BIPL sale and Mistreatment of Minority Shareholders

Nilam Bano | March 07, 2023 at 09:10 AM GMT+05:00

March 07, 2023 (MLN): JS Group, a prominent Pakistani conglomerate, has come under fire for alleged discriminatory behavior towards minority shareholders of BankIslami Pakistan Ltd. (BIPL) in a recent transaction that appears to have some anomalies.

The transaction in question involves the sale of 21.26% of BIPL shares by Jahangir Siddiqui & Co Ltd (JSCL) to JS Bank Ltd (JSBL). On Feb 16th, announced it would sell BIPL shares to the latter, subject to regulatory approvals and shareholder consent.

It mentioned that BIPL shares shall be sold against consideration of new 266,747,496 shares of JSBL (1.1318 shares of JSBL for every BIPL stock), as per a valuation carried out by an independent evaluator.

Then on March 3rd, JSBL announced plans to acquire 42.45% of BIPL shares without cash consideration or right shares. Instead, it would issue 532,629,349 new shares of JSBL to JSCL, and make a public offer for a maximum of 24.88% of BIPL equity, against consideration of up to 59.56% of JSIL shares and up to 67.90% of JSGCL’s.

This offer would be made in compliance with Listed Companies (Substantial Acquisition of voting shares & Take Over) Regulations 2017, it added. All of it seems fine and within the regulatory ambit of the SECP’s SRO from Sept 30, 2022.

The amendments state that “the acquirer must make an intimation within 180 days for making the public offer. If no announcement is made within the prescribed timelines, the earlier offer on the original terms will continue to be valid and binding on the acquirer, and the closing date of such a public offer will be extended to the date of closure of the public offer under the last subsisting competitive bid(s).”

The 90-day average closing price of the respective security before the public offer will be considered for calculating the consideration for existing as well as new securities. These amendments aim to ensure transparency and fairness in the acquisition of voting shares and takeovers, bringing Pakistan's securities regulations in line with international best practices.

The issue lies with the underlying discrimination against minority shareholders of JSCL, who will receive new shares of JSBL, while the public offer will be made against the consideration of shares of JS Group's (JSGCL and JSIL).

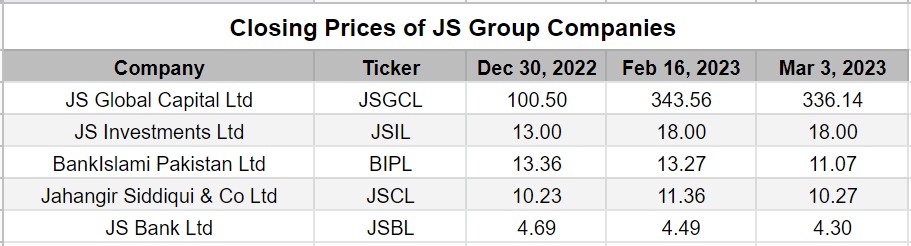

In addition, the market capitalization of JSGCL and JSIL has substantially increased in recent months, without any material information issued by the companies. Meanwhile, the average price of 90 days stood at Rs16.45 per share and Rs246 per share for JSCIL and JSGCL, respectively.

.jpg)

.jpg)

It should be noted that the free float of JSGCL is only 10% and that of JSIL 18%, while the remaining shareholding is owned by JS Group’s associated companies. Therefore, their shares may not be easily tradable due to illiquidity, raising concerns about potential share price management. Year-to-date, the price of JSGCL shares surged by 3.3x to Rs300 while that of JSIL also increased almost 35% to Rs18.

This has led to some concerns about the mistreatment of minority shareholders. The move could set a bad precedent for other conglomerates in the market who might leverage similar avenues to push the sale of equity in associated companies to minority shareholders. Yet, the PSX and the SECP have not taken any action to investigate the matter or demanded an explanation from the concerned companies. This is surprising since the regulators have in the past always acted promptly to seek explanations about any considerable price appreciations in stocks.

It’s also unfair to some BIPL shareholders who might have a strict Shariah mandate as they will be paid in shares of non-Islamic companies. Either the group should offer cash against BIPL’s shares to the minority shareholders so they can take a smooth exit. Otherwise, the PSX and SECP must take swift action to investigate the matter and protect the interests of minority shareholders.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction