Analyst Briefing: EPCL’s PVC business suffered massively due to COVID-19

MG News | August 11, 2020 at 11:19 AM GMT+05:00

August 11, 2020 (MLN): Engro Polymer and Chemical Limited held its analyst briefing on Monday, wherein it discussed and deliberated upon the latest financial performance of the company as well as its ongoing endeavors.

The company had posted net profits of Rs. 222 million (EPS: Rs 0.24), depicting a colossal decrease of 85.59% YoY as compared to net profits of Rs. 1.54 billion earned in the same period last year. The decline in earnings was a result of lower volumetric sales during the period, owing to lower economic activity stemming from the COVID-19 pandemic.

While commenting on the financial results, the management stated that the decline in demand amidst ongoing pandemic had caused accumulation of inventory, which further caused the prices of PVC to decline. The prices also dropped due to crude oil prices hitting an all-time low but showed massive recovery after the company had to shut down its cracker plant for maintenance purposes.

According to Foundation Securities, even though the demand for PVC fell drastically due to COVID-19, the management informed that some recovery was witnessed after the lockdown was lifted businesses were allowed to operate.

The demand for caustic also fell during the period as the downstream textile sector got severely impacted by the pandemic and ensuing lockdown.

The decline in net profits can also be attributed to factors such as higher gas prices and increased financial cost during the period, with the impact of the latter being somewhat negated by an increase in core delta and IFRS 16 impact.

Regarding the PVC expansion and VCM debottlenecking projects, the management said that some delay was caused in the progress due to the COVID-19 situation, therefore, the projects are now likely to come into being in 2021.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,505.32 213.84M |

1.56% 2125.35 |

| ALLSHR | 85,676.59 518.66M |

1.21% 1028.23 |

| KSE30 | 42,266.08 71.86M |

1.73% 719.85 |

| KMI30 | 194,908.61 73.97M |

1.66% 3188.84 |

| KMIALLSHR | 56,464.98 309.17M |

1.14% 637.25 |

| BKTi | 38,362.12 10.90M |

1.41% 534.51 |

| OGTi | 27,884.68 10.27M |

0.77% 214.00 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,655.00 | 119,915.00 118,035.00 |

-975.00 -0.82% |

| BRENT CRUDE | 68.49 | 69.01 68.31 |

-0.03 -0.04% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 |

0.95 0.99% |

| ROTTERDAM COAL MONTHLY | 104.50 | 0.00 0.00 |

-0.65 -0.62% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.47 | 66.99 66.29 |

0.09 0.14% |

| SUGAR #11 WORLD | 16.75 | 16.82 16.54 |

0.19 1.15% |

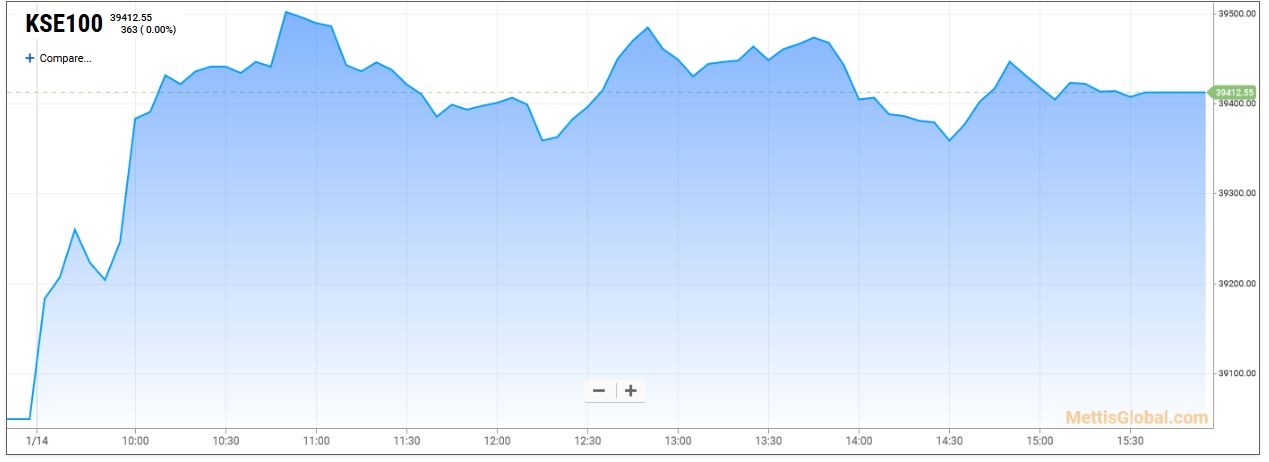

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

PIB Auction

PIB Auction