When the coronavirus struck and forced the physical world to shut down, it was in the online realm that everyone sought reprieve. At the forefront were businesses, which faced an existential crisis: either go extinct or move digital.

In Pakistan too, there was a shift towards online channels and the e-commerce sector boomed. Figures released by the State Bank of Pakistan gave FY20 e-commerce sales at Rs234.6 billion, jumping by 55% year-on-year. Yet, its share as a percentage of GDP is still minute and the sector overall continues to face hurdles in reaching the masses.

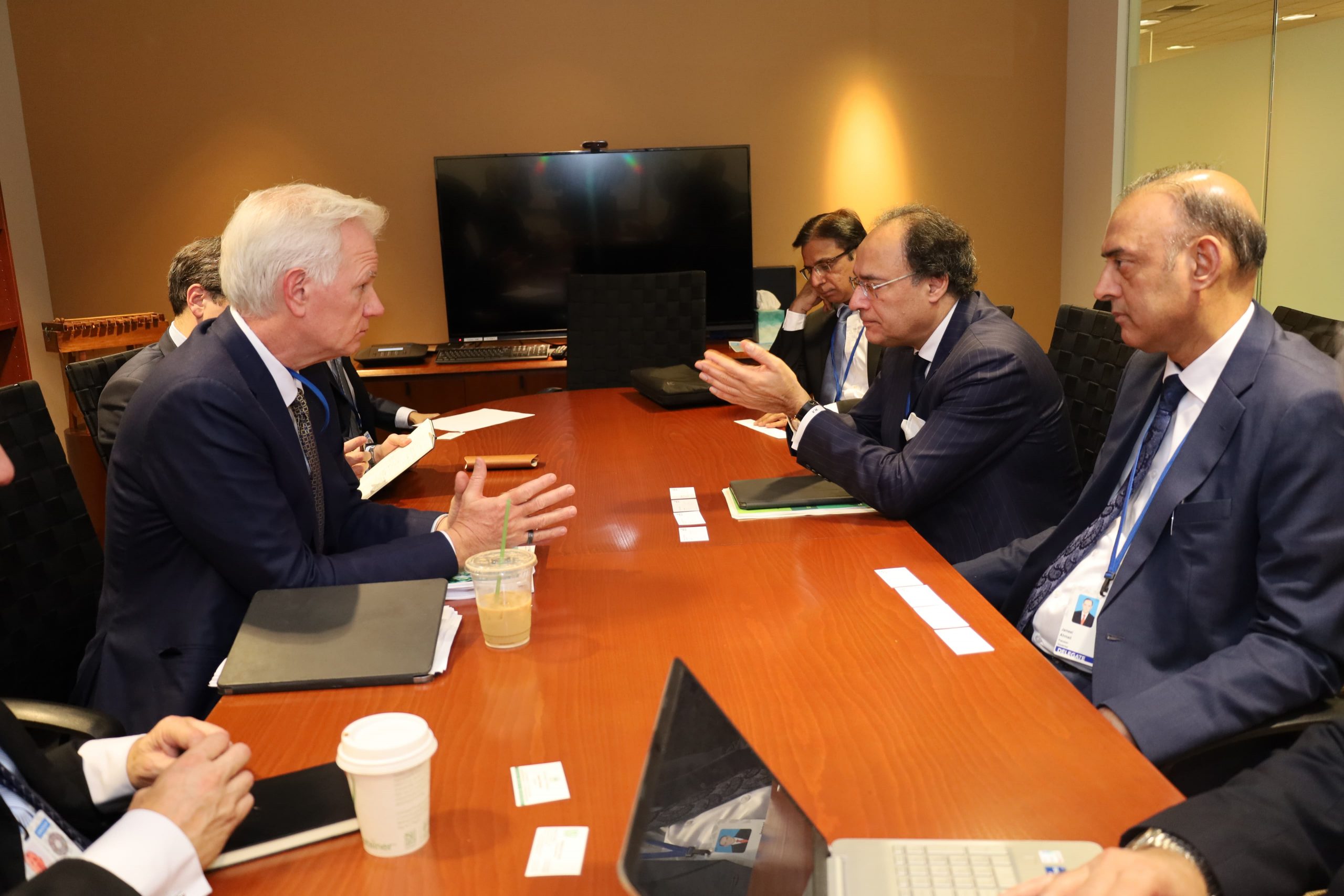

Trying to cash in on this opportunity is Daraz – acquired by Alibaba over two years back, which has been aggressively expanding and investing in the ecosystem. To learn more about the company’s efforts and the overall sector, MG spoke with the global CEO Bjarke Mikkelsen, who has been at the helm since 2015 and before that served as an executive director at Goldman Sachs.

Below are the edited excerpts.

2020 witnessed e-commerce emerging as the natural gainer from Covid-19. What kind of impact did you see?

BM: In terms of customers, there was a huge uptick in user numbers with signups simply exploding. However, orders haven’t followed to the same extent, partly because Pakistan was already going through a tough phase economically due to inflation. On the supply side too, more and more sellers have registered with us.

The underlying growth was still around 60% but it’s a lot less than our regional markets. We expect a lot of delayed impact in the coming year though.

What’s Daraz’s current market share and where does Pakistan lie in the company’s gross merchandise value?

BM: I would rather not guess because there is no official study on the real size of the market but in prepaid space, you can see from the e-commerce numbers of the State Bank report. Based on that, (which includes transactions on international platforms like Amazon as well), we represent roughly a third of the market. That share will be bigger in the cash-on-delivery segment.

Pakistan represents a little more than a third of Daraz’s total business, followed by Bangladesh at a very similar size and then come the remaining countries.

What are the main drivers of Daraz’s gross merchandise value?

BM: It’s divided into four broad categories, led by electronics with 35-40% contribution, followed by fashion at 15-20%, fast-moving consumer goods (which includes health and beauty products) another 20%. The remaining share is clustered under lifestyle, which includes everything else.

Can you talk about the trends in prepaid orders both in terms of volume and value?

BM: Up to two years back, there was a huge difference in the value and volume of prepaid orders with the latter at around just 10%. But we have been able to bridge that gap as the number of prepaid orders now account for 30-35% of the transactions whereas their value is in the range of 50-55% of our GMV. A third of those are actually coming from our closed-loop Daraz wallet, which has really improved the customer experience. Previously for refunds, we used to give money to the bank in a day but they sometimes took a month to send it to the customer accounts.

A while back, you launched an in-house logistics service, Daraz Express. How has its performance been so far and what percentage of the total orders are done through it?

BM: Today, we do more than 65% of all Daraz deliveries through DEX and it’s pretty similar across geographies. As for delivery time, it’s 1-2 days faster than with external partners.

In fact as a result, the performance of third-party logistics players has also dramatically improved. Previously there was a huge gap in the success rate of deliveries with the ones done in-house at 92% while 3PL were about 75%, but that figure has since improved to 85%.

Generally speaking, e-commerce is relatively more expensive (unless at a discount) in Pakistan than the offline market. How can that be changed?

BM: In some cases, I agree but in others, we do offer quite competitive rates. But to expand that and have more of our products be price competitive, there are two solutions: first is to create seller density so they are in more active competition with each other; and the second is checks where we go into the market and track prices. In more established e-commerce markets, there are online prices available so it’s easy to check. However, in Pakistan, often the best prices you see would be in the offline market and it’d not be the one that you see, but the one that you negotiate.

That’s the price we want to be competitive with and that’s the challenge. But we do what we can to optimise it. Lastly, we just have to simply scale. E-commerce is such a small proportion of the market in Pakistan that most sellers don’t want to disrupt their offline business with online prices. The bigger we get, the bigger ecommerce gets in Pakistan, the more sellers would be willing to sacrifice their online prices and go for much higher volumes, taking out a lot of fixed costs.

Time and again, questions are raised about the quality of products offered by Daraz. What measures are you taking to ensure that?

For starters, we have purchase protection for all customers that provides 100% refund through Daraz wallets on damaged or incorrect products. Then there is “Fulfilled by Daraz”, which is any product coming from one of our warehouses and can guarantee the quality because we pack it ourselves. We can also ensure a faster delivery of 1.5-2 days. That also means same day delivery for any product if you are in that city.

You can also filter by “Fulfilled by Daraz” on the portal in case that’s what you want to see. Another way is Daraz mall, having sellers that are trusted and verified. Lastly, there’s the general marketplace, use of reviews and ratings, where we continue to strive for exceptional service.

Unlike regional countries such as Iran and Egypt, major South Asian e-commerce stores are available only English instead of local languages, thus limiting their accessibility. Is any work being done in this regard?

BM: Translating content into Urdu is the plan for this coming year and the way we are doing it is with algorithms and machine learning. This is one of the big synergies with Alibaba.

One thing is the navigation: it’s not that difficult to do an Urdu version of the category tree for example. But more than 50% of our customers go directly to the search bar and the challenge is that if you have 20 million products, then it’s a lot of products to do a detailed mapping of every single one of them with each attribute. This is best done through an algorithm and once we do that with Urdu, it’d be easier to add more local languages as well.

Copyright Mettis Link News