APL’s profits jump by 3x YoY in 9MFY22

MG News | April 21, 2022 at 01:52 PM GMT+05:00

April 21, 2022 (MLN): Attock Petroleum Limited (APL) posted a remarkable growth its net profits during 9MFY22 clocked in at Rs11.25bn (EPS: Rs113), up by 3x YoY, largely due to volumetric sales.

The top line of the company expanded by 77%YoY to Rs 241bn in 9MFY22 as compared to Rs135bn in SPLY, due to n jump in volumes by 18% YoY (volumes of MS and HSD climb up by 19% and 40% YoY) and massive surge in prices of petroleum products, a report by Arif Habib Limited noted.

On account of higher inventory gains realized in the period under review, the gross margins of the company increased to 8.75% from5.65% in 9MFY21.

In addition, the other income of the company surged to Rs1.2bn, compared to Rs943 million in the same period last year while the company received Rs300mn net impairment reversal on financial assets in 9MFY22.

Meanwhile, the company paid Rs5.42bn in terms of operating expenses.

More notably, financial income increased by 16%YoY to Rs1.15 while the company bore the financial charges of Rs1bn in 9MFY22.

On the taxation front, the effective tax rate has come to 29.2% from 28.87% in the SPLY.

|

Profit and Loss Account for the Nine months ended March 31, 2022 ('000 Rupees) |

|||

|---|---|---|---|

|

|

Mar-22 |

Mar-21 |

% Change |

|

Sales |

262,518,173 |

159,194,898 |

64.90% |

|

Sales tax and other govt levies |

(21,481,914) |

(23,496,179) |

-8.57% |

|

Net sales |

241,036,259 |

135,698,719 |

77.63% |

|

Cost of products sold |

(219,942,808) |

(128,031,533) |

71.79% |

|

Gross profit |

21,093,451 |

7,667,186 |

175.11% |

|

Other income |

1,202,181 |

943,816 |

27.37% |

|

Net impairment reversal on financial assets |

300,608 |

(234,054) |

- |

|

Operating expenses |

(5,417,185) |

(2,697,350) |

100.83% |

|

Operating Profit |

17,179,055 |

5,679,598 |

202.47% |

|

Finance income |

1,149,047 |

989,846 |

16.08% |

|

Finance costs |

(1,072,698) |

(1,114,426) |

-3.74% |

|

Net finance income |

76,349 |

(124,580) |

- |

|

Share of loss/profit of associated companies |

(166,216) |

(22,522) |

638.02% |

|

Other charges |

(1,184,743) |

(381,227) |

210.77% |

|

Profit before taxation |

15,904,445 |

5,151,269 |

208.75% |

|

Provision for income tax |

(4,657,487) |

(1,487,229) |

213.17% |

|

Profit for the period |

11,246,958 |

3,664,040 |

206.96% |

|

Earnings per share - basic and diluted (Rupees) |

113.00 |

36.81 |

206.98% |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

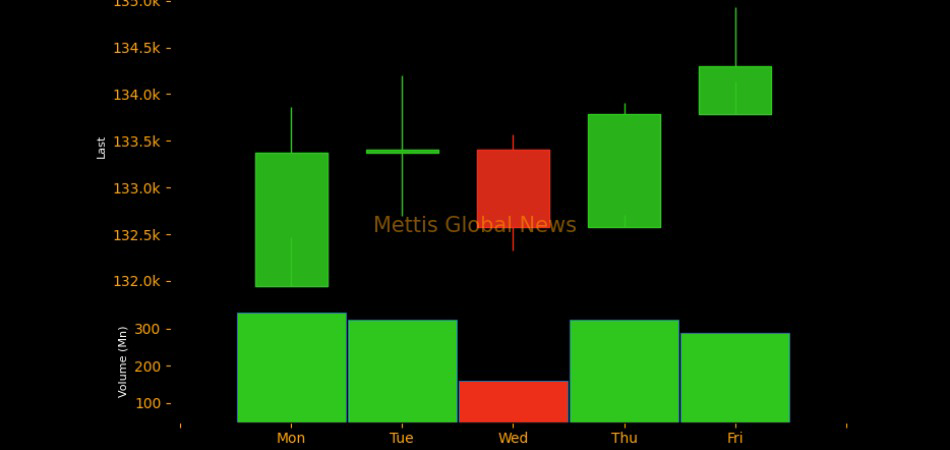

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|