Intelligent Diversification

Abu Ahmed | July 01, 2024 at 02:45 PM GMT+05:00

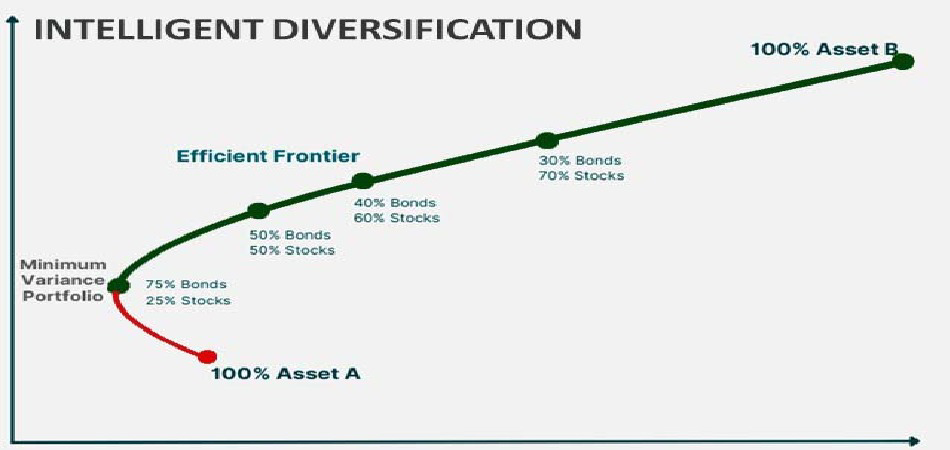

July 01, 2024 (MLN): Diversifying in vestments across different classes of assets is the first and foremost lesson in portfolio investing. An ideally diversified investment portfolio offers a given level of return with zero risk.

vestments across different classes of assets is the first and foremost lesson in portfolio investing. An ideally diversified investment portfolio offers a given level of return with zero risk.

However, as zero risk is not destined for portfolio investing, investors assume risk for a higher return. Markowitz’s Efficient Frontier is there to help them select a portfolio that offers higher returns against higher risk well within their appetite.

Investors’ non-preference for zero risk becomes more obvious when we look at the KPIs of the Equity Mutual Funds meant to measure the performance of Funds. None reflects AMCs’ satiety for minimal return for the sake of capital protection. Whether it is Active share, Alpha, Sharp ratio, Upside & Down Capture, etc., all reflect a desire for a return over and above the benchmark return.

The desire for a return over and above the benchmark returns predominantly links to the need for growth in the fund, growth for bridging the gap between assets and liabilities to remain solvent, retaining clients, financing products and market developments, and last but not least for maintaining the competitive edge over peers, therefore, diversification that does not feed growth hardly justifies its economic existence.

Intelligent Diversification is all about pursuing growth without sacrificing capital preservation. Thus, a portfolio needs to be built with objectives to preserve capital on the one hand and increase capital purchasing power over time on the other hand.

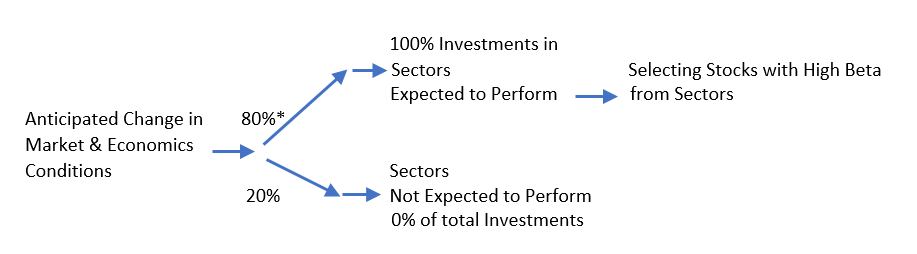

One way to achieve this is by investing in high beta stocks within the sectors expected to perform in an anticipated change in the market and economic environments.

* Probability that Sectors will perform

Constructing such a portfolio amplifies the probability of performing the portfolio by two folds. First, by assuring return through investing in sectors that have a high likelihood of performing in the future, Second, by linking return to price sensitivity of a stock to changes in the benchmark index, beta.

Expected Return = Return from Sector’s Performance + Beta Return

E (Return) = [ (80%x%Inv.x%Inc.in price) + (20%*%Inv.x%Inc.in price) ] + ∑ (Rf + β*( Rm – Rf ) ]

The first component represents the return from the systematic risk in the market, whereas, the second component shows returns based on the riskiness of stocks relative to the rest of the market. It is to be remembered that price volatility is the key to making Intelligent Diversification work.

Therefore, Intelligent Diversification is like clubbing Dynamic Diversification (Dynamic Assets Allocation) with price volatility of stocks within the cluster of selected sectors.

Mr. Bernard Baruch, a successful stock investor of the early 1900s, nicknamed ‘The Lone Wolf of Wall Street’, was right when he said “It is unwise to spread one’s fund over too many different securities.”, [Bernard Baruch, My Own Story, Holt, Rinehart & Winston, New York, 1975, 256].

Next time, Think Intelligently When Diversifying Your Equity Portfolio

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,830.22 319.89M | -0.14% -243.51 |

| ALLSHR | 102,922.38 808.59M | -0.19% -197.80 |

| KSE30 | 52,169.49 112.77M | -0.13% -68.01 |

| KMI30 | 242,960.31 62.27M | -0.31% -745.44 |

| KMIALLSHR | 66,780.42 307.03M | -0.21% -140.25 |

| BKTi | 47,435.60 66.45M | 0.00% 0.50 |

| OGTi | 33,373.62 6.42M | 0.72% 237.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,400.00 | 87,795.00 86,380.00 | -285.00 -0.33% |

| BRENT CRUDE | 62.28 | 62.73 62.02 | -0.10 -0.16% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 2.40 2.71% |

| ROTTERDAM COAL MONTHLY | 96.45 | 0.00 0.00 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.40 | 58.75 58.13 | 0.02 0.03% |

| SUGAR #11 WORLD | 15.30 | 15.34 15.16 | 0.10 0.66% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Disbursement Report of Foreign Economic Assistance

Disbursement Report of Foreign Economic Assistance