, as well as weak domestic and external demand conditions, S&P expects real GDP growth to fall to 2.4% this fiscal year--a 12-year low. Taken together with Pakistan's relatively fast population growth of approximately 2.0% per year, real per capita economic growth will fall to an anemic 0.4%. That will contribute to a decline in Pakistan's 10-year weighted average per capita growth to 1.8%, below the global average of 2.3% for economies at a similar level of income.

The Pakistani rupee's approximately 25% depreciation against the U.S. dollar in fiscal 2019 has also contributed to a decline in the economy's nominal GDP per capita. S&P has forecasted GDP per capita to fall to just above US$1,200 by the end of this fiscal year, versus US$1,565 in fiscal 2017-2018.

Growth will also be constrained by domestic security challenges and extended hostility with neighboring India and Afghanistan. These conditions, along with inadequate infrastructure, mainly in transportation and energy, are additional bottlenecks to foreign direct investments.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

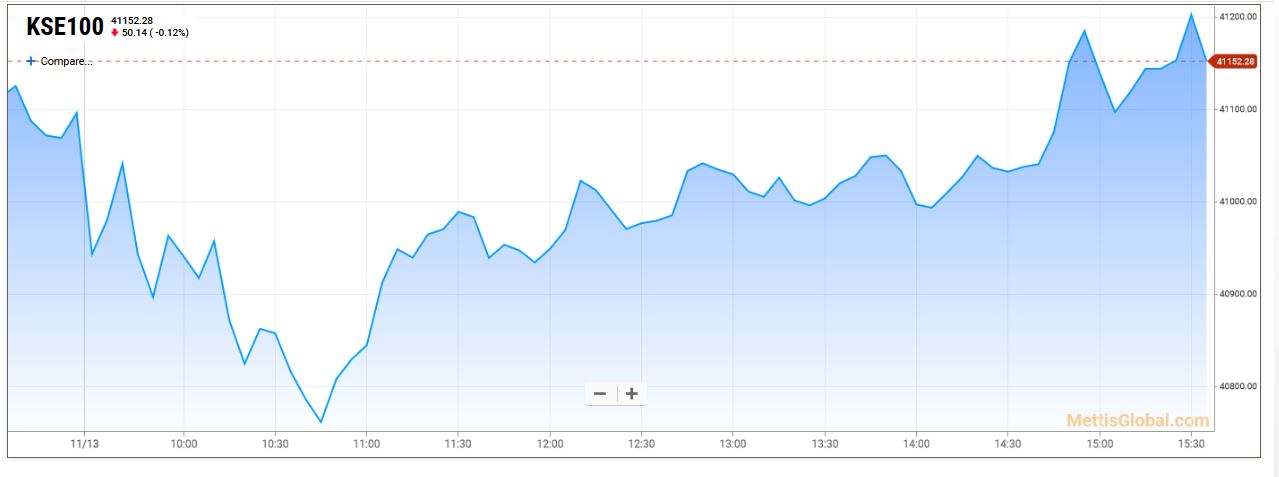

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction