Intraday Report: PSX suffers as geopolitical tensions escalate

MG News | January 18, 2024 at 10:47 AM GMT+05:00

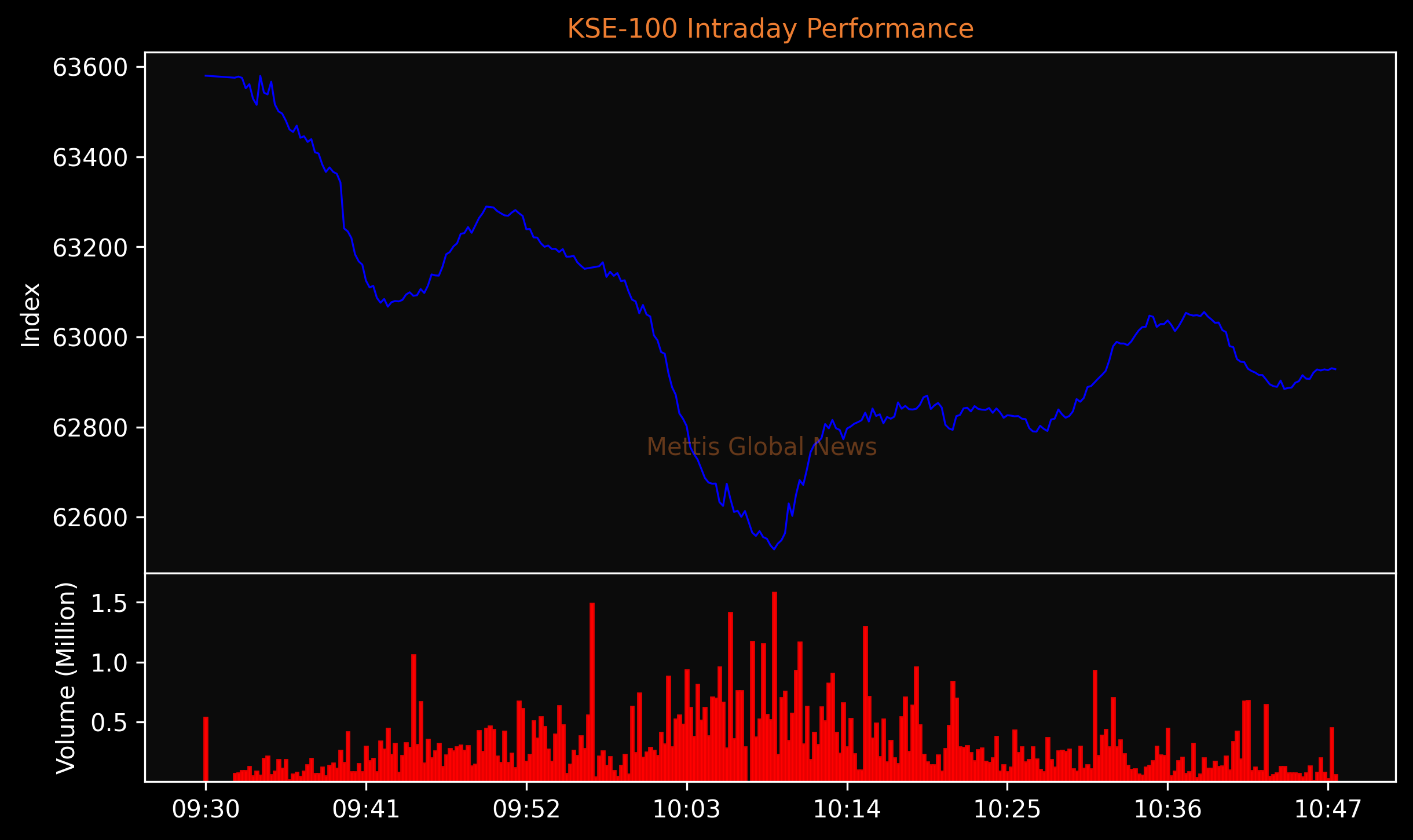

January 18, 2024 (MLN): The escalating geopolitical tensions took their toll on investor sentiment as the benchmark KSE-100 index fell 639.27 points or 1.01% to trade at 62,928 [10:47am PST].

This morning Pakistan undertook a series of targeted military strikes against terrorist hideouts in Iran after Tehran launched similar attacks the day before.

A number of terrorists were killed during the Intelligence-based operation, codenamed ‘Marg Bar Sarmachar'.

"This morning’s action was taken in light of credible intelligence of impending large scale terrorist activities by these so called Sarmachars", Ministry of Foreign Affairs said in a statement.

The tit-for-tat responses is the most significant escalation between the two neighbors who have had testy relations in the past, Bloomberg said.

The strikes come at a time of rising turmoil in the Middle East over the war between Israel and Iran-backed Hamas, which has been raging for more than 100 days.

Yesterday, KSE-100 experienced a drop of 170 points or 0.27%, despite positive economic data.

In today's session, the index has traded a volume of 95.1 million shares.

KSE-100 index is being down by Commercial Banks with 135.21, Cement with 93.29, Power Generation & Distribution with 81.29, Oil & Gas Exploration Companies with 70.08, and Oil & Gas Marketing Companies with 55.72 points.

Companies dragging the index lower are HUBC with 55.83, PPL with 43.23, OGDC with 42.15, LUCK with 33.46 and PAKT with 28.4 points.

In the broader market, the All-Share index is trading at 42,574.84 with a net loss of 493.69 points.

| Company | Volume |

|---|---|

| KEL | 31,169,252 |

| WTL | 19,710,777 |

| BOP | 11,036,519 |

| CNERGY | 7,438,785 |

| PTC | 6,822,895 |

| PIBTL | 6,005,000 |

| PIAA | 5,288,500 |

| TREET | 4,513,850 |

| PPL | 4,245,768 |

| HASCOL | 3,506,500 |

To note, the KSE-100 has gained 21,475 points or 51.81% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 477 points, equivalent to 0.76%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,010.00 | 119,275.00 117,905.00 | 1390.00 1.18% |

| BRENT CRUDE | 72.35 | 72.82 72.29 | -0.89 -1.22% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.98 | 70.41 69.92 | -0.02 -0.03% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|