Improving global funding conditions aid emerging market recovery, but pressure remains for lowest-rated sovereigns: Moody’s

By MG News | September 14, 2020 at 11:36 AM GMT+05:00

September 14, 2020: Moody's Investors Service says in a new report that while global financing conditions have eased markedly in recent months, many emerging and frontier market economies will commence their recoveries with greater fiscal and external weaknesses.

"Emerging and frontier market economies have experienced a substantial shock through multiple channels: a drop in export values on lower commodity prices; weaker tourism and lower global demand; and volatility in non-resident capital flows. We expect fiscal and external imbalances to widen and, in the most severe cases, liquidity pressures will rise toward serious stress or default," says Michael S. Higgins, a Moody's Analyst.

Some of these sovereigns have struggled to find external sources of borrowing to fund fiscal and external gaps and have tapped emergency financing from international financial institutions like the International Monetary Fund and other multilateral lenders. However, as global capital flows remain volatile, many will face substantial credit challenges through their recoveries, even if they do emerge from the crisis without defaulting. Limited fiscal space and subdued foreign direct investment are likely to inhibit greater employment creation and consumption.

And while a strong international policy response, fueled by advanced economies' substantial monetary stimulus, has enabled capital flows into emerging markets to normalize, funding conditions are still much tighter for the lowest-rated sovereigns, as investors remain cautious about increased liquidity pressures and risk of default among these sovereigns.

In this environment, uneven economic recoveries and weakened fiscal and external profiles will leave lasting credit challenges for many, even after global economic conditions normalize. Low-rated sovereigns will face pressure on their creditworthiness as weak reserve adequacy constrains monetary policy flexibility and increases fiscal risks for governments with large foreign currency borrowings. In particular, sovereigns with large upcoming external debt repayments, and reliance on tourism and commodities are among those most exposed, given a potentially more prolonged period of weaker dollar inflows from traditional export earnings.

Moody’s

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,635.00 | 110,525.00 107,865.00 |

-780.00 -0.71% |

| BRENT CRUDE | 67.78 | 67.96 67.22 |

-0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.99 | 67.18 65.40 |

-1.01 -1.51% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

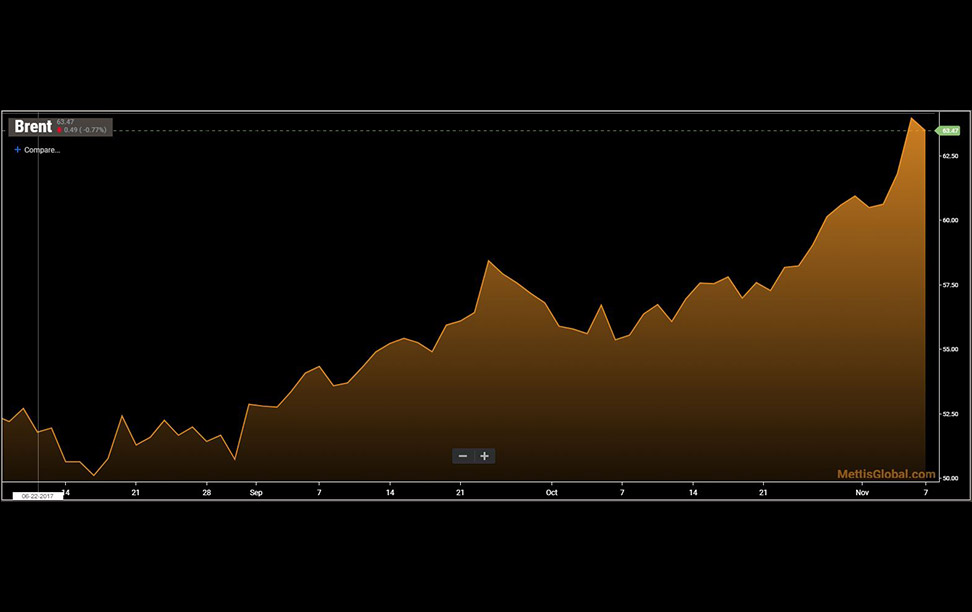

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI