Ferozsons’ growth slows, profit dips to Rs252m in first half

MG News | February 28, 2025 at 02:28 PM GMT+05:00

February 28, 2025 (MLN): Ferozsons Laboratories Limited (PSX: FEROZ) reported a 1.84% YoY decline in its after-tax profit for the half-year ended December 31, 2024, clocking in at Rs252.33 million [EPS: Rs5.80] compared to Rs257.05m [EPS: Rs5.91] in the same period last year (SPLY).

Despite a 4.66% YoY increase in revenue, reaching Rs7.02bn from Rs6.71bn in SPLY, the company's gross profit improved by 11.09% YoY to Rs2.77bn due to a relatively lower 1.07% increase in the cost of sales.

However, administrative expenses surged by 17.91% YoY to Rs423.92m, while selling and distribution expenses saw a significant 44.48% YoY rise, reaching Rs1.66bn.

Other expenses decreased by 52.67% YoY, standing at Rs64.54m, while other income dropped by 35.12% YoY to Rs75.65m.

The company's profitability was further impacted by a 52.54% YoY rise in finance costs, which stood at Rs275.78m.

As a result, profit before taxation stood at Rs400.16m, reflecting a 7.48% YoY increase.

The company's tax expenses rose by 28.29% YoY, amounting to Rs147.83m, further weighing on the bottom line.

| Financial Result For The Period Ended December 31, 2024 (Rupees) | |||

| Particulars | Dec-24 | Dec-23 | % Change |

| Revenue - net | 7,023,685,165 | 6,710,877,978 | 4.66% |

| Cost of sales | (4,265,982,079) | (4,220,747,657) | 1.07% |

| Gross profit | 2,766,703,086 | 2,490,130,321 | 11.09% |

| Administrative expenses | (423,921,230) | (359,531,783) | 17.91% |

| Selling and distribution expenses | (1,664,524,241) | (1,151,919,488) | 44.48% |

| Other expenses | (64,537,666) | (136,361,384) | -52.67% |

| Other income | 75,653,704 | 116,610,353 | -35.12% |

| Profit from operations | 689,373,653 | 558,728,919 | -29.57% |

| Finance cost | (275,783,784) | (180,756,913) | 52.54% |

| Profit before income tax, final tax, and minimum tax | 413,589,869 | 377,971,106 | 9.42% |

| Minimum tax differential | (13,431,470) | - | - |

| Final tax | - | (5,685,667) | - |

| Profit before income tax | 400,158,499 | 372,285,439 | 7.48% |

| Income tax | (147,832,453) | (115,231,896) | 28.29% |

| Profit after taxation | 252,326,046 | 257,053,543 | -1.84% |

| Earnings per share - basic and diluted | 5.8 | 5.91 | -1.86% |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

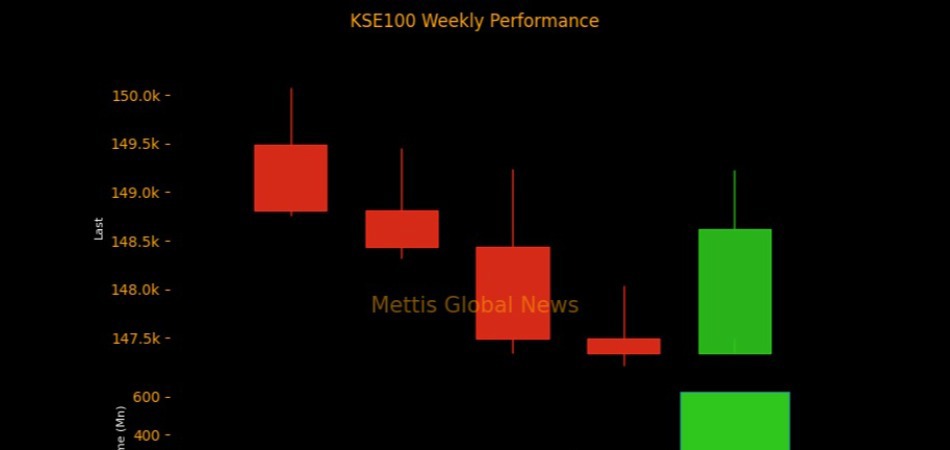

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,375.00 | 109,815.00 109,305.00 | 600.00 0.55% |

| BRENT CRUDE | 67.42 | 67.46 67.38 | -0.06 -0.09% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.96 | 64.04 63.90 | -0.05 -0.08% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI