Crisis on Horizon: Oil prices expected to surge amidst ongoing geopolitical unrest

Abdur Rahman | October 08, 2023 at 04:54 PM GMT+05:00

October 08, 2023 (MLN): Pakistan's economy can once again get caught in the crossfire of the ongoing Israel-Palestine conflict, hurting the nation's already fragile economy.

The country had just started to experience a slight reduction in its surging inflation, this can reignite and aggravate the already persistent inflationary pressures.

Such a scenario threatens to undermine the recent hopes of relief in petrol prices that many Pakistanis had started to consider.

Moreover, these escalating oil prices could trigger a second-round effect on the economy, further straining Pakistan's economic stability.

To note, higher energy prices can affect consumer prices/inflation through direct, indirect and second-round effects.

As a net importer heavily reliant on oil, Pakistan remains susceptible to global geopolitical conflicts, as evidenced by the significant impact of the Russia-Ukraine war in 2022.

To recall, in 2022, the Russia-Ukraine war had far-reaching consequences worldwide, especially for countries like Pakistan, feeling its impact through surging oil prices.

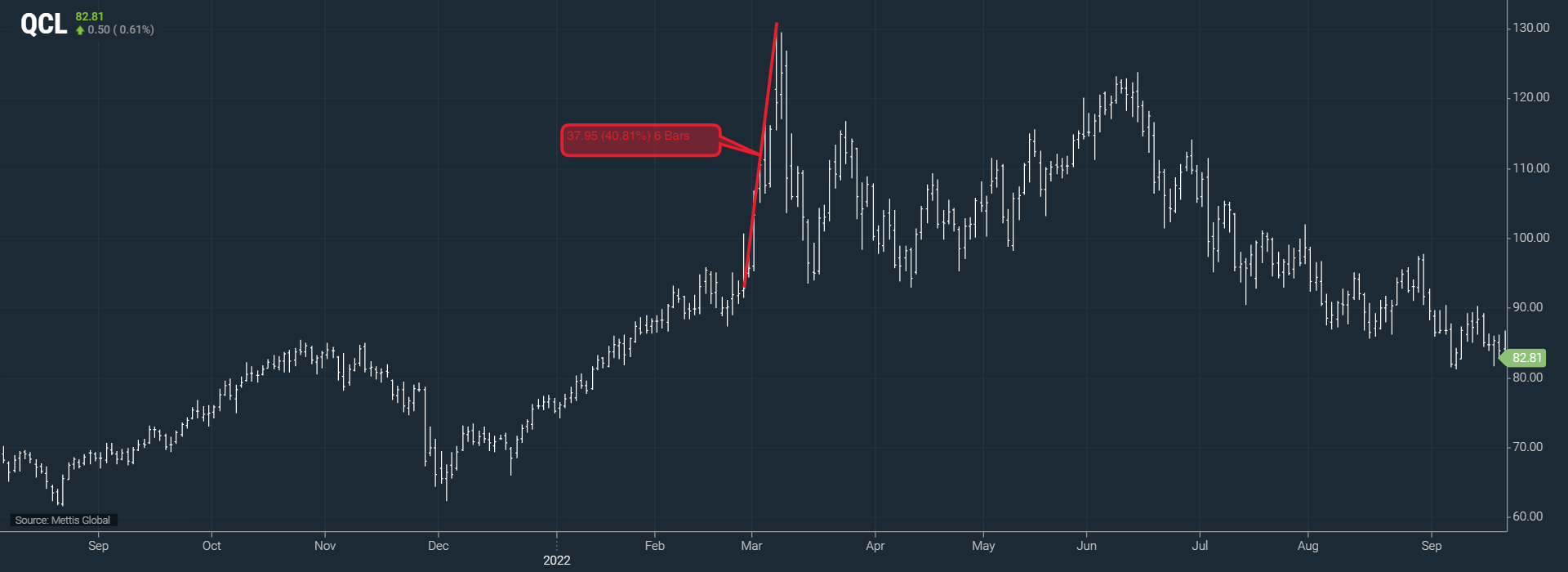

The following chart shows the impact on gold and oil prices after Russia's president Vladimir Putin declared military invasion on Ukraine in his address to the nation on February 24, 2022.

In just a few weeks, the price of international spot gold increased by around 9%, from $1,900 to $2,070, almost reaching its record high of $2,075 set during the COVID-19 pandemic.

While the oil prices saw a far bigger increase of almost 40%, with its key benchmark rising from about $93 on February 24 to an all-time high of $130 by March 7 of 2022.

On top of this, the U.S. Strategic Petroleum Reserves (SPR) have just 17 days of supply remaining, which is their lowest in history.

The SPR's current inventory of 17 days' supply represents just half of its historical average since 1990, which is around 33 days.

Moreover, the OPEC+ in its meeting held on Wednesday reaffirmed their commitment to over 1.5 million barrels per day of voluntary production cuts.

Meanwhile, both Saudi Arabia and Russia also stuck to their decision to cumulatively reduce oil production by 1.3m bpd till the year end.

Disclaimer: The views and analysis in this article are the opinions of the author and are for informational purposes only. It is not intended to be financial or investment advice and should not be the basis for making financial decisions.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 113,390.00 108,020.00 | -4475.00 -3.97% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 64.55 63.88 | -0.59 -0.91% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI