Another brick in the wall of cement profits in 1HFY25

Sara Ateeq | March 27, 2025 at 02:46 PM GMT+05:00

March 27, 2025 (MLN): Pakistan's listed cement sector has shown notable growth in 1HFY25, with profit after tax (PAT) up by 30.36% to Rs86 billion.

A key driver behind this performance is the improvement in gross profitability, which jumped by 14.34%.

While operational expenses rose by 15% due to increased distribution costs, operating profit still posted a solid 14.16% gain.

However, despite a decline in overall industry demand during 1HFY25, exports provided a silver lining with a 32% increase, driven primarily by sea-based shipments.

| Consolidated statement of profit and loss for 1HFY25 December 31, 2024 (Rupees in '000) | 2024 | 2023 | %Change |

| Revenue | 460,578,371 | 434,445,671 | 6.02% |

| Cost of Sales | 314,157,661 | 306,392,550 | 2.53% |

| Gross Profit | 146,420,711 | 128,053,121 | 14.34% |

| Administrative Expenses | 8,759,962 | 8,080,824 | 8.40% |

| Distribution Cost | 16,302,448 | 14,181,885 | 14.95% |

| Other expenses | 6,355,933 | 5,056,568 | 25.70% |

| Total operating expense | 31,418,342 | 27,319,277 | 15.00% |

| Operating profit | 115,002,368 | 100,733,844 | 14.16% |

| Net impairment reversal on financial assets | 70,303 | - | |

| Changes in fair value of biological assets | 240,827 | 207,287 | 16.18% |

| Net Impairment Losses | 330,000 | 177,000 | 86.44% |

| Other Income | 19,332,159 | 15,346,527 | 25.97% |

| Gain on assets held at fair value | 7,553 | 190,663 | -96.04% |

| Finance cost | 28,194,802 | 35,986,192 | -21.65% |

| Share of Profit | 13,131,287 | 10,662,856 | |

| Profit before income tax / final tax /levy | 119,259,695 | 91,534,125 | |

| Income tax / final tax /levy | 751,641 | 1,550,780 | -51.53% |

| Profit Before Taxation | 118,508,055 | 89,983,345 | 31.70% |

| Taxation | 32,506,210 | 23,561,771 | 37.96% |

| Profit after Taxation (PAT) | 86,001,844 | 65,970,774 | 30.36% |

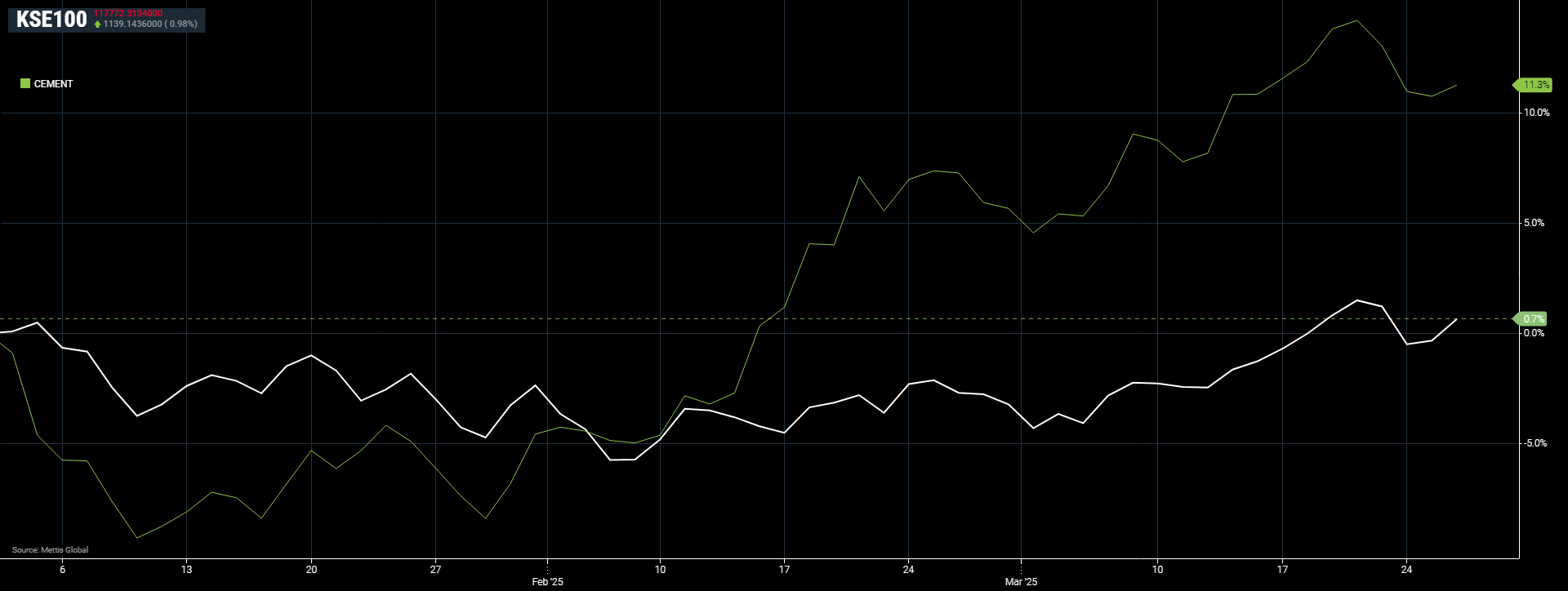

The cement sector outperformed the KSE-100 index during the CY25TD, with LUCK being the top performer in the cement sector.

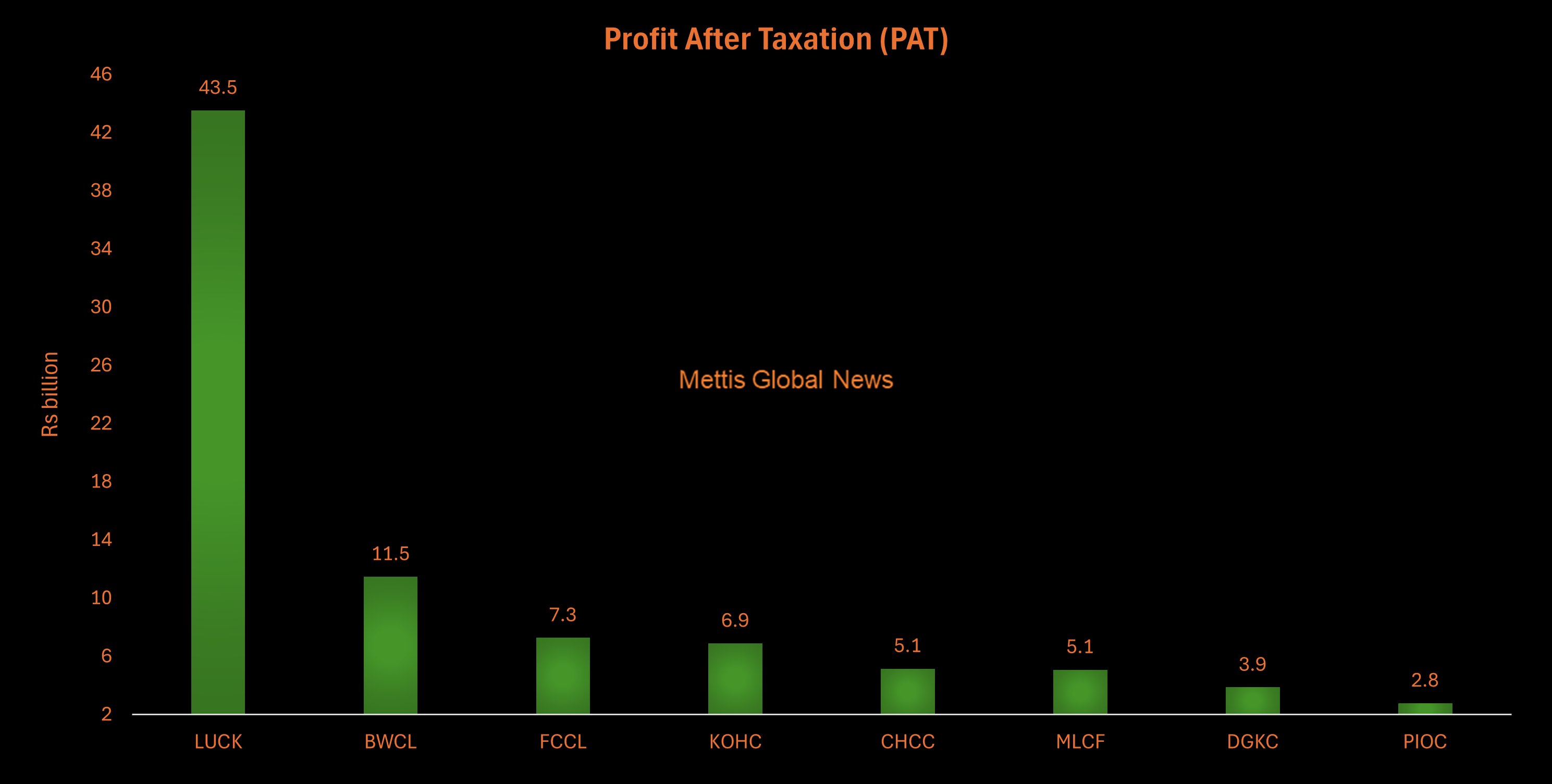

LUCK posted an impressive PAT of Rs43.52bn, outpaced Bestway Cement Limited (BWCL) and Fauji Cement Company Limited (FCCL), which recorded Rs11.47bn and Rs7.27bn, respectively.

Pre-tax profit growth was highest for BWCL at 65% (Rs17.8bn), followed by FCCL at 44.5% (Rs11.70bn), while LUCK posted a modest 13.8% increase (Rs54.09bn)

Higher taxation affected all three companies, with BWCL’s tax burden rose by 57.9% (Rs6.32bn) and FCCL’s by 57% (Rs4.43bn). LUCK faced a lower tax hike of 15% (Rs10.57bn).

Even after taxation, LUCK’s earnings per share (EPS) of Rs134 significantly outperformed BWCL (Rs19.23) and FCCL (Rs2.96).

LUCK remained the market leader in revenue, with an 8.7% increase in revenue to Rs224.48bn. FCCL, however, recorded the highest revenue growth rate at 18.6%. The total revenue of FCCL climbed to Rs47.8bn, fueled by stronger sales.

BWCL saw the slowest revenue growth at just 1.3% to Rs55.6bn.

BWCL and FCCL capitalized on controlled expenses and investment income, recorded 28.3% and 38.6% increases in operating profit, respectively.

LUCK, however, saw almost no movement in operating profit, up by 0.9% to Rs51.86bn.

This stagnation was due to a sharp 23.7% rise in distribution costs, despite administrative expenses slightly declined.

LUCK and BWCL's finance costs declined by 22.6% and 19.3%, respectively, reduced pressure on their bottom lines.

FCCL, however, faced a 20% increase in finance costs, which impacted overall profit. Other income played a crucial role in FCCL’s success, up by 93.5%, while BWCL also saw a strong 56.8% rise. LUCK’s other income grew modestly at 6.5%.

| Earnings snapshot – cement sector (Rupees in '000) | ||||||||

| Consolidated profit and loss statements for 1HFY25 | LUCK | BWCL | FCCL | KOHC | CHCC | MLCF | DGKC | PIOC |

| Revenue | 224,479,019 | 55,604,403 | 47,844,363 | 20,663,391 | 20,301,996 | 34,747,988 | 40,145,909 | 16,791,302 |

| Cost of Sales | 159,361,249 | 35,195,133 | 31,059,263 | 11,884,923 | 12,606,972 | 22,208,269 | 31,161,740 | 10,680,112 |

| Gross Profit | 65,117,770 | 20,409,270 | 16,785,100 | 8,778,469 | 7,695,024 | 12,539,719 | 8,984,169 | 6,111,190 |

| Administrative Expenses | 4,105,230 | 914,860 | 848,578 | 372,218 | 293,259 | 1,259,934 | 715,343 | 250,540 |

| Distribution Cost | 9,151,750 | 812,034 | 1,402,612 | 100,694 | 408,778 | 2,390,476 | 1,958,752 | 77,352 |

| Other expenses | 2,387,475 | 959,023 | 811,953 | 562,591 | 359,929 | 461,533 | 342,920 | 470,509 |

| Total operating expense | 15,644,455 | 2,685,917 | 3,063,143 | 1,035,502 | 1,061,966 | 4,111,943 | 3,017,015 | 798,401 |

| Operating profit | 49,473,315 | 17,723,353 | 13,721,957 | 7,742,966 | 6,633,058 | 8,427,776 | 5,967,154 | 5,312,789 |

| Net impairment reversal on financial assets | - | - | - | - | - | - | 70,303 | - |

| Changes in fair value of biological assets | - | - | - | - | - | - | 240,827 | - |

| Net Impairment Losses | - | - | - | - | - | 330,000 | - | - |

| Other Income | 10,740,161 | 718,627 | 386,959 | 3,055,971 | 871,043 | 1,212,946 | 2,268,476 | 77,976 |

| Gain on assets held at fair value | - | - | - | - | - | - | 7,553 | |

| Finance cost | 14,874,491 | 4,597,569 | 2,408,546 | 209,751 | 382,275 | 2,090,608 | 2,791,267 | 840,295 |

| Share of Profit | 9,183,779 | 3,947,508 | - | - | - | - | - | - |

| Profit before income tax / final tax /levy | 54,522,764 | - | - | 10,589,186 | 7,121,826 | - | 5,755,493 | - |

| Income tax / final tax /levy | 429,980 | - | - | 21,506 | 1,893 | - | 298,262 | - |

| Profit Before Taxation | 54,092,784 | 17,791,919 | 11,700,370 | 10,567,681 | 7,119,933 | 7,220,114 | 5,457,231 | 4,558,023 |

| Taxation | 10,572,044 | 6,324,224 | 4,433,228 | 3,682,753 | 1,971,439 | 2,142,376 | 1,595,031 | 1,785,115 |

| Profit after Taxation (PAT) | 43,520,740 | 11,467,695 | 7,267,142 | 6,884,927 | 5,148,494 | 5,077,738 | 3,862,200 | 2,772,908 |

| Earnings per share (EPS) | 134 | 19.23 | 2.96 | 35.15 | 26.5 | 4.85 | 8.42 | 12.21 |

*EPS in Rs

Future outlook

The cement sector in Pakistan encountered hurdles during 1HFY25, with demand remained under pressure.

According to the quarterly report by Cherat Cement Company Limited (CHCC), overall industry demand declined by 4% during 1HFY25.

While an anticipated reduction in interest rates and eased inflation may support demand in the medium term, the 2HFY25 is expected to remain sluggish due to seasonal factors such as winter, followed by Ramadan and Eid-ul-Fitr.

LUCK

According to the quarterly report, LUCK remains committed to operational efficiency through renewable energy solutions to mitigate energy costs.

The company’s ongoing expansion in Samawah, Iraq, with the addition of a new cement grinding mill and clinker line, is set to enhance operational efficiency and profitability, contributing to a 50% capacity enhancement.

Strong demand is anticipated for its foreign operations, positioning the company for increased capacity utilization. In the power sector, challenges persist due to circular debt and issues in electricity transmission and distribution.

However, the commencement of Thar coal supply next year is expected to improve the merit order and reduce electricity supply costs to the National Grid. LUCK continues to explore new revenue streams and optimize costs to maximize shareholder returns.

