Gold firms on China central bank resuming purchases after 6-month pause

MG News | December 09, 2024 at 12:20 PM GMT+05:00

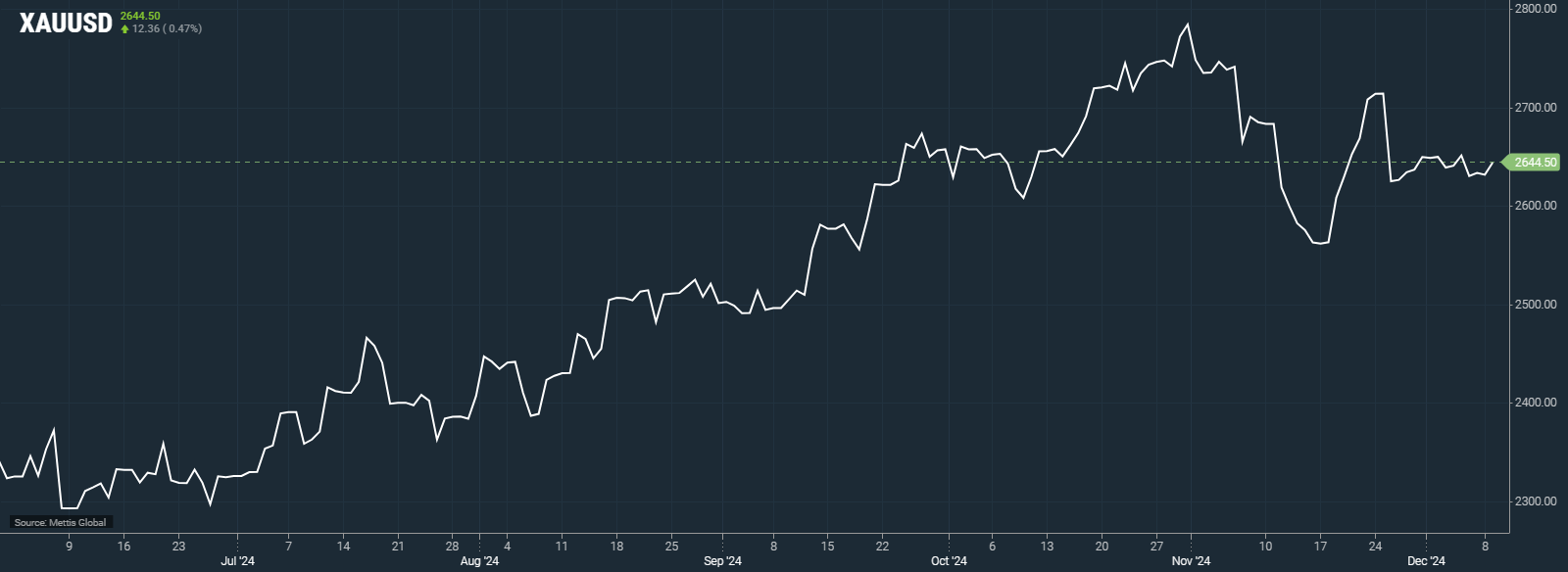

December 09, 2024 (MLN): Gold spot prices gained 0.47% ($12.36) at $2,644.50 per ounce, as of [12:18 pm PST] from the prior day's close of $2,633.33 per ounce, Gold futures also added 0.1% to $2,661.70.

Gold prices gained on Monday, with support from top consumer China's central bank resuming gold purchases after a six-month hiatus, while investors awaited U.S. inflation data this week for cues into the Federal Reserve's next move.

Gold is supported by headlines that China's central bank resumed purchasing gold in November, as Reuters reported.

This could be "good news for gold bulls," as they know they have the People's Bank of China (PBOC) behind them to underpin some strength for bullion prices, IG market strategist Yeap Jun Rong said.

Resumption of its purchases may support Chinese investor demand, which has been muted since the PBOC paused its 18-month buying streak in May.

"The decision to increase gold holdings, particularly following Trump's recent election victory, reflects the PBOC's proactive approach to safeguarding economic stability amid evolving global conditions," OCBC analysts said.

Robust central bank buying, monetary policy easing and geopolitical tensions have driven gold to multiple record highs this year, setting the metal on track for its best year since 2010 with a nearly 28% increase so far.

Gold is seen as a safe-haven investment during times of economic and political uncertainty and thrives in low-interest rate environment.

Traders are now looking forward to U.S. inflation data on Wednesday.

"The inflation read may determine if U.S. policymakers will implement a hawkish cut next week", Yeap said.

Yeap further noted, "This could strengthen the U.S. dollar and weaken gold prices if the Fed signals a pause in the rate-cutting process into early 2025".

On the geopolitical front, Syrian rebels seized the capital Damascus and President Bashar al-Assad fled to Russia after a 13-year civil war and six decades of his family's autocratic rule.

Spot silver steadied at $30.95 per ounce, platinum was flat at $930.52 and palladium rose 0.8% to $963.74.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 178,853.10 424.99M | 3.29% 5702.68 |

| ALLSHR | 107,335.86 693.28M | 2.85% 2972.30 |

| KSE30 | 54,676.69 210.97M | 3.52% 1860.41 |

| KMI30 | 250,620.93 139.36M | 2.14% 5257.28 |

| KMIALLSHR | 68,647.30 398.45M | 1.89% 1273.91 |

| BKTi | 52,773.10 107.33M | 7.09% 3494.44 |

| OGTi | 35,032.42 34.95M | 0.79% 274.54 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,895.00 | 66,930.00 66,300.00 | 565.00 0.85% |

| BRENT CRUDE | 70.43 | 70.45 70.19 | 0.08 0.11% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 105.50 105.50 | -0.10 -0.09% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.17 | 65.31 64.77 | 0.12 0.18% |

| SUGAR #11 WORLD | 13.77 | 13.78 13.47 | 0.29 2.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account