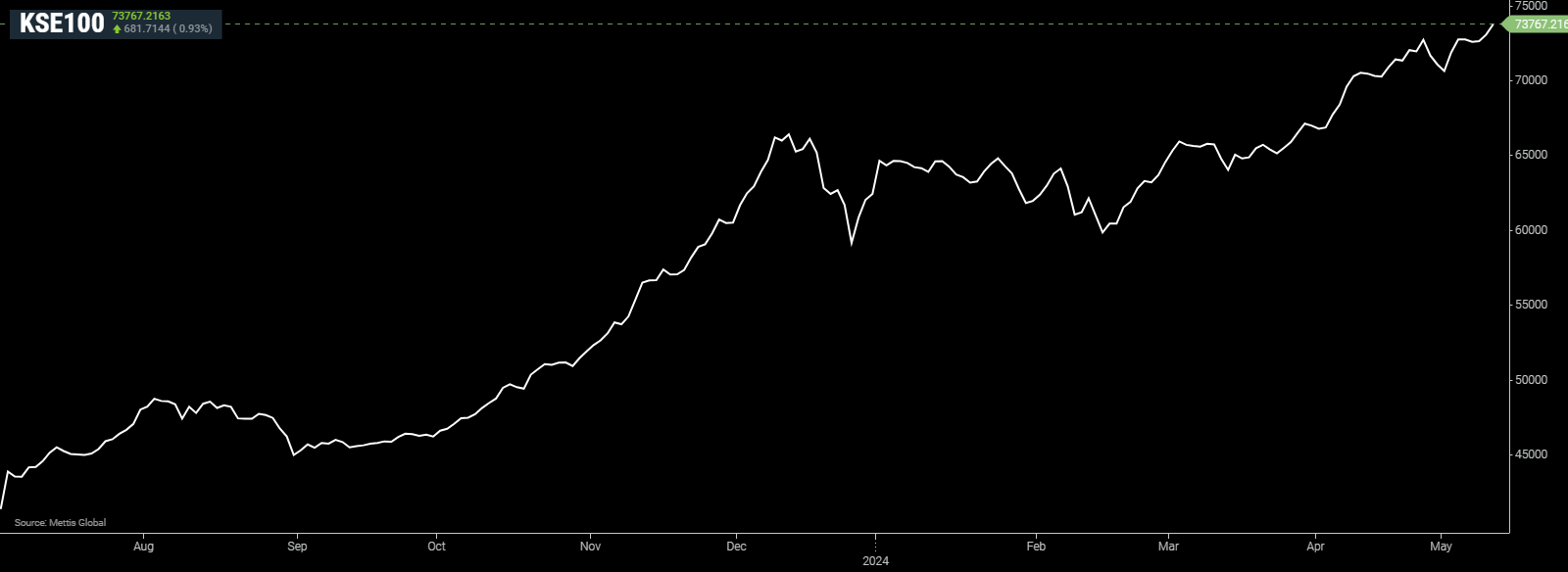

KSE-100 index forecast to hit 87,000 by year-end: Report

MG News | May 13, 2024 at 11:57 AM GMT+05:00

May 13, 2024 (MLN): The Pakistan stock market’s benchmark KSE-100 index is expected to surge past the 87,000 level by December 2024 and 106,000 by June 2025, according to the latest strategy report by Topline Securities.

This provides a further return of 18% by December 2024 and 45% by June 2025, from the current index level.

After incorporating Pakistan’s successful completion of $3 billion stand-by agreement with International Monetary Fund (IMF) and initiation of talks for a new IMF program, current Price to Earnings (PE) ratio of 3.7x will linearly revert to its historical average of 6.93x over next 3 years of IMF program, the report noted.

This is subject to successful implementation of the program and its conditionalities with respect to fiscal/monetary discipline and structural reforms, it said.

Topline Securities expects the forward PE to rise to 4.6x by June 2025, taking the KSE-100 index target for June 2025 to 106,000.

In line with this, the index target for December 2024 is now revised up to 87,000, from an earlier target of 75,000.

“For FY25, we estimate real GDP to grow in the range of 3.5-4.0% from our earlier numbers of 3.5%,” it said.

The upward revision is after incorporating government’s crop target numbers for next season along with the slight positive adjustment in service numbers considering negligible growth in last two years.

Topline Securities expect inflation to come down to an average of 13.0-13.5% during FY25 (vs. FY24E inflation of 24.4%).

The inflation estimates of FY25 include a 15% hike in power tariff, an 8% hike in rent, a 14.5% hike in wheat prices (taking market price back to support price of Rs4,000/40kg), a 14.3% hike in fuel price (assumed Rs20/liter change in PDL), and a 40% hike in gas tariff (20% in Jul 2024 and 20% in Jan 2025).

Going with the inflation assumption of 13-13.5% during FY25, the brokerage house expects interest rates to witness cumulative cuts of 500-600bps till June 2025 with real interest rate assumption of 300-400bps.

Sector-wise, due to expected monetary easing, deregulation of non-essential pharmaceutical prices, lower inflation, and gradual addressal of recurring circular debt, the report noted that high leverage, pharma, consumer and circular debt affected companies/sectors will garner investors' attention in next 12 months.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,967.75 144.99M | 0.43% 709.21 |

| ALLSHR | 100,219.72 257.20M | 0.46% 463.06 |

| KSE30 | 51,094.65 55.01M | 0.35% 176.77 |

| KMI30 | 232,474.46 74.06M | -0.13% -297.30 |

| KMIALLSHR | 63,896.07 140.52M | 0.18% 115.39 |

| BKTi | 49,739.41 34.84M | 1.44% 708.25 |

| OGTi | 32,670.61 2.61M | -0.07% -23.12 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile