February 01, 2023 (MLN): It is an extension of the previous article, Should Investors in Stock possess skills for predicting future of the Stock Market? The article explains how a dependable prediction about Stock Market can be made by developing an Event & Impact Colander.

The previous article concluded with a Yes but how to make dependable predictions was left to the wild imagination of readers.

There are numerous tools & techniques available for forecasting the future, varying between Soft and Hard approaches. The most obvious among them happens to be Technical Analysis.

A set of techniques that are based on statistical principles and employ historical data to forecast the future by identifying trends & patterns within it. Though its predictive capability is undeniable, yet inherently lacks a futuristic outlook due to the non-inclusion of Internal & External Environments developments, such as political, economic, technological, social & regulatory, which are supposed to have a direct bearing on the state of capital market in general and on stock price in particular through influencing investors™ perception about the future performance of market or stock price.

Contrarily, Predictive Modeling is considered superior to technical analysis on many counts.

First, it is based on probability. The second involves data mining for predicting future events. So, it is broader in scope and sound in technical. Random Forest, Generalized Linear Model for Two Values, Gradient Boosted Model, K-Means, Prophet, Logistic Regression, Decision Trees, Neutral networks, and Time Series analysis are some examples of Predictive Modeling.

Each one has its own unique utility. For example, some are good for weather forecasting whereas others are more appropriate for online marketing, fraud detection, and investment management.

With the advancement in Information Technology and Artificial Intelligence a wide range of off-the-shelf application software, such as Sisense, Oracle Crystal Ball, IBM SPSS Predictive Analytics Enterprise, and SAS Advanced Analytics, are available which have made the task of prediction easier, more structured and systematic.

However, due to the considerable financial resources and & technical literacy needed to acquire and use them effectively & efficiently, they are practically out of bound to common investors.

Common investors in Stock Market in fact need a model which is simple to understand and easier to employ for predicting the future of the capital market with a reasonable degree of accuracy. Building such a predictive model is possible by conjuring technical analysis and an Event & Impact Calendar.

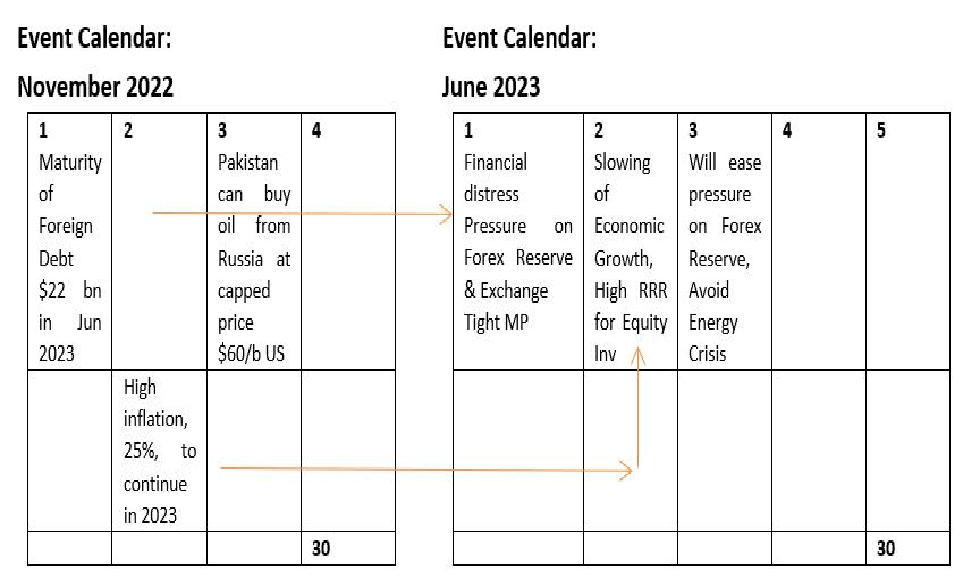

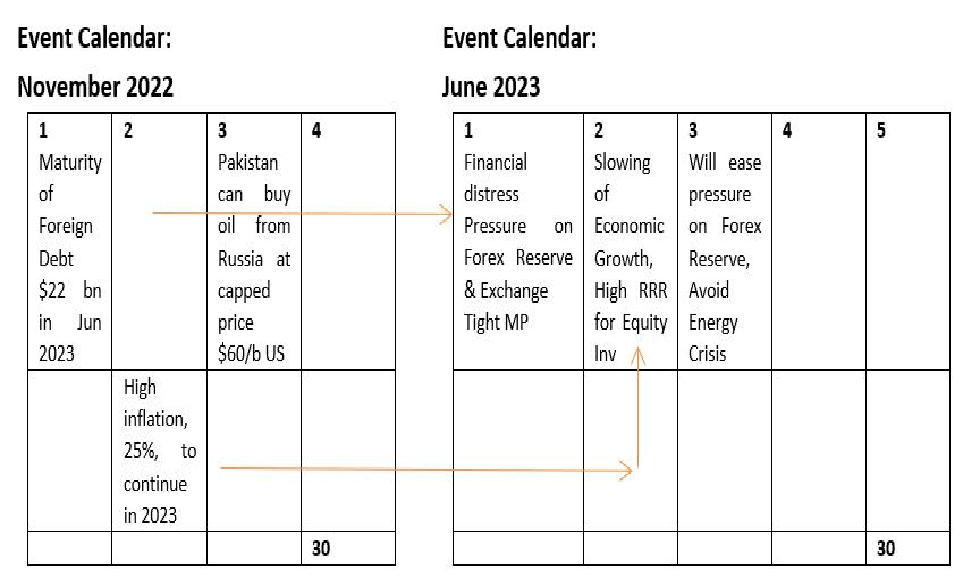

Event & Impact Calendar is basically a mapping of external environments. Events are recorded date-wise as they happened with the narrative of their likely implications on some future date. The Calendar on which Events are recorded is called an Event Calendar while the Calendar bears narration of likely implications of the event that occurred and is termed an Impact Calendar.

Therefore, Impact Calendar portrays the future appears to be on the basis of events unfolding presently.

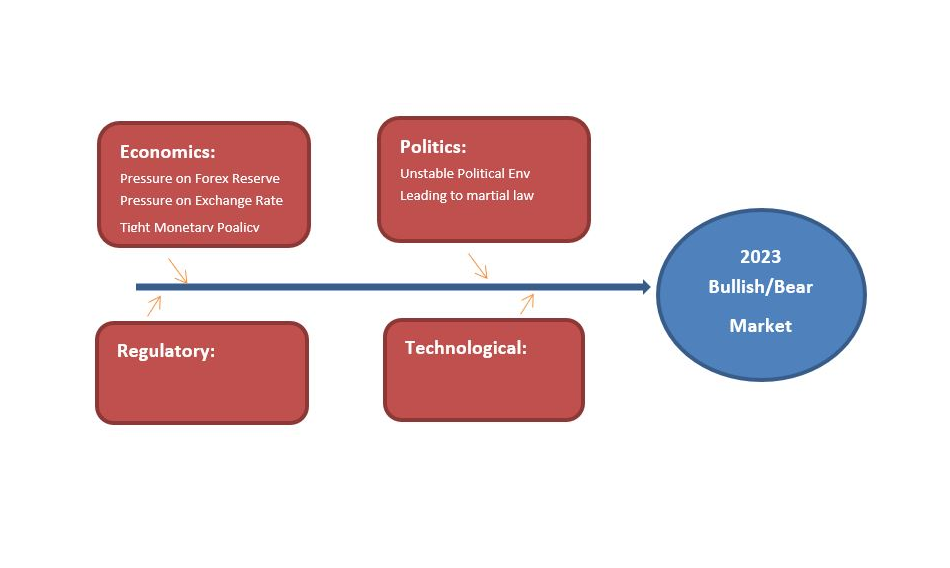

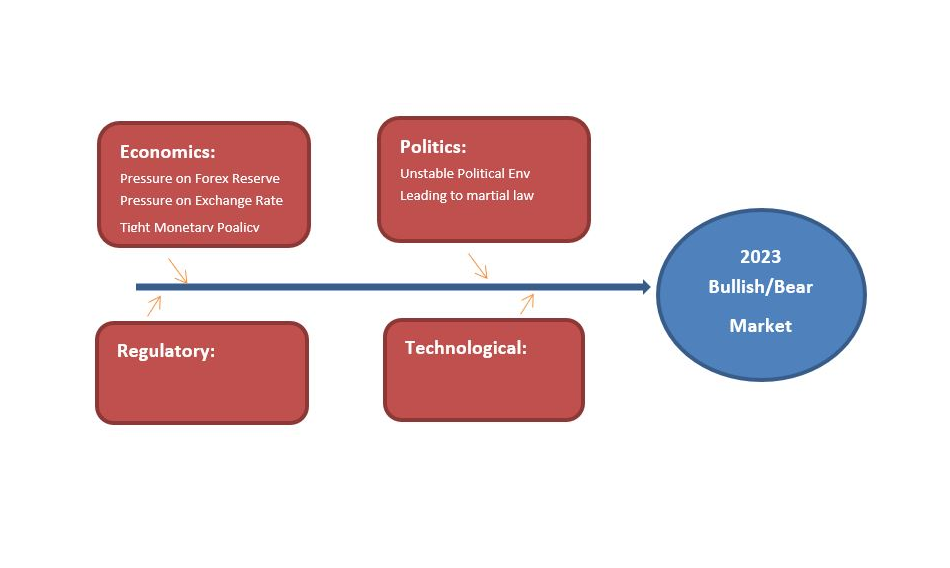

With a contextual view of the future within economic, political, regulations, and social environments an inference is drawn about how a development in a particular environment will affect the movement of a benchmark index, such as the PSX-100 index in our case.

We have seen that a political or economic development affects investors™ sentiments positively or negatively and the Stock Market rises or falls accordingly.

The process starts with the categorization of news/event, such as Political, Economic, Social, and Technological.

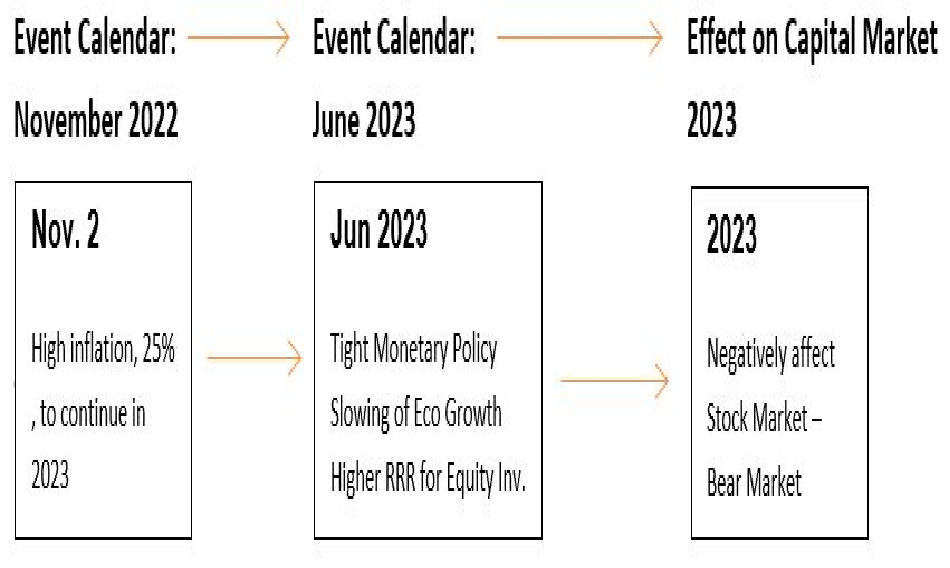

Considering that political or economic events occur frequently and have a great influence on the behavior of the stock market as compared to Regulatory & Technological development, moreover, time lag between occurring of an economic & political event and its subsequent impact is relatively shorter than the other two, I confined the discussion to working modalities of the model to one factor only, i.e. economic, to explain how it may be helpful in making a dependable prediction of future of Stock Market. For example in the month of November 2022 following economic events were reported on different dates.

Economic:

Event Calendar:

November 2022

|

1

Maturity of Foreign Debt $22 bn in Jun 2023

|

2

|

3

Pakistan can buy oil from Russia at capped price $60/b US

|

4

|

5

|

6

|

7

|

8

|

9

|

10

|

|

11

|

|

|

|

|

|

|

|

|

20

|

|

21

|

High inflation, 25%, to continue in 2023

|

|

|

|

|

|

|

|

30

|

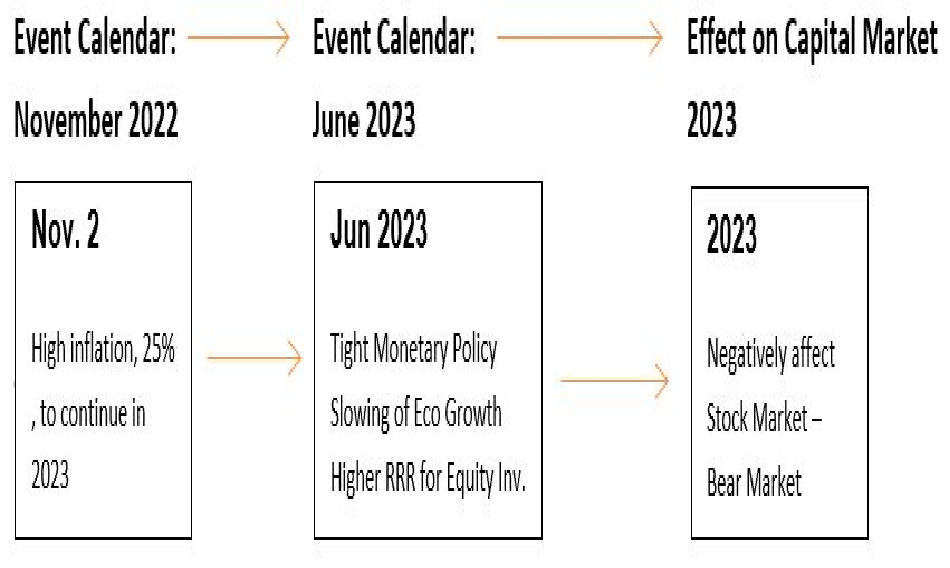

In the second stage, likely implications of unfolded economic events are mapped onto an Impact Calendar at some date or month in the future. This results in the gradual development of a future economic scenario.

Thus, the Impact Calendar lets us have a compartmental view of the economic landscape at a point in time in the future. With a contextual view economic environment in the future, an inference is drawn about how such economic developments will affect the Stock Market at a point in time in the future.

The process is repeated for political, technological, regulations, and social elements as well. Inferences drawn from each are then synthesized to have a view of combined bearing on the Stock market.

This allows for making a more dependable prediction about the future of the Stock Market in the near or distant future.

The model can be further refined by assigning the probability to happen of an event and weightage to its implication. Quantification of the model will monetize implications of the happening event thereby will pave ways for estimating probable gains or losses to investment in shares by calculating gains or losses in the benchmark index and by linking the same to portfolio beta. However, even the subjective assessment of the politico-economic developments is sufficient to make dependable predictions about the Stock Market, Benchmark Index, such as PSX-100.

The Event & Impact Calendar becomes more effective in predicting the future of the capital market when it is used in conjunction with technical analysis.

It works well in a situation when there is a time lag between occurring of an event and the unveiling of its implication in the future.

With practice, the model can be calibrated to a higher degree of precision. However, effective deployment of the model comes with reasonable understanding of politics and economics.

*The writer is a business graduate in Finance and MIS from IBA, Karachi with MSc in Statistics from the University of Karachi and a fellowship in Life Insurance from LOMA, USA, and a certified trainer by the US-AID Programme. He has been associated with business schools as a visiting faculty teaching courses on investment, finance, and financial risk management.

He is currently engaged in investment research and policy with one of the leading life insurance companies in Pakistan.

MTB Auction

MTB Auction