Engro Polymer may issue Preference Shares worth Rs 3 billion to expand its PVC capacity

MG News | January 14, 2020 at 10:48 AM GMT+05:00

January 14, 2020 (MLN): The Board of Directors of Engro Polymer and Chemicals, in its meeting held on January 13, 2020, has resolved that the company may issue Preference Shares to individuals, companies, body corporates, commercial banks, DFIs, financial institutions, mutual funds, provident / pension / gratuity funds / trusts, etc.

According to a notification issued by the company in this regard, the shares will be issued by way of pre-IPO placements and public offering, at a price of Rs. 10 each, aggregating up to Rs. 3 billion.

The proceeds of the Preference Shares shall be primarily utilized to expand the Company’s Poly-Vinyl-Chloride capacity and debottlenecking of Vinyl Chloride Monomer production capacity without increasing leverage, with the intention of obtaining tax credits under the applicable laws.

The Preference Shares intended to be issued shall have the following rights, privileges, terms, and conditions;

- Listed

- Perpetual (subject to conversion option and call-option)

- Cumulative

- Call-option – Exercisable by the investor after the expiry of twelve months from the issue date in full or part

- Conversion option – Exercisable by the investor after the expiry of eighty months from the issue date based on a 1:1 ratio

- Non-voting

- Preferential dividend calculated at the rate of 6-month KIBOR + 3.5% per annum, on a cumulative basis and payment of the same shall be at the discretion of the Board of Directors and shall be in priority to ordinary shareholders

- Preference over ordinary shares in the event of liquidation / winding up of the company

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

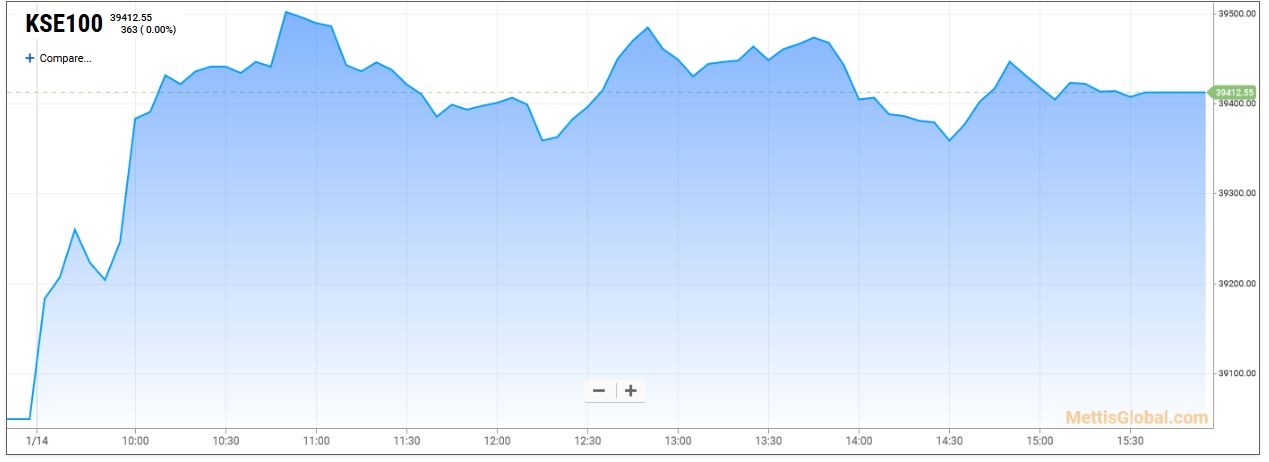

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves