Gold price rises 1.18% on Fed rate cut speculation

MG News | December 11, 2024 at 12:51 PM GMT+05:00

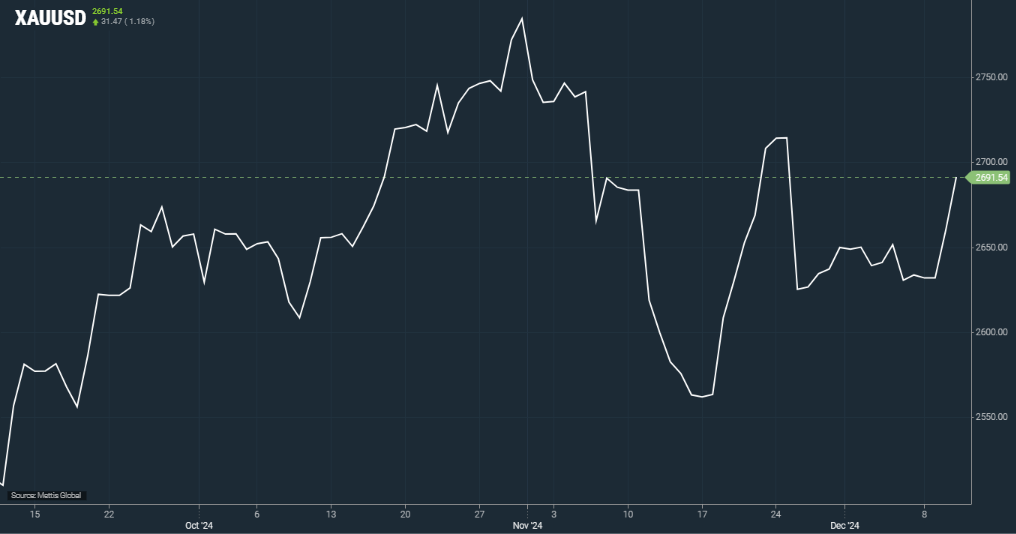

December 11, 2024 (MLN): Gold spot prices gained 1.18% ($31.47) at $2,691.54 per ounce, as of [12:40 pm PST] from the prior day's close of $2,693.87 per ounce, This marks the highest level since November 25.

Gold futures also decreased 0.27% to $2,674.8.

Gold prices remained near a two-week peak touched earlier on Wednesday, supported by escalating geopolitical tensions and expectations of another rate cut by the Federal Reserve next week, ahead of a closely watched U.S. inflation report.

Investors' focus is on the U.S. Consumer Price Index (CPI), which is expected to have risen by 0.3% in November. The data could help set expectations for the Fed's 2025 policy, as Reuters reported.

"An expected (CPI) number pretty much gives the Fed green light to cut (interest rates) next week and that might be the catalyst we need to see for gold," said Kyle Rodda, financial market analyst at Capital.com.

The Fed is likely to cut rates by 25 basis points on Dec. 18, according to 90% of economists polled by Reuters, with most expecting a pause in late January amid concerns over inflationary risks.

Gold is considered a safe investment during economic and geopolitical turmoil and tends to thrive in a low-interest-rate environment.

Central bank buying, monetary policy easing and geopolitical tensions have propelled bullion to multiple record highs this year, putting it on track for its best year since 2010, with an over 30% increase so far.

Goldman Sachs on Tuesday reiterated its bullish stance on prices and pushed back on the argument that bullion cannot rally to $3,000 per ounce by end-2025 in a world where the dollar stays stronger.

Reuters further revealed that spot silver shed 0.5% to $31.75 per ounce, platinum dropped 1% to $932.75 and palladium rose 0.2% to $969.50.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,830.22 319.89M | -0.14% -243.51 |

| ALLSHR | 102,922.38 808.59M | -0.19% -197.80 |

| KSE30 | 52,169.49 112.77M | -0.13% -68.01 |

| KMI30 | 242,960.31 62.27M | -0.31% -745.44 |

| KMIALLSHR | 66,780.42 307.03M | -0.21% -140.25 |

| BKTi | 47,435.60 66.45M | 0.00% 0.50 |

| OGTi | 33,373.62 6.42M | 0.72% 237.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,830.00 | 88,175.00 86,760.00 | -310.00 -0.35% |

| BRENT CRUDE | 62.28 | 62.73 62.02 | -0.10 -0.16% |

| RICHARDS BAY COAL MONTHLY | 87.50 | 0.00 0.00 | 1.30 1.51% |

| ROTTERDAM COAL MONTHLY | 94.50 | 0.00 0.00 | 0.45 0.48% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.40 | 58.75 58.13 | 0.02 0.03% |

| SUGAR #11 WORLD | 15.30 | 15.34 15.16 | 0.10 0.66% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Disbursement Report of Foreign Economic Assistance

Disbursement Report of Foreign Economic Assistance