Fauji Fertilizer Q3 profit surges 80%

MG News | October 28, 2024 at 03:06 PM GMT+05:00

October 28, 2024 (MLN): Fauji Fertilizer Company Limited (PSX: FFC) earned a profit after tax of Rs16.48 billion [EPS: Rs12.95] during the quarter ending September 2024, up a significant 80.4% from the profit of Rs9.13bn [EPS: Rs7.18] in the same period last year (SPLY).

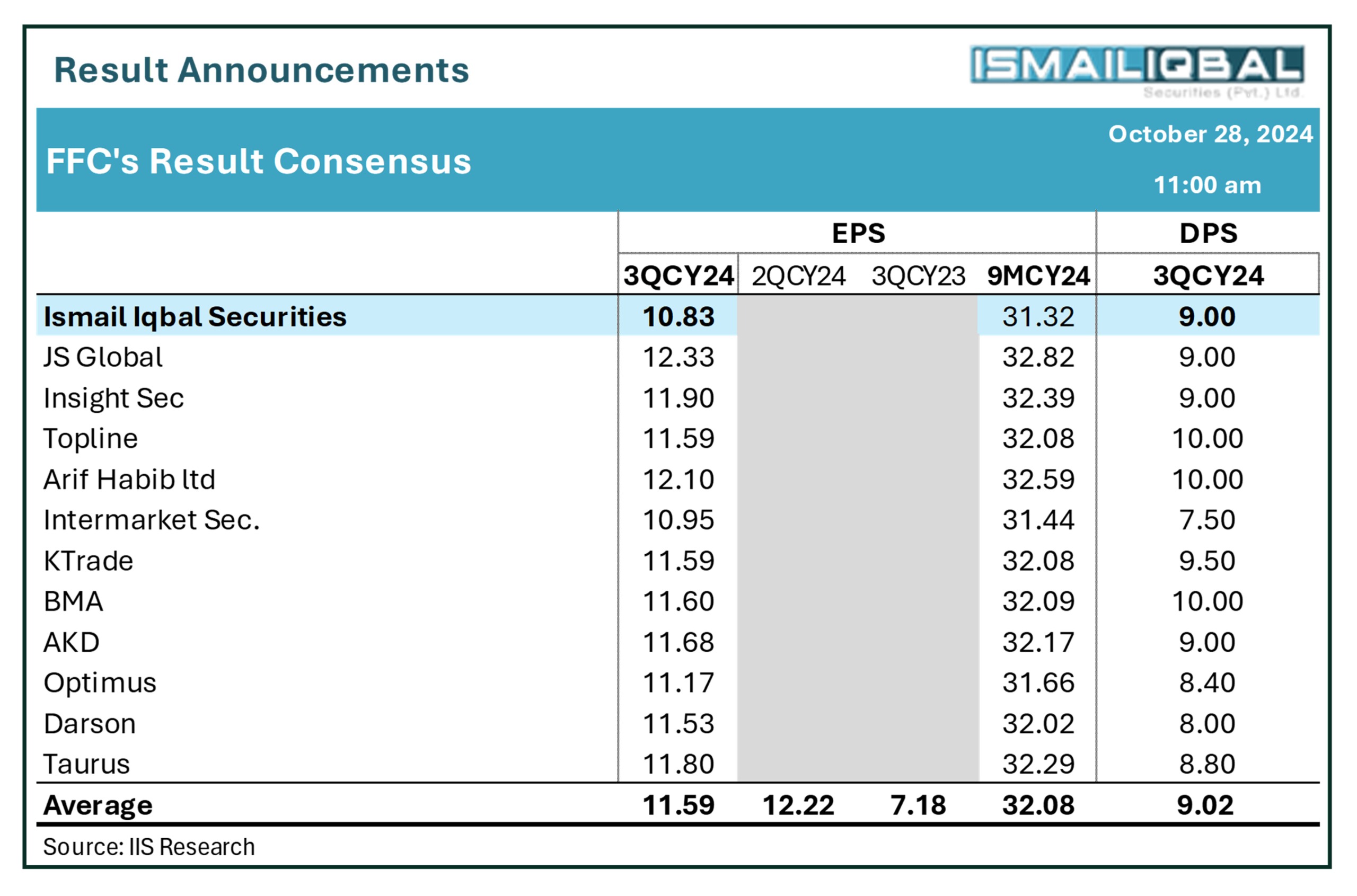

That was also higher than the analysts' estimates of Rs11.59 per share.

The major factor of this performance was the exceptional return on investments which combined with dividend income stood at around Rs25bn, the company said in a stock filing Monday.

The company's plants produced 1,900 thousand tonnes of Sona Urea, operating at optimum capacity. Sona Urea sales were recorded at 1,864 thousand tonnes, along with marketing of 94 thousand tonnes of urea imported by the government.

Its total urea sales stood at 1,958 thousand tonnes, reflecting an improved market share of 43%, compared to 39% during the same period last year.

FFC sold Sona Urea at much lower rates compared to international prices, leading to estimated benefit of USD 320 million for local farmers and preventing a significant outflow of the Country's foreign currency reserves.

The company's revenue rose 14.1% to Rs50.34bn as compared to Rs44.14bn in SPLY. Gross profit jumped by 91.1% to Rs26.1bn in Q3 2024.

The gross margins improved to 51.8% as compared to 30.9% in SPLY.

"Our initiative to provide farmers with easier access to our products at company's specified rates has demonstrated strong potential," it said.

"We have successfully achieved opening of 70 Company owned sales outlets across the Country, and have registered approximately 50,000 farmers across Pakistan, covering a total land area of around 600 thousand acres to date," it added.

The company that in view of the ongoing merger and to ensure equitable distribution of dividends to all the shareholders of the merged entity, no interim dividend has been announced by the board.

The board, however, remains committed to resume its payout trend upon successful completion of the amalgamation process, it further noted.

On the tax front, the company paid a higher tax worth Rs9.29bn against an expense paid worth Rs4.74bn in the corresponding period of last year, a rise of 96.0%.

This translates to an effective tax rate of 36.1% as compared to 34.2% in SPLY.

| Unconsolidated (un-audited) Financial Results for quarter ended September 30, 2024 (Rupees in '000) | |||

|---|---|---|---|

| Sep 24 | Sep 23 | % Change | |

| Sales | 50,339,437 | 44,135,176 | 14.06% |

| Cost of sales | (24,243,754) | (30,482,254) | -20.47% |

| Gross Profit/ (loss) | 26,095,683 | 13,652,922 | 91.14% |

| Selling And Distribution Expenses | (5,340,744) | (2,988,327) | 78.72% |

| Other Gains / (Losses) | (655,453) | (359,615) | 82.27% |

| Other Income | 9,071,344 | 6,231,264 | 45.58% |

| Other Operating Expenses | (2,093,515) | (1,313,516) | 59.38% |

| Finance Cost | (1,303,719) | (1,347,814) | -3.27% |

| Profit/ (loss) before taxation | 25,773,596 | 13,874,914 | 85.76% |

| Taxation | (9,292,104) | (4,740,062) | 96.03% |

| Net profit/ (loss) for the period | 16,481,492 | 9,134,852 | 80.42% |

| Basic earnings/ (loss) per share | 12.95 | 7.18 | - |

Amount in thousand except for EPS

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.15 378.01M | -6.99% -11015.95 |

| ALLSHR | 88,401.15 613.63M | -6.18% -5825.86 |

| KSE30 | 44,996.51 162.61M | -6.90% -3333.70 |

| KMI30 | 210,039.41 136.40M | -6.52% -14647.92 |

| KMIALLSHR | 57,315.72 369.31M | -5.79% -3523.37 |

| BKTi | 42,364.50 67.24M | -6.87% -3125.46 |

| OGTi | 31,480.49 21.12M | -1.88% -602.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,285.00 | 68,625.00 65,685.00 | -10.00 -0.01% |

| BRENT CRUDE | 103.15 | 119.50 99.00 | 10.46 11.28% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 99.91 | 119.48 96.25 | 9.01 9.91% |

| SUGAR #11 WORLD | 14.30 | 14.48 14.25 | 0.20 1.42% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)