Analyst Briefing: Six newly approved products to add Rs 150 million in AGP’s revenue

MG News | December 23, 2020 at 03:34 PM GMT+05:00

December 23, 2020 (MLN): AGP Limited, a shariah compliant pharmaceutical and a subsidiary of OBS, recently conducted an analyst briefing session to discuss the latest financial performance of the company and its future roadmap.

The company posted net profits of Rs 414 million (EPS: Rs 1.48) during 1QFY21, as opposed to the profits of Rs 321 million (EPS: 1.15) in the same quarter of last year.

As per the management, the profitability of the company is attributable to higher sales volume which showed a growth of 30% YoY, owing to consistency in covid-19 cases. According to the key notes covered by Darson Securities, the management expects the company to continue its upward trajectory growth of double digit in future.

The gross margins of the company clocked in at 52.15% down from 56.96% in the previous quarter of last year largely due to PKR devaluation and one-off provision for imported antibody testing kits.

To highlight, AGP is a part of the OBS group and around 52.98% of its shares are owned by Aitkenstuart Pakistan, followed by Muller and Phillips (Pakistan) (Private) Limited (13.54%), Baltoro Growth Funds (9%), Aspin Pharma (Pvt.) Limited (4.79%) and others (1.2%).

AGP’s main products include, Rigix, Ceclor, Osnate-D and Anafortan Plus. Rigix have market share of around 54% and it is antihistamine drug, which is the part of COVID-19 drugs. In addition, 6 more products of the company have been approved by the government which are expected to contribute around Rs150 million to the topline of the company, the report highlighted.

Commenting on the business expansion plan, the management of the company informed that they are currently looking for inorganic growth expansion or diversification which will help in further growth in company’s revenue.

With regards to drug prices, the company said that it has implemented annual price increase in early October in primary market which was then implemented in secondary market in early November, the report said.

Furthermore, this year, company booked capital expense of Rs 400 million and for FY21, the company’s capex is expected to be around Rs 600 million, management stated.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

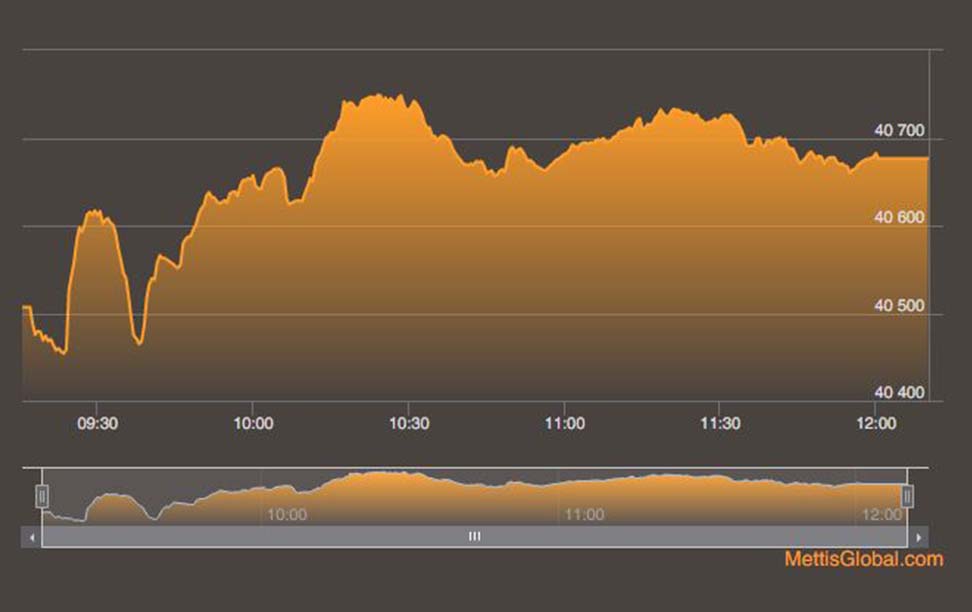

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction