Intraday Report: PSX starts week with sharp decline

By MG News | July 22, 2024 at 10:00 AM GMT+05:00

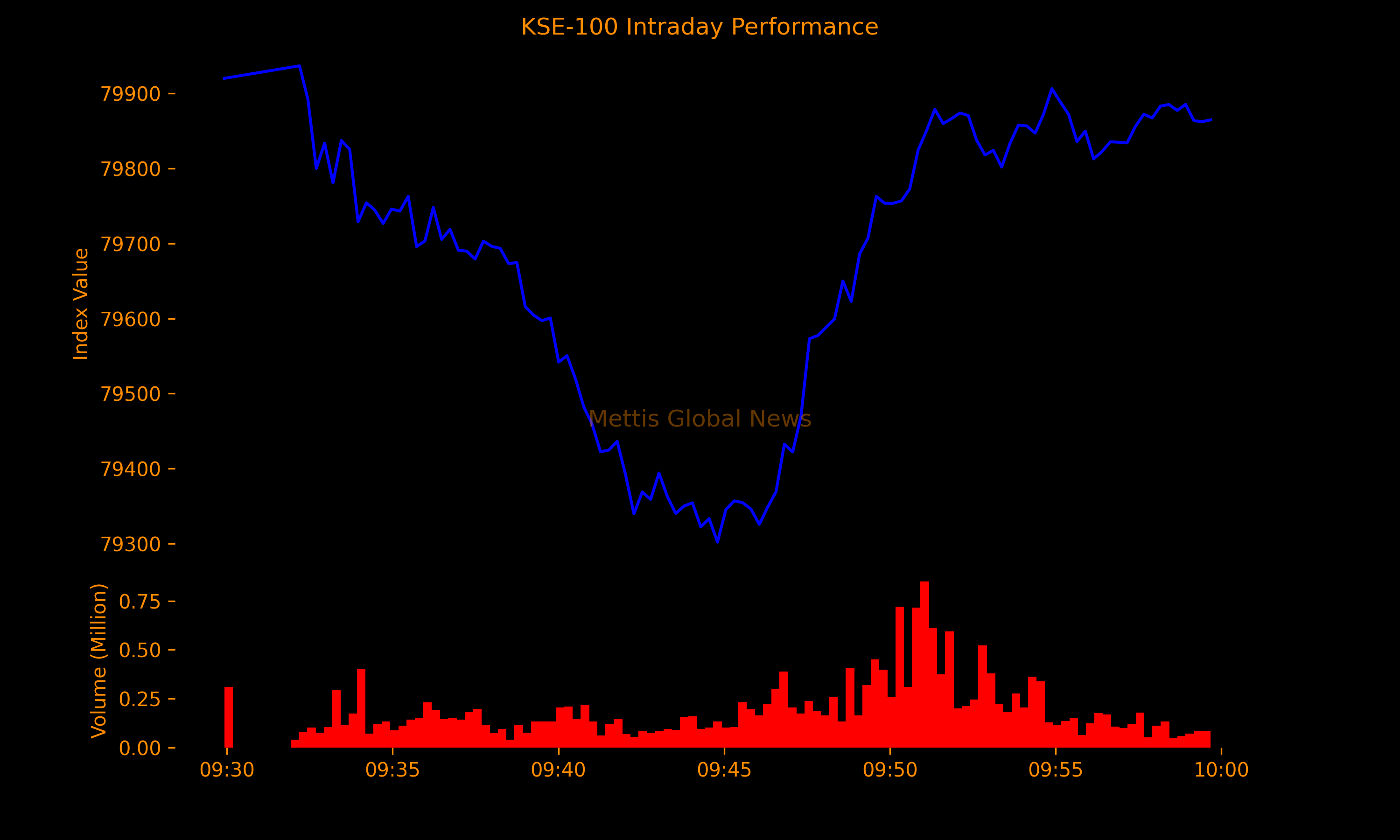

July 22, 2024 (MLN): Pakistan stocks started the week on a bearish note as the benchmark KSE-100 Index initially dropped 816 points or 1.02%, but later recovered most of the losses.

By 10:00am, the index traded near 79,872, a decrease of 245.87 points or 0.31%.

Last week, the index recorded a marginal increase of 174 points or 0.2%.

In an unexpected move, the government slashed the capital gains tax (CGT) rates for non-filers by half on securities acquired during the last two years.

The tax rates on capital gains for securities acquired between July 01, 2022, and June 30, 2024, have been reduced by 50% for all holding period categories for non-filers.

This reduction brings the tax rate for non-filers in line with that of investors appearing in the active taxpayer list (ATL). Previously, it was double.

In economic news, Pakistan's current account recorded its smallest deficit in 13 years amid robust growth in remittances and exports, which more than offset the uptick in imports.

Meanwhile, the cash-strapped nation attracted $1.52bn total foreign investment in FY24, up from $601m last year.

Top losers during the day were PGLC (-7.29%), PKGS (-4.39%), ABOT (-3.26%), EFUG (-2.83%), and HABSM (-2.61%).

In terms of index-point contributions, companies that dragged the index lower were HUBC (-52.55pts), ENGRO (-38.37pts), BAFL (-29.57pts), UBL (-28.35pts), and HMB (-24.97pts).

Sector-wise, KSE-100 Index was let down by Commercial Banks (-103.21pts), Power Generation & Distribution (-69.13pts), Pharmaceuticals (-24.76pts), Engineering (-15.63pts), and Oil & Gas Exploration Companies (-13.40pts).

In the broader market, the All-Share Index was at 50,766.53 with a net loss of 87.89 points or 0.17%.

To note, the KSE-100 has gained 1,427 points or 1.82% so far this month, whereas the ongoing calendar year has witnessed a cumulative increase of 17,421 points, equivalent to 27.90%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 105,800.00 | 106,200.00 105,625.00 |

50.00 0.05% |

| BRENT CRUDE | 67.20 | 67.29 67.09 |

0.09 0.13% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.48 | 65.65 65.40 |

0.03 0.05% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI