Fitch Ratings warns of challenging APAC credit conditions

MG News | October 14, 2024 at 12:26 PM GMT+05:00

October 14, 2024 (MLN): Asia Pacific (APAC) regional credit conditions could face challenges from trade protectionism, weaker economic growth, and mounting geopolitical tensions if Donald Trump wins a second presidential term, according to the report issued by Fitch Ratings on Monday.

"Our analysis focuses on the potential for major policy shifts if the Republican candidate wins November’s US presidential election," the report reads.

Fitch does not assess the positions of his opponent, Vice President Kamala Harris, in detail, but anticipates greater continuity of President Joe Biden’s policy positions if she wins.

Potential US policy changes under a Republican presidency could present several risks to issuers in APAC. Intensified trade tensions may have significant effects for sovereigns and companies that export goods to the US.

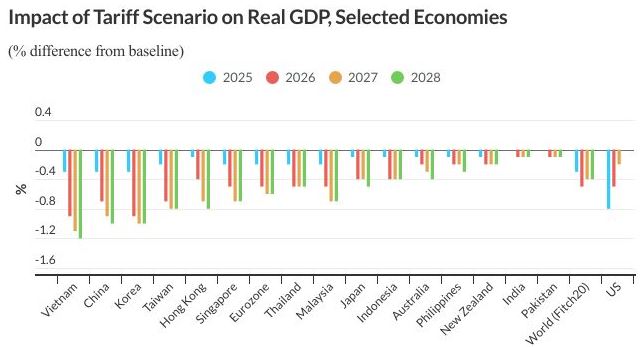

The scenario analysis further indicates that if US trade protectionism increases sharply it could result in significantly lower growth in several APAC economies.

Under a worst-case scenario with retaliation from the US’s trading partners, growth in China, South Korea and Vietnam would be particularly affected, with real GDP in 2028 being 1% or more below the level under Fitch's current baseline.

India, which is less export-oriented, would be relatively unaffected. Lower interest rates due to a weaker economic backdrop could affect banks' profitability and credit costs, with varying effects across APAC markets.

Geopolitical risks, notably stemming from tensions between China and the US, could be a significant factor for APAC irrespective of the winner of the presidential election but would be likely to be raised if trade protectionism rises sharply, the report noted.

This could result in a more volatile global economic environment, and potentially put upward pressure on governments’ defence spending, adding to fiscal consolidation challenges, it said.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 183,049.81 350.08M | 0.49% 896.25 |

| ALLSHR | 109,841.97 731.28M | 0.37% 406.56 |

| KSE30 | 55,980.66 79.85M | 0.38% 209.40 |

| KMI30 | 259,664.81 146.46M | 0.67% 1734.22 |

| KMIALLSHR | 70,650.71 440.38M | 0.27% 189.19 |

| BKTi | 52,787.22 32.29M | 0.12% 64.20 |

| OGTi | 36,172.75 5.18M | -0.80% -290.18 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,005.00 | 68,115.00 66,895.00 | 290.00 0.43% |

| BRENT CRUDE | 69.61 | 69.78 69.54 | 0.21 0.30% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | 0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 102.75 | 102.75 102.00 | 1.05 1.03% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.87 | 65.03 64.78 | 0.24 0.37% |

| SUGAR #11 WORLD | 13.86 | 14.12 13.82 | -0.26 -1.84% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Workers' Remittances

Workers' Remittances