Intraday Report: KSE-100 surges over 2.4% post-budget

By MG News | June 13, 2024 at 10:05 AM GMT+05:00

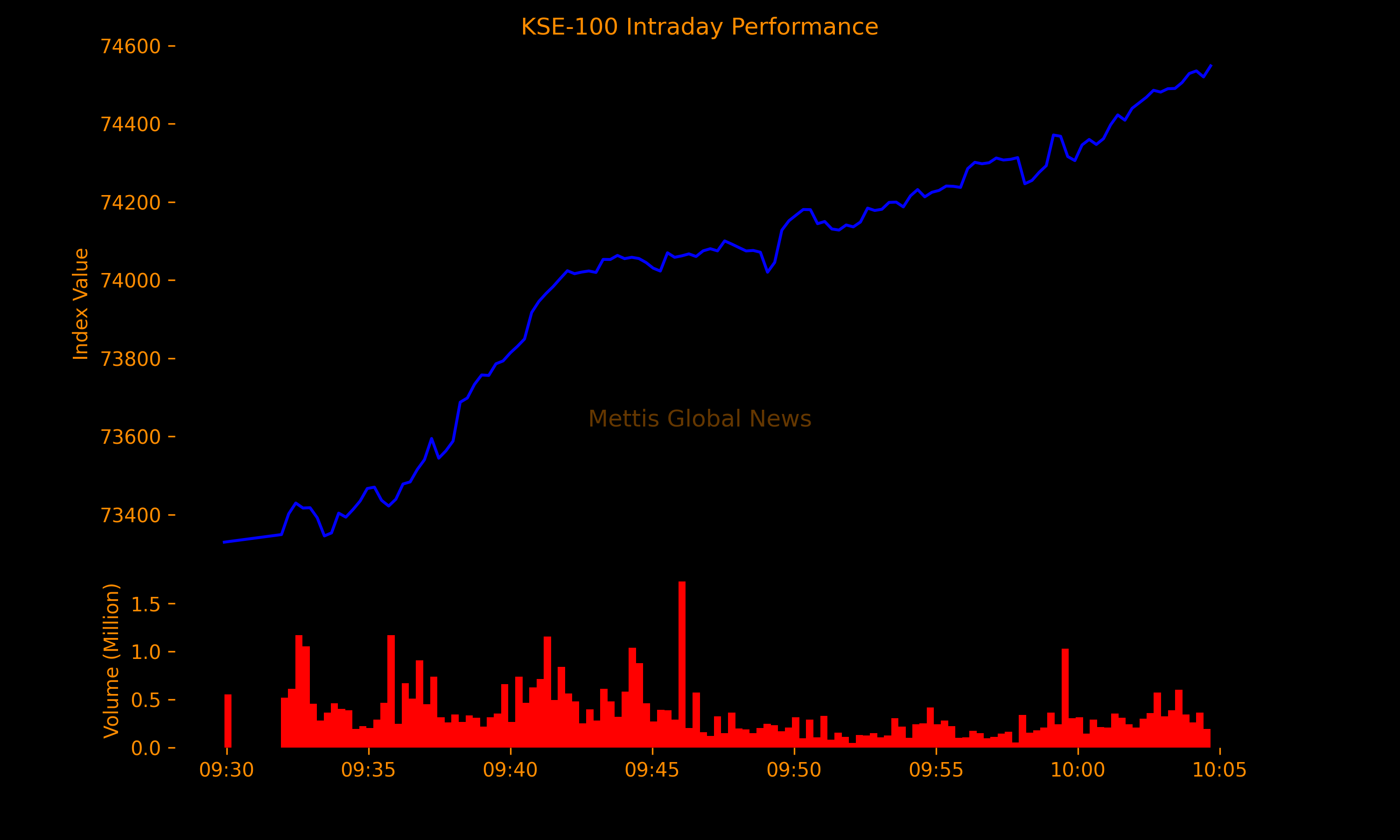

June 13, 2024 (MLN): Pakistan stocks soared on Thursday following the announcement of budget 2024-25 yesterday, with the benchmark KSE-100 index surging 1,755.57 points or 2.41% to 74,553 as of 10:04am.

The government decided to set the capital gains tax at a flat rate of 15% for filers for the sale of securities acquired on or after July 01, 2024.

For non-filers, the gain will be taxed at normal rates with a minimum rate of 15% and a maximum rate of 45%.

Arif Habib Limited in its budget review said, "We believe that the change in the CGT rate was one of the major uncertainties and caused panic in the market during the last couple of weeks.

"Maintaining the current CGT rates for filers would positively impact the market."

Similarly, AKD Securities in its budget review said, "The budget is neutral for the overall market, as a Capital Gains Tax (CGT) of 15% on purchases from July 2024 onward is imposed at a flat rate, given the holding period of less than one year for majority of retail and high-net-worth (HNW) investors."

Meanwhile, increase in taxation rate on dividend income derived from debt securities of mutual funds is slightly positive for market, it added.

Moreover, there is no significant change in the factors affecting the top three sectors of the Pakistan Stock Exchange (PSX).

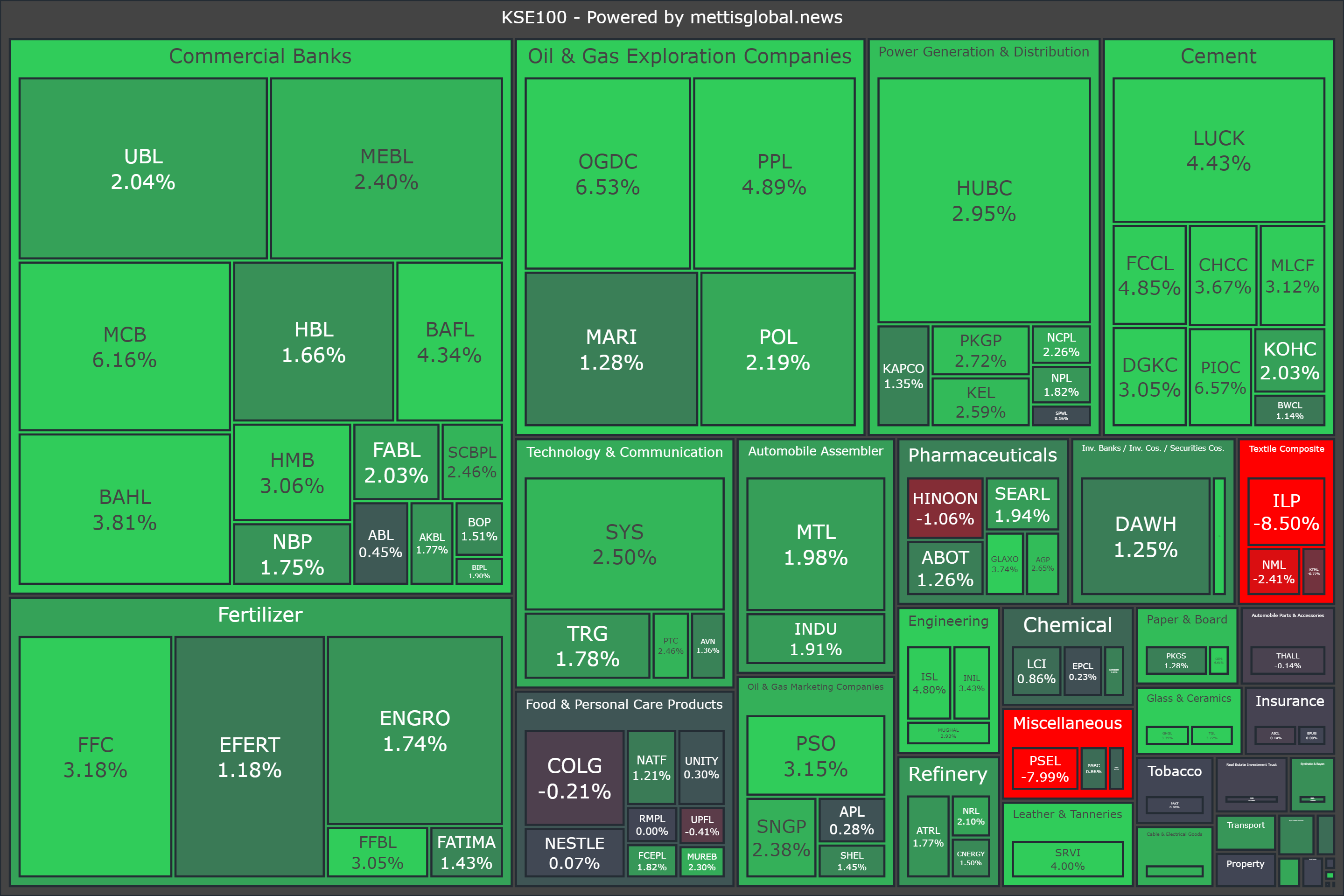

KSE-100 index was supported by Commercial Banks (548.02pts), Oil & Gas Exploration Companies (345.11pts), Cement (238.53pts), Fertilizer (196.13pts), and Power Generation & Distribution (160.49pts).

Companies adding points to the index were MCB (159.38pts), OGDC (158.34pts), HUBC (124.61pts), PPL (117.6pts), and LUCK (109.48pts).

In the broader market, the All-Share index was at 47,741.67 with a net gain of 907.38 points.

To note, the KSE-100 has gained 33,121 points or 79.9% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 12,123 points, equivalent to 19.41%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,759.15 208.29M |

1.22% 1559.73 |

| ALLSHR | 80,718.99 588.26M |

1.17% 931.37 |

| KSE30 | 39,739.31 81.67M |

1.62% 634.31 |

| KMI30 | 188,724.61 72.61M |

0.97% 1809.00 |

| KMIALLSHR | 54,570.55 271.48M |

0.68% 368.67 |

| BKTi | 34,688.71 36.17M |

3.62% 1212.03 |

| OGTi | 28,169.75 8.21M |

0.74% 207.17 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,455.00 | 107,525.00 105,440.00 |

1705.00 1.61% |

| BRENT CRUDE | 67.01 | 67.29 66.98 |

-0.10 -0.15% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 0.00 0.00 |

-3.70 -3.44% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.30 | 65.65 65.26 |

-0.15 -0.23% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

CPI

CPI