Indus Motors likely to standout in terms of volumetric growth

By MG News | February 07, 2019 at 02:57 PM GMT+05:00

February 7, 2019: Total passenger cars and light commercial vehicles (LCV) sales are expected to down by 5% YoY to approximately 22,448 units in the month of January 2019, stated a research report by JS Global.

The contraction in volumes is expected mainly due to the anticipation of 15% YoY shrinkage in unit sales of Pak Suzuki (PSMC), which is attributable to a likely drop in Mehran, Bolan and Ravi sales during the month.

Additionally, the increment of 10% to 15% YoY in prices of various models are expected to have a negative impact on automaker’s price-sensitive customers.

Indus Motor (INDU) is expected to standout in terms of volumetric growth, on the back of buoyant Corolla volumes, despite pullbacks in Fortuner demand due to the non-filer restriction being maintained for larger engine sizes.

Honda Atlas (HCAR) is expected to report tepid growth of 3% YoY, since lackluster demand in BR-V could potentially wipe out a recovery in Civic/City sales during the month.

In addition to this, in the tractor segment, a depressing outlook persists in the short term on the back of price hikes due to rupee devaluation, where Millat Tractors (MTL) and Al-Ghazi Tractors (AGTL) are likely to face weakening demand and their sales are expected to plunge by 37% and 45% YoY respectively.

In view of Mr. Ahmed Lakhani, at JS Global, despite the mini-budget and tougher restrictions imposed on CBU imports that provide some relief to local passenger car companies (PSMC in particular), current car prices remain at all-time highs following massive rupee devaluation and the impact on demand will become more visible as order backlogs trim down further.

Furthermore, the impact of recent monetary tightening measures will also bear down on volumes, particularly for HCAR and PSMC with higher proportion of car financing compared to INDU.

In addition to this, new entrants like Kia and Hyundai are expected to commence production from 1QFY20 and 3QFY20 respectively, whereas Ghandhara Nissan (GHNL) is also in the process of procurement of plant and machinery for assembly of Datsun vehicles, these new capacities coming in will outweigh other benefits and in particular hurt the pricing power of existing OEMs.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,624.75 88.97M |

-0.58% -778.44 |

| ALLSHR | 82,969.29 489.14M |

-0.26% -218.76 |

| KSE30 | 40,352.62 31.97M |

-0.74% -298.84 |

| KMI30 | 190,823.62 36.17M |

-0.66% -1260.29 |

| KMIALLSHR | 55,703.66 251.04M |

-0.26% -144.04 |

| BKTi | 36,187.06 5.56M |

-0.65% -235.82 |

| OGTi | 28,246.70 6.81M |

-0.67% -190.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,045.00 | 109,545.00 108,625.00 |

-170.00 -0.16% |

| BRENT CRUDE | 69.98 | 70.09 69.85 |

-0.17 -0.24% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

2.05 2.15% |

| ROTTERDAM COAL MONTHLY | 106.65 | 106.65 106.25 |

0.50 0.47% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.13 | 68.27 67.78 |

-0.20 -0.29% |

| SUGAR #11 WORLD | 16.15 | 16.37 16.10 |

-0.13 -0.80% |

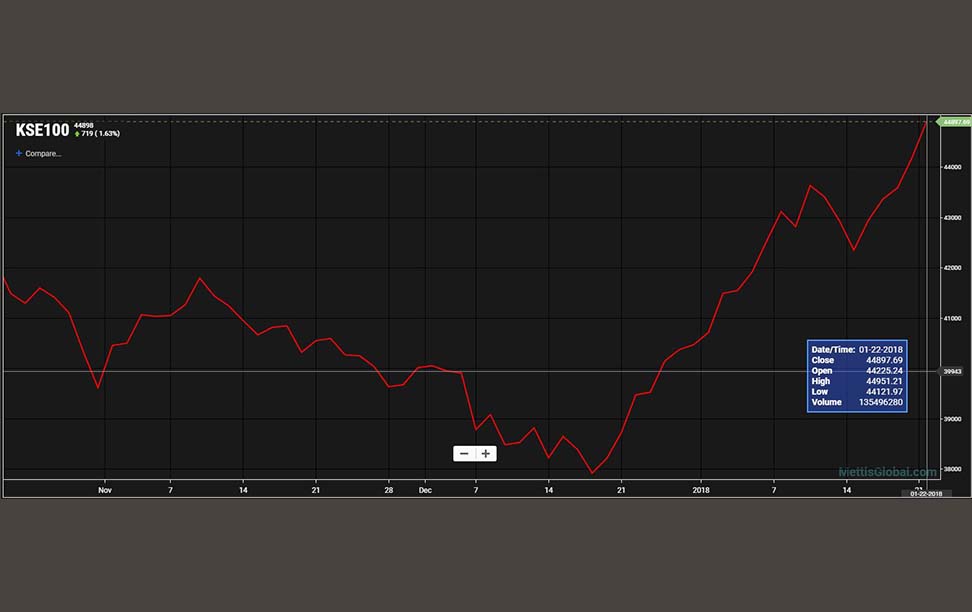

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)