Higher export volumes of various items fail to show up in trade figures : AKD Securities

By MG News | December 18, 2018 at 12:38 PM GMT+05:00

December 18, 2018 (MLN): Provisional figures put together by the Pakistan Bureau of Statistics (PBS) paint a comprehensive picture of trade in Pakistan during the month of November 2018.

According to the previously released summary report, imports in November was $ 4.62 billion (provisional) as compared to $ 4.84 billion (provisional) in October, 2018 showing a decrease of 4.44% and by 2.77% as compared to $ 4,758 million in November, 2017. This could be termed as an after effect of rupee devaluation.

However on the flip side, exports in November were $1.84 billion (provisional), as compared to $ 1.9 billion (provisional) in October, 2018 showing a decrease of 3.15% and by 6.35% as compared to $1,968 million in November, 2017. This cancels out the positive effect of reduced imports to some extent.

There are a number of reasons for slowdown in exports which includes energy shortage, overvalued exchange rate and lack of confidence on government policies.

Mr. Umer Farooq, Investment Analyst at AKD Securities told Mettis Link News that export volume of various important value-added items such as bedwear, knitwear and garments, has increased on yearly basis, but due to the economic slowdown experienced globally, there is a predominant pricing pressure which is why the increased export volume is not reflected in the figures.

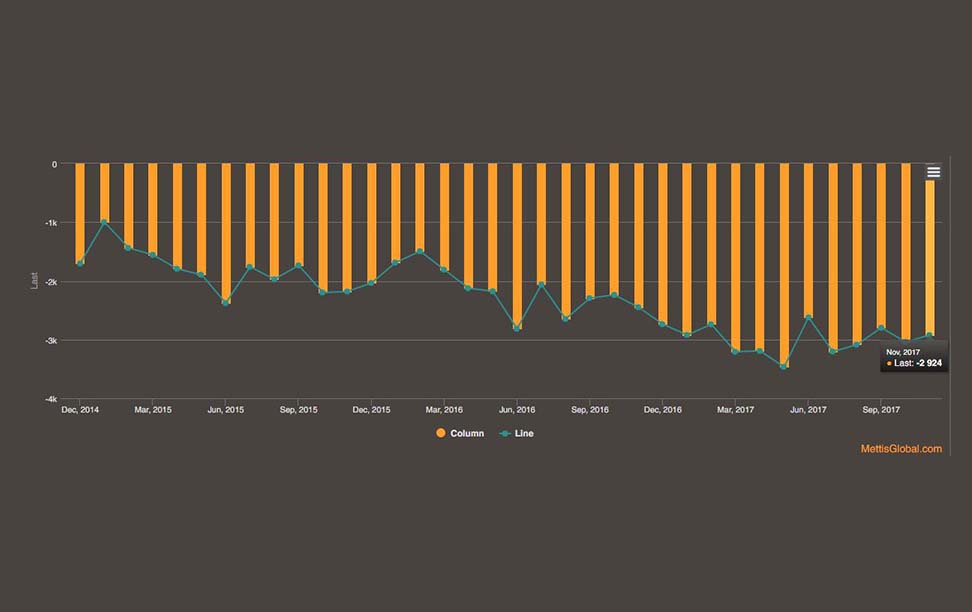

Fortunately, the trade deficit has shown improvement on monthly basis as well as yearly.

Main commodities exported during the month were Knitwear (Rs.33.59 billion), Readymade garments (Rs.28.42 billion), Bedwear (Rs.25.99 billion), Cotton cloth (Rs.22.29 billion), Rice others (Rs.18.13 billion), Cotton yarn (Rs.10.61 billion), Towels (Rs.8.64 billion), Madeup articles (excl. towels & bedwear) (Rs.8.18 billion), Rice Basmati (Rs.5.02 billion) and Fish & fish preparations (Rs.4.68 billion).

On the other hand, commodities imported in November included Petroleum products (Rs.93.07 billion), Petroleum crude (Rs.50.86 billion), Natural Gas Liquefied (Rs.35.16 billion), Plastic materials (Rs.24.49 billion), Palm oil (Rs.21.9 billion), Iron & steel (Rs.18.67 billion), Electrical machinery & apparatus (Rs.17.7 billion), Fertilizer manufactured (Rs.17.4 billion), Iron & steel scrap (Rs.15.67 billion) and power generating machinery (Rs.12.82 billion).

The cumulative deficit in trade during the July-November period of current fiscal year, has been reported at $14.5 billion compared to $14.8 billion recorded for the corresponding period of last year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,655.08 111.43M |

1.14% 1455.65 |

| ALLSHR | 80,647.19 304.89M |

1.08% 859.56 |

| KSE30 | 39,667.05 41.67M |

1.44% 562.05 |

| KMI30 | 188,435.82 34.61M |

0.81% 1520.22 |

| KMIALLSHR | 54,533.06 130.50M |

0.61% 331.18 |

| BKTi | 34,553.40 21.61M |

3.22% 1076.72 |

| OGTi | 28,075.53 2.75M |

0.40% 112.95 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,705.00 | 106,760.00 105,440.00 |

955.00 0.90% |

| BRENT CRUDE | 67.18 | 67.29 67.05 |

0.07 0.10% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.50 | 65.65 65.34 |

0.05 0.08% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI