FATIMA's profit soars by 20% YoY to Rs13bn in 9MCY23

MG News | October 26, 2023 at 10:22 AM GMT+05:00

October 26, 2023 (MLN): Fatima Fertilizer Company Limited (PSX: FATIMA) has revealed its profit and loss statement for 9MCY23 as per which the company recorded a profit of Rs12.99bn [EPS: 6.19], compared to Rs10.82bn profit reported in the Same Period Last Year (SPLY), reflecting an increase of 20.17% YoY.

Going by the results, the company's top line rose by 61.01% YoY to Rs161.43bn as compared to Rs100.26bn in SPLY.

The cost of sales also went up by 87.08% YoY but was lesser than proportionate to sales increase, which improved the gross profit by 24.30% YoY to Rs51.75bn in 9MCY23.

On the expense side, the company observed an increase in Selling and distribution expenses by 56.61% YoY and administrative expenses by 24.72% YoY to clock in at Rs8.3.bn and Rs5.44bn respectively during the review period.

Similarly, FATIMA's other operating expenses for the 9MCY23 increased by 9.78% YoY to Rs5.41bn.

Moving forward, other income during the review period grew by 36.27% YoY to stand at Rs2.54bn in 9MCY23 as compared to Rs1.87bn in SPLY.

The company’s finance costs surged by 78.35% YoY and stood at Rs3.85bn as compared to Rs2.16bn in 9MCY22, mainly due to higher interest rates.

On the tax front, the company paid a higher tax worth Rs17.91bn against the Rs15.62bn paid in the corresponding period of last year, depicting a rise of 14.72% YoY.

| Condensed Consolidated Interim Financial Results for Nine months ended September 2023 | |||

|---|---|---|---|

| Sep 23 | Sep 22 | % Change | |

| Sales | 161,429,848 | 100,261,849 | 61.01% |

| Cost of sales | (109,678,044) | (58,626,579) | 87.08% |

| Gross Profit | 51,751,804 | 41,635,270 | 24.30% |

| Selling and distribution expenses | (8,302,233) | (5,301,136) | 56.61% |

| Administrative and general expenses | (5,444,241) | (4,365,054) | 24.72% |

| Share of (loss) / profit from associates | (954) | 2,665 | - |

| Other losses | (376,614) | (319,248) | 17.97% |

| Other Income | 2,543,518 | 1,866,496 | 36.27% |

| Other expenses | (5,414,074) | (4,931,794) | 9.78% |

| Finance cost | (3,850,030) | (2,158,717) | 78.35% |

| Profit before tax | 30,907,176 | 26,428,482 | 16.95% |

| Taxation | (17,914,951) | (15,616,886) | 14.72% |

| Net profit for the period | 12,992,225 | 10,811,596 | 20.17% |

| Basic and diluted earnings/ (loss) per share | 6.19 | 5.15 | - |

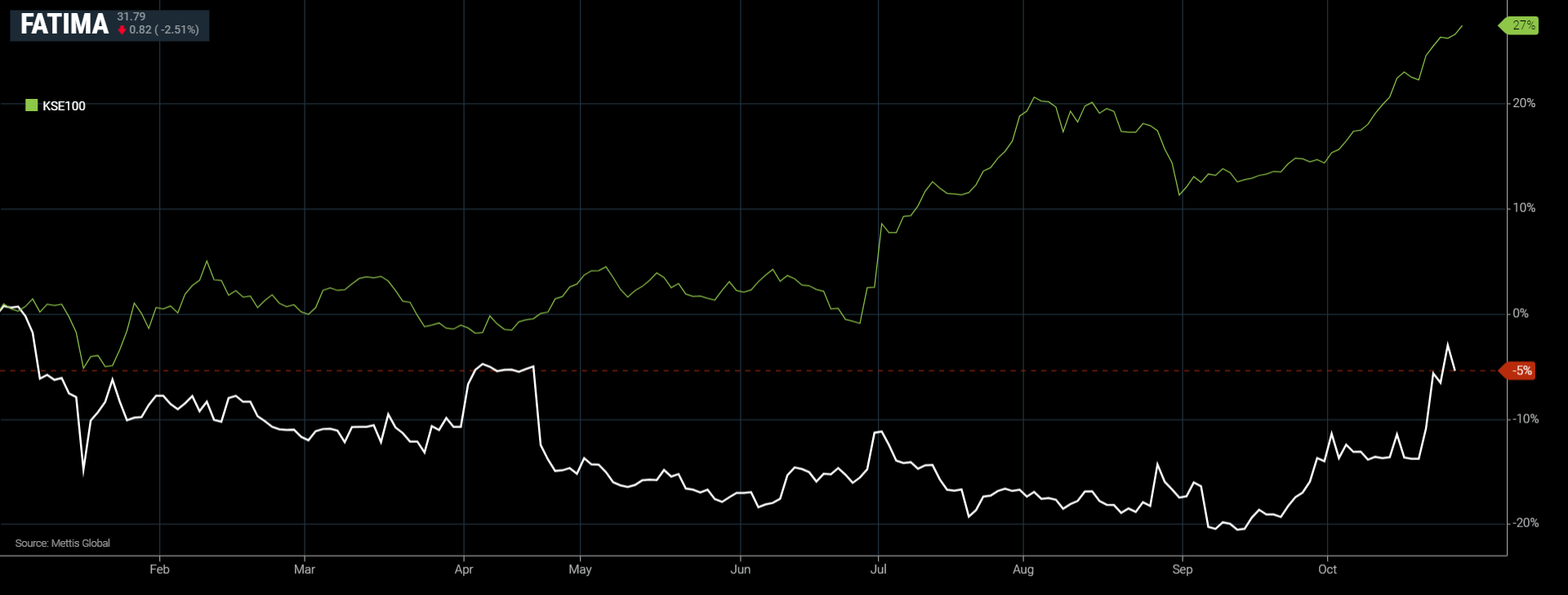

FATIMA and KSE-100 YTD Performance

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,525.00 | 119,740.00 118,145.00 | 1230.00 1.04% |

| BRENT CRUDE | 73.05 | 73.17 71.75 | 0.54 0.74% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.79 | 69.83 68.45 | 0.58 0.84% |

| SUGAR #11 WORLD | 16.56 | 16.58 16.37 | -0.03 -0.18% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|