Eurozone economy heading to rough waters: German study

MG News | November 05, 2018 at 09:41 PM GMT+05:00

BERLIN, Nov. 5: The Eurozone economy is heading towards choppier waters again, a study published on Monday by the Munich-based Ifo Institute for Economic Research (Ifo) warned.

According to the study, business confidence as measured by the Ifo's Eurozone barometer has fallen markedly by 6.6 points to 19.6 points in the single currency area between October and December.

The figure was the lowest measured by the German institute since mid-2016 and reflected downgrades in the assessment of both the Eurozone's current economic situation as well as in expectations for its future growth.

"The euro area's economy is moving into rough waters," a statement by Ifo president Clemens Fuest read. The findings were based on a quarterly survey of 370 economic experts.

Fuest noted that pessimism was particularly rife in Italy and Spain during the fourth quarter (Q4) of 2018. In Spain, survey participants were markedly less upbeat about the economic outlook than they had been in the previous quarter. However, they only downgraded their assessments of the current economic situation to a relatively small extent.

In Italy, experts' assessments of both the current economic situation and future expectations were far more negative than in Q3. The weaker data comes shortly after Rome and Brussels have become embroiled an ongoing spat over government spending plans pursued by the new government of the highly-indebted Mediterranean country.

Expectations remained almost unchanged in Germany and France, while assessments of current economic situation deteriorated slightly. By contrast, assessments of the current economic situation improved in the Netherlands.

The experts polled by Ifo also scaled back their export expectations for the euro area, reflecting concerns in the Eurozone that international barriers to trade are becoming more formidable. A larger number of experts further believed that short and long-term interest rates will rise over the next six months, and that the U.S. dollar will continue to strengthen against other currencies.

When questioned about the development of consumer prices in the survey, respondents raised their inflation rate forecast for 2018 from 1.7 percent to 1.8 percent on average. At the same time, experts indicated that their confidence in economic policy as adopted throughout the Eurozone continued to decline.

(Xinhua/APP)

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,605.00 | 118,705.00 117,905.00 | 985.00 0.84% |

| BRENT CRUDE | 72.73 | 72.82 72.71 | -0.51 -0.70% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.33 | 70.41 70.18 | 0.33 0.47% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

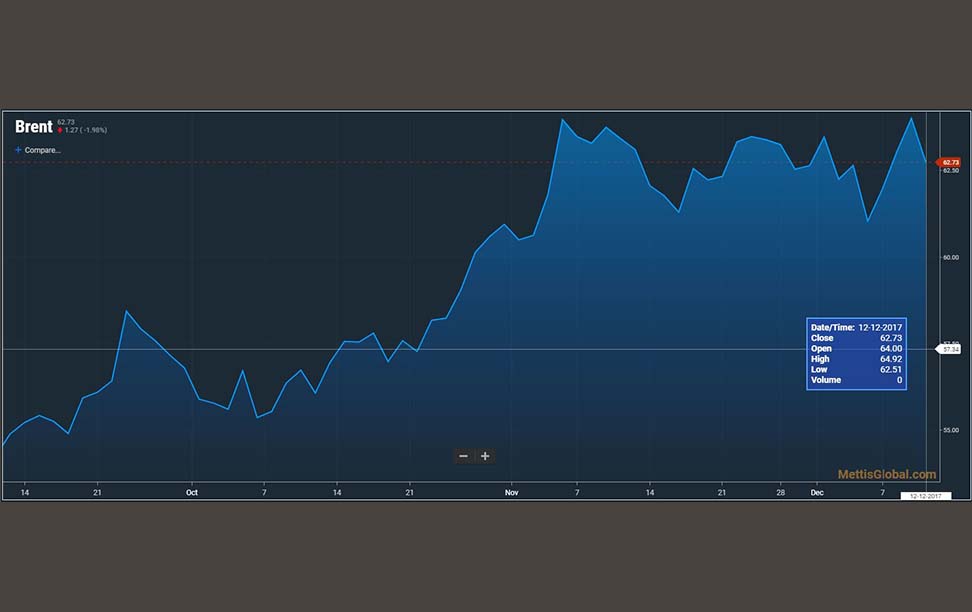

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|