BOP posts strong annual profit despite economic challenges

MG News | February 17, 2025 at 09:52 PM GMT+05:00

February 17, 2025 (MLN): A meeting of the Board of Directors of the Bank of Punjab (PSX: BOP) was held on 17th February 2025 to review and approve the Annual Audited Financial Statements for the year ended December 31, 2024.

Despite facing challenges on both the revenue and expenditure sides, including the implementation of IFRS-9, the debt restructuring of a large state-owned entity, and a difficult interest rate environment, the Bank remained resilient, according to the press release issued by Bank.

Additionally, despite the MDR anomaly and significant investments in technology and infrastructure, the Bank posted a pre-tax profit of Rs24.56 billion for the year 2024.

The Board also declared a cash dividend of Rs1.8 per share, marking a historic milestone with the highest-ever profit and the largest cash dividend payout in the bank's 35-year history.

Total deposits grew to Rs1.71 trillion from Rs1.52tr in 2023.

A significant contributor to this growth was the 24% increase in current account deposits, which rose to Rs354bn and now constitute 20.7% of total deposits.

These deposits have more than doubled over the past three years.

The balance sheet expanded to Rs2.38tr, further strengthening the bank's financial and capital position. Revenue growth remained strong across all segments, particularly in fee income and capital gains etc., which grew by 51% during the year.

The Board acknowledged that the cost-to-income ratio improved to 60.76% (adjusted) in 2024.

Based on September 2024 results, the Bank maintained the lowest cost per employee at Rs2.4mn against a peer average of Rs3.6mn and the second-lowest cost per branch at Rs45.5mn against a peer average of Rs56.3mn.

The Bank also achieved a total administrative cost-to-gross revenue ratio of 12.2% compared to the industry average of 15.0%, demonstrating strong cost discipline and operational efficiency.

With a continued focus on improving the composition of current accounts within total deposits and the removal of minimum deposit rate conditions on public sector deposits, the cost-to-income ratio is expected to improve further in the coming years.

The Board also approved BOP's inaugural dividend policy, which explores the possibility of interim/quarterly dividends, moving beyond the conventional annual model, with a preference for cash dividends over bonus shares.

This shift aims to strengthen investor confidence and attract long-term institutional investments, backed by projected stability in BOP's earnings.

Looking ahead, the Board approved the strategic roadmap for 2025-27, focusing on growth, capital build-up, digital innovation, and cost efficiency.

A key priority is the acceleration of the transition to a fully Shariah-compliant banking model, in line with SBP guidelines.

Additionally, the Bank will continue expanding its digital services with enhanced cybersecurity measures and will introduce Al powered financial solutions to improve customer experience and operational efficiency.

The Board commended BOP's management for its pivotal role in executing key initiatives under the Chief Minister of Punjab's programs, including the Kissan Card, Livestock Card, Student Bike Scheme, Dhee Rani Card, Minority Card, and Asaan Karobar Finance & Card Schemes.

These initiatives have been successfully facilitated through BOP's robust digital banking infrastructure.

Furthermore, the Bank has played a key role in the successful execution of the CM Punjab Apni Chat Apna Ghar scheme, which facilitates home financing for low- and middle-income families.

The Board recognized that, with a clear vision, strong leadership, and robust financial position, BOP is well-positioned to continue its growth trajectory, delivering greater value to its customers, investors, and the broader economy.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

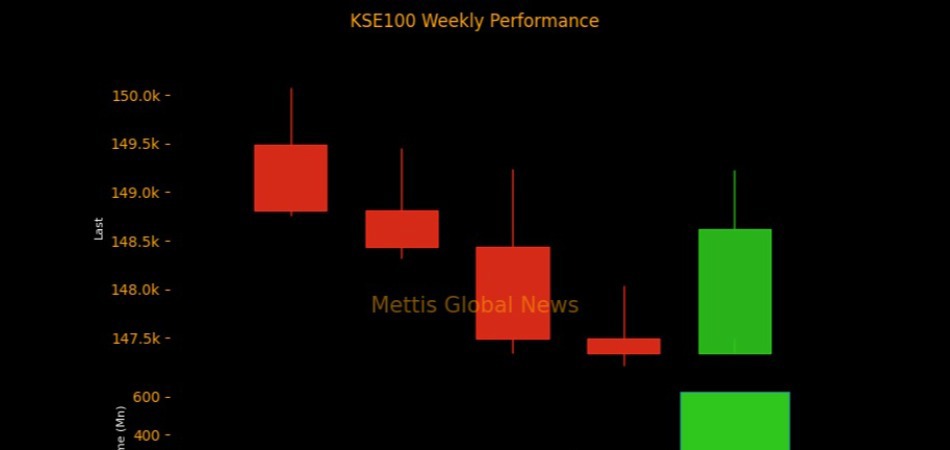

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 0.00 0.00 | -510.00 -0.47% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 0.00 0.00 | 0.00 0.00% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI