HASCOL’s Sukuk assigned default rating due to non-payment of an installment

By MG News | March 31, 2021 at 12:28 PM GMT+05:00

March 31, 2021: VIS Credit Rating Company Ltd. (VIS) has assigned a ‘D’ rating (Defaulted Obligation) to the six-year privately placed Sukuk of Rs. 2bn, issued by Hascol Petroleum Limited (HPL) on account of non-payment of an installment due.

The Sukuk was issued in 2015 and had so far been serviced without delay (15 out of 20 payments have been made successfully). The Sukuk previously carried a rating of ‘BBB-’ with ‘Negative outlook’.

Sukuk rating was based on the instrument carrying a debt servicing mechanism to progressively retain upcoming installment in an escrow account under a trustee arrangement, which mechanism has apparently faltered.

As per September’20 accounts, HPL’s equity stood at negative Rs. 33.3 billion (excluding revaluation surplus). On account of this, and the above-mentioned instrument default, the debt repayment capacity of the company has substantially eroded.

Accordingly, ratings have been revised to ‘CC/C’ (Double C/Single C) with ‘Negative outlook’ from ‘BB+/A-3’ (BB Plus/A-Three). Long term rating of ‘CC’ signifies high default risk and a short-term rating of ‘C’ signifies doubtful capacity for timely payment of obligations. The last ratings were announced on April 17, 2020.

Press Release

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 128,199.43 336.91M |

2.05% 2572.11 |

| ALLSHR | 79,787.62 1,023.63M |

1.53% 1202.91 |

| KSE30 | 39,105.00 121.90M |

2.49% 951.21 |

| KMI30 | 186,915.61 131.16M |

1.10% 2029.11 |

| KMIALLSHR | 54,201.88 553.60M |

0.81% 438.07 |

| BKTi | 33,476.68 51.49M |

4.87% 1555.00 |

| OGTi | 27,962.58 9.77M |

0.68% 188.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 105,800.00 | 106,200.00 105,625.00 |

50.00 0.05% |

| BRENT CRUDE | 67.15 | 67.29 67.09 |

0.04 0.06% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.44 | 65.65 65.40 |

-0.01 -0.02% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

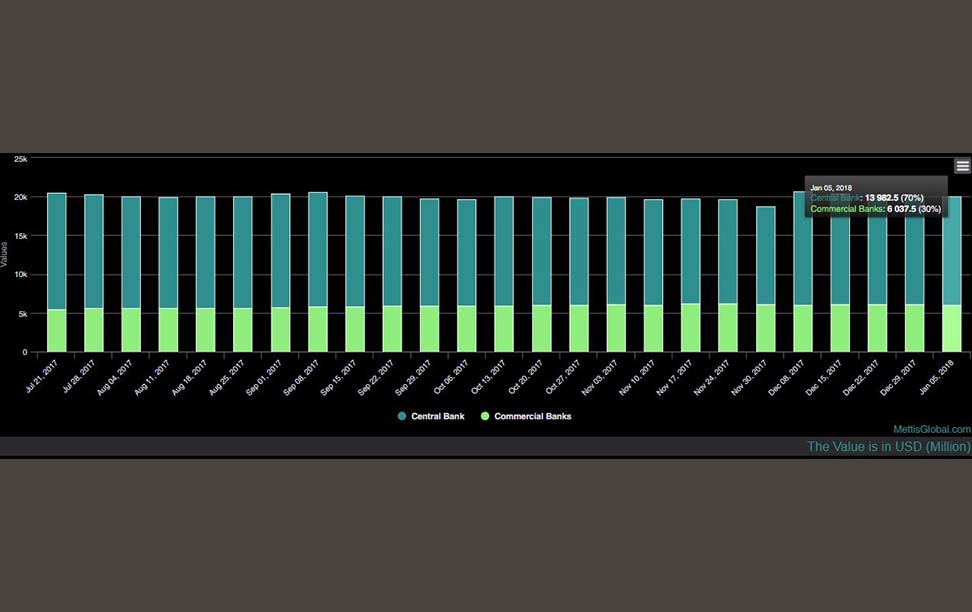

CPI

CPI