Foreign Currency Deposits remain lackluster in November

By MG News | December 12, 2019 at 02:41 PM GMT+05:00

December 12, 2019 (MLN): Foreign Currency Deposits during the month of November 2019 stood at $7.7 billion, depicting an increase of 5%YoY.

While on a month-on-month basis, it marked a marginal decline as in October 2019 it recorded at $7.86 billion, shows SBP updated data on foreign currency deposits and its utilizations.

The data shows that the growth in deposits denominated in foreign currency remained lackluster, resulting in a rundown of international reserves held by commercial banks. It is argued that the decline in foreign currency deposits is mainly associated with PKR appreciation, as investors are reluctant to convert their savings into dollar deposits to evade the negative impact of PKR appreciation.

According to the data, foreign currency deposits by Residents stood at $6.98 during the month under review which was only 2% higher than deposits reported in November 2018, while 2% weakened as compared to deposits of October 2019.

As these deposits help to finance large fiscal and external current account deficits, during the month $490 million has been utilized to finance country’s exports whereas, $411 million has been utilized for import financing.

Further, $1.5 billion has been placed with SBP, while $70 million and $570 million placed within Pakistani banks and outside Pakistan respectively.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,890.63 212.20M |

1.32% 1691.21 |

| ALLSHR | 80,780.49 596.41M |

1.24% 992.86 |

| KSE30 | 39,807.23 83.40M |

1.80% 702.23 |

| KMI30 | 188,799.00 73.23M |

1.01% 1883.39 |

| KMIALLSHR | 54,579.31 274.37M |

0.70% 377.43 |

| BKTi | 34,858.30 37.15M |

4.13% 1381.62 |

| OGTi | 28,171.77 8.27M |

0.75% 209.19 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 107,415.00 | 107,525.00 105,440.00 |

1665.00 1.57% |

| BRENT CRUDE | 66.97 | 67.29 66.94 |

-0.14 -0.21% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 0.00 0.00 |

-3.70 -3.44% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.26 | 65.65 65.23 |

-0.19 -0.29% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

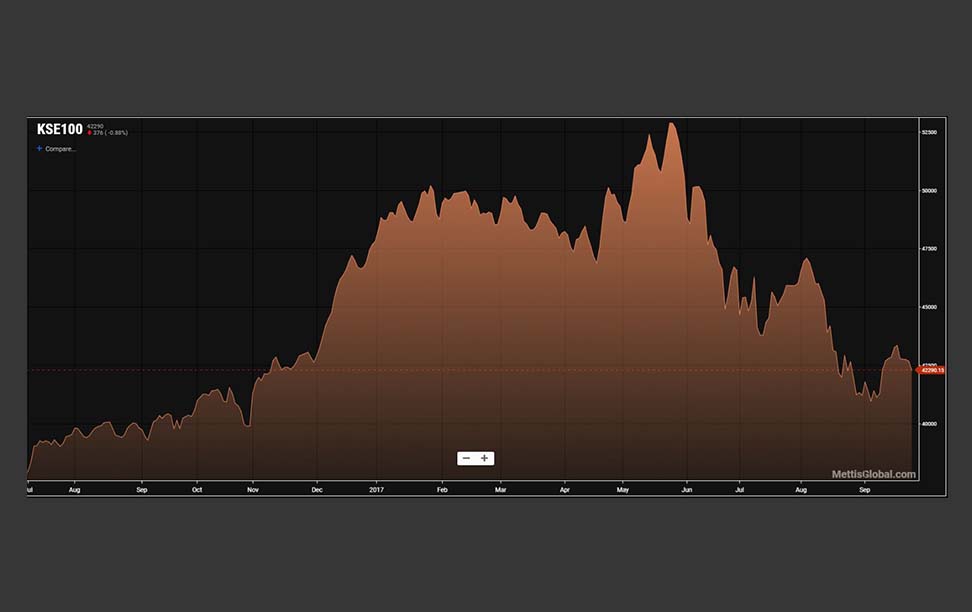

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI