KE to overcome setbacks: CEO

MG News | May 09, 2023 at 04:09 PM GMT+05:00

May 09, 2023 (MLN): Moonis Alvi, CEO of K-Electric Limited (PSX: KEL) has expressed confidence in the company's ability to overcome setbacks and commitment to stabilize Karachi electricity despite the financial challenges during a latest interview with Ali Khizar, Economist at Business Recorder.

The company recently posted its financial results for 9 months of FY23 with a reported Rs39.4 billion loss, raising concerns in the minds of many about what this means for the company, its future plans, and the power sector as a whole.

Moonis assured that a substantial portion of the reported loss had already been accounted for in the company's budget, and the lenders were duly informed.

He reiterated KE's commitment to stabilizing Karachi and the industry, emphasizing that the company's tariff is regulated, and they perform accordingly. Moonis expressed confidence in securing a favorable tariff moving forward.

The CEO attributed the loss to several factors. First, the macroeconomic conditions led to an industry slowdown, resulting in reduced demand from the commercial and residential sectors.

Additionally, the increase in tariffs made it challenging for a single utility to collect payments, leading to defaults and households struggling to pay their bills.

The fixed cost of debt at 12.5% also posed a challenge when interest rates surged above 21%, resulting in a loss of Rs12bn.

Furthermore, the company incurred foreign exchange losses of Rs9bn.

Moonis further stated that these losses could have been avoided through hedging. The company had received approval for hedging, but unfortunately, due to the shortage of dollars in the country, they were unable to execute the hedging process through banks, despite having disbursed the loans.

Moving forward, KEL is determined to implement hedging strategies to prevent such exchange losses in the future.

Moonis highlighted the need for sustainable tariffs and the privatization of debt-ridden companies to address circular debt issues. Privatization would ensure that companies face the cost privately when they fail to meet benchmarks, rather than burdening the country.

He emphasized that KE's losses would not contribute to circular debt, as they would be borne solely by the company's investors.

Regarding load shedding, Moonis assured that KE was committed to maintaining its previous policies and minimizing interruptions.

However, importing gas and furnace oil could pose challenges if the government or the suppliers faced difficulties, potentially leading to load shedding.

When questioned about KE's governance, Moonis stated that the management had presented a budget to the board in June, outlining projected losses. The company has comprehensive plans in place, and its operations are thoroughly regulated.

In terms of dividends, Moonis said that although KE has never paid any dividends in the past, they plan to do so in the next seven years. This decision aims to prioritize shareholders.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

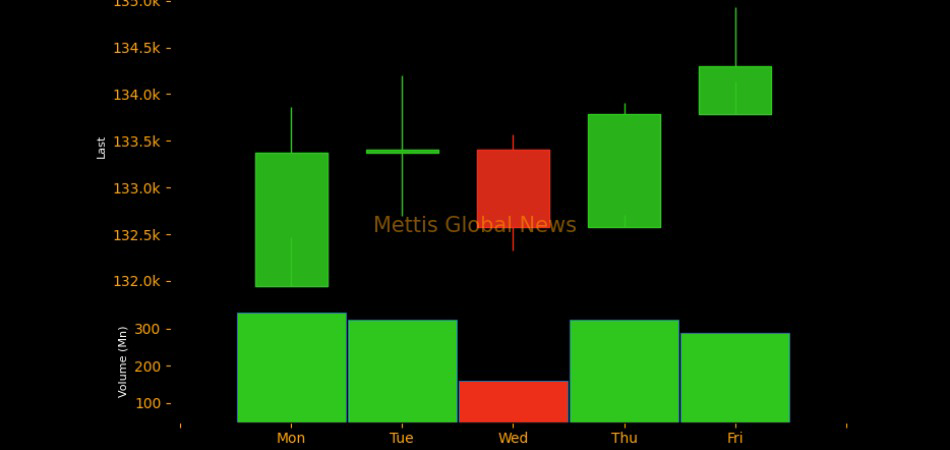

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|