Current account hits a sour note on surging primary deficit

Nilam Bano | June 24, 2024 at 08:21 AM GMT+05:00

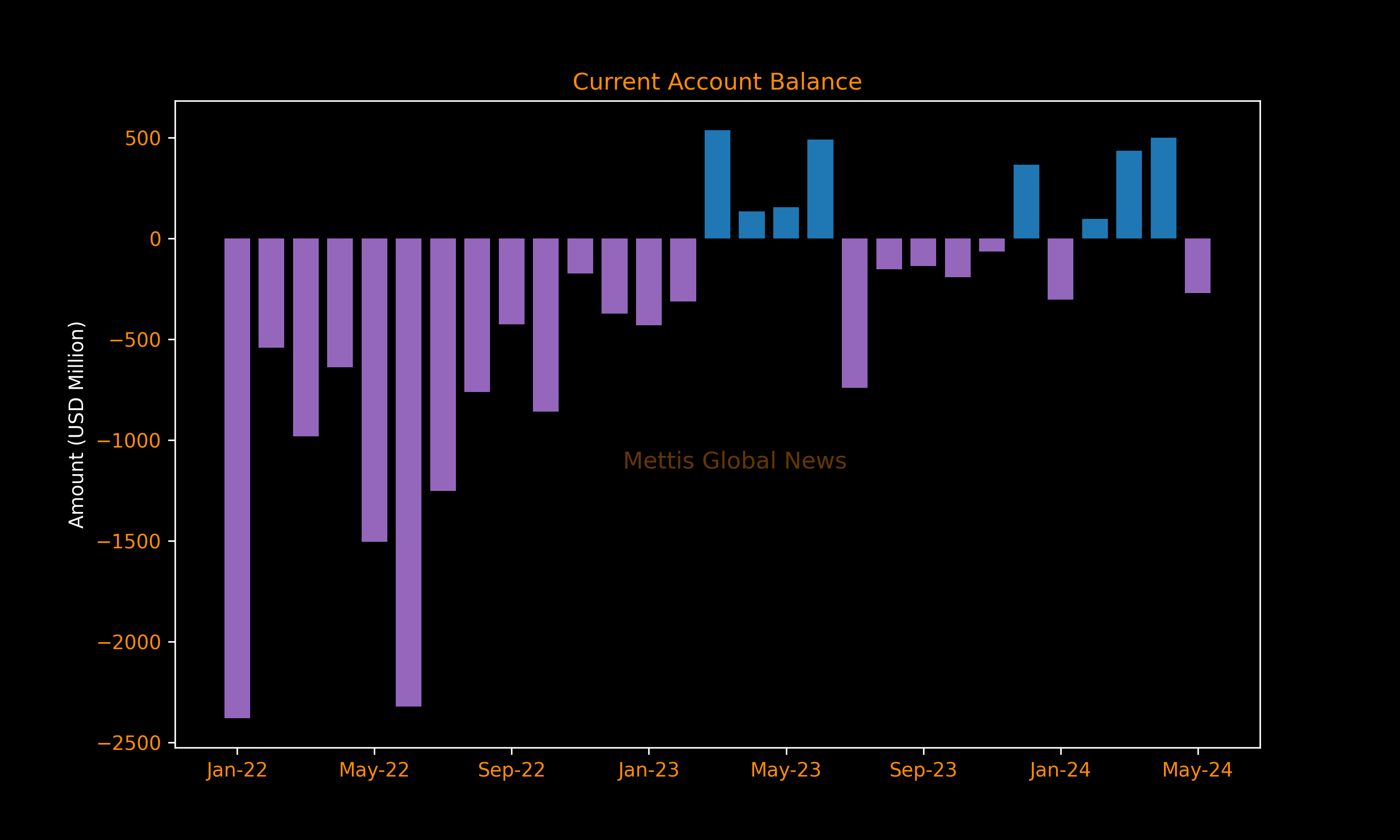

June 24, 2024 (MLN): Contrary to the expectations of a current account surplus for the fourth consecutive month in May, a significant surge in the primary deficit dragged the current account into the deficit zone ($270 million) despite record-high workers’ remittances, which soared to $3.24 billion in May.

Why primary deficit has increased? The State Bank of Pakistan (SBP) permitted foreign companies to send home profits and dividends, resulting in over $1bn in dividend payments during May.

This move is backed by increased foreign exchange reserves and months of current account surpluses, urging the SBP to clear a backlog of payments that had amassed due to previous reserve constraints.

“Almost the entire backlog of repatriations has been cleared. Additionally, Pakistan made $2bn in debt repayments in May, with another $8bn due in the next two months”, Governor SBP Jameel Ahmad, confirmed during a recent analyst briefing.

Experts are of the view that the last month of the ongoing fiscal year, June, may also witness high-profit repatriations by foreign companies and elevated imports of goods and services.

Adding oil to the fire, workers’ remittances might see a notable dip post-Eid. In addition, debt servicing and relaxed import restrictions will contribute to a larger deficit for the full fiscal year.

On Friday, the SBP reported a current account deficit of $270m for May, a surprising contrast to the $491m surplus in April.

The recent months had seen surpluses of $128m in February, $434m in March, and $491m in April, however, May's number marks a notable reversal of this positive trend.

Notably, the current account was also in surplus in May of the previous fiscal year with $155m. It is important to mention that during 11MFY24, the country’s balance of payments gap significantly narrowed by 88%, down to $464m from $3.765bn in the same period last fiscal year and $17.48bn in FY22.

This improvement is accredited to managed imports and stringent control over dollar outflows. The central bank was predominantly strict in FY23, prohibiting the outflow of profits and dividends on foreign investments.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 174,472.80 415.89M | 0.33% 576.45 |

| ALLSHR | 104,651.34 842.56M | 0.49% 512.09 |

| KSE30 | 53,490.51 167.58M | 0.40% 214.40 |

| KMI30 | 249,663.89 207.53M | 0.51% 1277.01 |

| KMIALLSHR | 68,039.48 418.05M | 0.42% 287.19 |

| BKTi | 48,368.14 50.33M | 0.46% 219.70 |

| OGTi | 34,867.38 19.89M | 1.69% 580.53 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 88,825.00 | 89,960.00 87,125.00 | 1265.00 1.44% |

| BRENT CRUDE | 61.33 | 61.88 60.95 | -0.16 -0.26% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -0.10 -0.12% |

| ROTTERDAM COAL MONTHLY | 96.75 | 96.75 96.30 | 0.45 0.47% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.98 | 58.47 57.60 | -0.10 -0.17% |

| SUGAR #11 WORLD | 14.86 | 15.26 14.80 | -0.40 -2.62% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251230120446451_06c077.webp?width=280&height=140&format=Webp)

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market