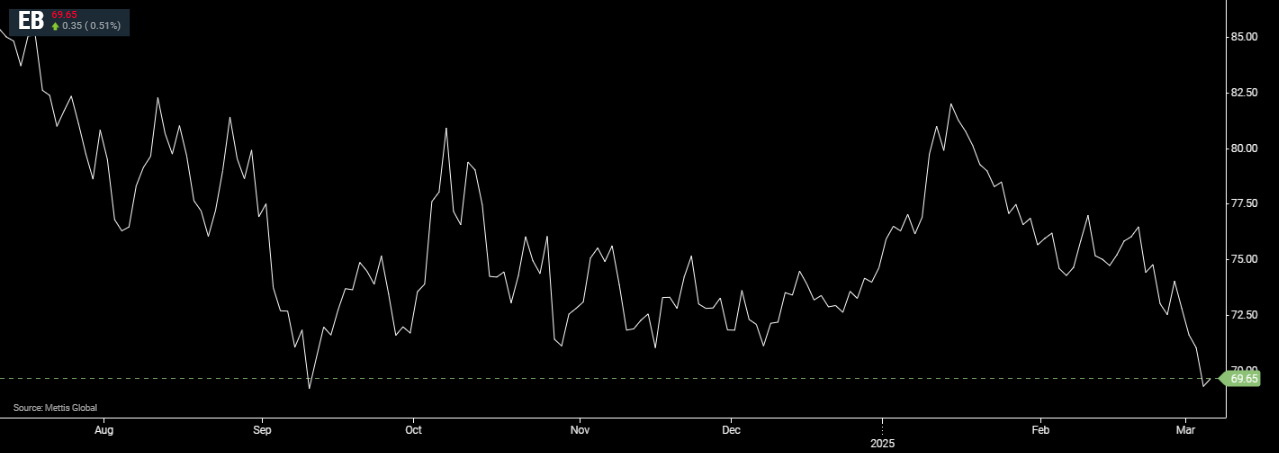

Brent crude rises after hitting a 3.5-year low of $68.33

MG News | March 06, 2025 at 11:01 AM GMT+05:00

March 06, 2025 (MLN): Oil prices rose on Thursday after heavy sell-offs drove the market to a multi-year low, however tariff uncertainties and a rising supply outlook capped gains.

Brent crude futures increased by $0.35, or 0.51%, to $69.65 per barrel after hitting a 3.5-year low of $68.33.

West Texas Intermediate (WTI) crude futures rose by $0.34, or 0.51%, to $66.65 per barrel by [10:55 am] PST.

The decline eased as the U.S. said it will exempt automakers from the 25% tariffs, raising optimism the impact of the trade dispute may be mitigated.

"The sharp dip in oil prices below the key $70.00 level may prompt a slight breather in today's session, as technical conditions attempt to stabilise from oversold territory," said Yeap Jun Rong, market strategist at trading platform IG.

"However, recovery momentum remains fragile, with unfavourable supply-demand dynamics being a key overhang for bullish sentiment," he added.

Prices fell after the U.S. enacted tariffs on Canadian and Mexican goods, including energy imports, at the same time major producers decided to raise output quotas for the first time since 2022.

Additionally, a source familiar with the discussions said that U.S. President Donald Trump may eliminate the 10% tariff on Canadian energy imports, such as crude oil and gasoline, that comply with existing trade agreements.

"Trump’s trade measures are threatening to reduce global energy demand and disrupt trade flows in the global oil market, as Reuters reported.

This was exacerbated by a rise in U.S. inventory," Daniel Hynes, senior commodity strategist at ANZ, said in a note on Thursday.

Market sentiment remains bearish from the double impact of the tariffs and the decision by OPEC+, the Organization of the Petroleum Exporting Countries and allies including Russia to raise output.

Crude stockpiles in the U.S., the world's biggest oil consumer, rose more than expected last week amid seasonal refinery maintenance.

Meanwhile, gasoline and distillate inventories fell due to a hike in exports, the Energy Information Administration said on Wednesday.

Crude inventories rose by 3.6 million barrels to 433.8m barrels in the week, the EIA said, far exceeding analysts' expectations in a Reuters poll for a 341,000-barrel rise.

There are further signs of weakness in American oil demand, with U.S. waterborne crude oil imports dropping to a four-year low in February, driven by a decline in Canadian barrels shipped to the East Coast.

Ship tracking data indicates that refinery maintenance, including a prolonged turnaround at the region’s largest plant, suppressed demand.

Tariffs also remain in effect on U.S. imports of Mexican crude, a smaller supply stream than Canadian crude but an important one for U.S. refineries on the Gulf Coast.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,465.00 | 118,480.00 117,905.00 | 845.00 0.72% |

| BRENT CRUDE | 73.47 | 73.63 71.75 | 0.96 1.32% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.30 | 70.33 70.18 | 0.30 0.43% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|