BWCL

BWCL maintains its position as one of the lowest-cost producers in the country, providing it with a competitive edge against market challenges.

The management remains vigilant and committed to proactive strategies to ensure the company’s strong performance and superior shareholder returns.

FCCL

FCCL expects local dispatches to remain stable in the next six months, with an improvement in export sales.

The projected decline in inflation and interest rates, along with potential positivity in construction activity towards the end of FY25, could lead to improved market conditions.

The management continues to focus on cost optimization to achieve the best possible results.

KOHC

Kohat Cement Company Limited (KOHC) is advancing its infrastructure development, with plans to finalize the import of plant and machinery upon favorable improvements in the construction sector, according to its quarterly report.

The company has successfully installed and commissioned an additional 5.34MW of solar power, increasing its total solar capacity to 15.34MW.

This project aims to reduce reliance on the National Grid, achieving significant cost savings and contributing to sustainability efforts.

Additionally, the board has approved the establishment of a 30MW coal-fired power plant at its Kohat site.

The Letter of Credit for the import of plant and equipment has been established, and contractor selection for construction and installation is in progress.

Completion is expected by the end of the next financial year, reducing power consumption costs and reliance on the National Grid.

Given the current economic climate characterized by high construction costs and significant taxes and duties on property transactions, Kohat Cement does not anticipate experiencing growth in the current financial year.

However, the company is optimistically considering avenues to mitigate the prevailing challenges and to maximize its business potential.

CHCC

Cherat Cement Company Limited (CHCC) anticipates modest growth in domestic sales while identifying substantial export opportunities, particularly in Afghanistan.

Despite recent disruptions, demand from Afghanistan remains strong in the near term, although political issues may continue to pose challenges.

To counter rising coal and energy costs, the company is optimizing its fuel mix with alternative energy sources.

The installation of a 9 MW solar power plant is underway and is expected to be operational by the third quarter of the fiscal year, reinforcing its commitment to sustainability and cost efficiency.

Additionally, investments in cost-effective production technologies aim to enhance operational efficiency, improve shareholder value, and optimize working capital.

MLCF

According to the quarterly report, Maple Leaf Cement Factory Limited (MLCF) foresees a favorable outlook for the local cement market, driven by government infrastructure expansion and a resurgence in real estate demand.

These factors are expected to create improved sales opportunities and support sustainable growth. The company remains focused on reducing costs to enhance margins.

A sustainable supply chain for alternative fuels has been successfully developed, aligned with its commitment to operational efficiency and environmental stewardship.

This initiative is expected to reduce carbon emissions while delivering cost savings and enhanced profitability. Furthermore, Maple Cement is expanding its footprint in the healthcare sector through its subsidiary, Novacare Hospitals (Private) Limited (NHPL).

NHPL is currently developing its first hospital in Islamabad, with land acquisition completed and construction progressing as planned.

DGKC

DG Khan Cement Company Limited (DGKC) is leveraging export opportunities to cover fixed costs and strengthen foreign exchange reserves despite ongoing industry challenges.

The company’s improved gross profit margin reflects the success of its operational efficiency initiatives, which have been instrumental in mitigating cost pressures.

DGKC remains committed to resilience, forward-looking strategies, and continued operational efficiencies, reinforcing its long-term focus on shareholder value.

PIOC

Pioneer Cement Limited (PIOC) remains dedicated to enhancing cost efficiency, building on past achievements, and improving process efficiencies, according to the quarterly report of the company.

The company will continue its strategic focus on premium markets, which has been effective in the past and remains central to its approach moving forward.

However, the cement industry faces challenges ahead. The rise in gas tariffs and levies on captive power plants threaten future profitability, while domestic cement demand dropped by 10%.

Given the crucial role of the cement industry in national infrastructure and development, it would be prudent for the government to reconsider these inflationary measures.

A rationalized tax structure could help reduce costs for end-consumers and stimulate construction activity, fostering economic growth.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction