PKR slumps by 39 paisa per USD

Nilam Bano | November 23, 2022 at 05:04 PM GMT+05:00

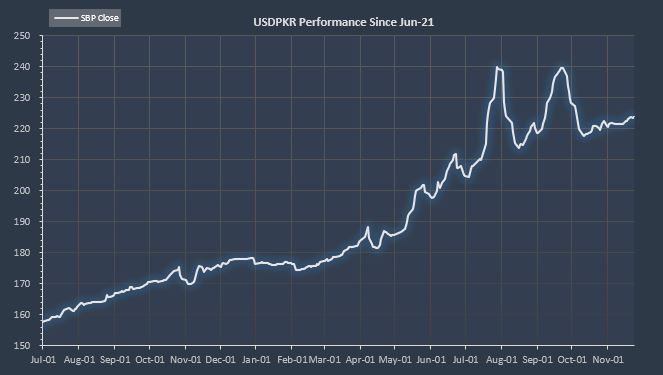

November 23, 2022 (MLN): After taking a breather yesterday, the Pakistani rupee (PKR) joined back its downward course as it depreciated by 39 paisa against the US dollar in today's interbank session. Accordingly, the local unit settled the trade at PKR 223.81 per USD, compared to yesterday's closing of PKR 223.42 per USD.

During the session, the rupee traded in a band of one rupee per USD showing an intraday high bid of 224.01 and low offer of 223.50 while in the open market, PKR was traded at 228.75/231 per USD.

The local unit once again came under pressure amid dwindling macros and political upheaval.

It is pertinent to mention that delay in the IMF’s ninth review and the rising 5-year credit default swap (CDS) have played a crucial role to push PKR towards a bottomless pit.

The cherry on the top, Nomura Holdings, Japan’s top brokerage and investment bank warned Pakistan and seven other nations are now at a high risk of currency crises.

The bank said that 22 of the 32 countries covered by its in-house “Damocles” warning system have seen their risk rise since its last update in May. It meant the sum of the scores generated on all 32 by the model has surged to 2,234 from 1,744 since May.

This is the highest total score since July 1999 and not too far from the peak of 2,692 during the height of the Asian crisis and an ominous warning sign of the growing broad-based risk in EM currencies, the report added.

In FYTD, PKR lost 18.96 rupees or 8.47%, while it plummeted by 47.29 rupees or 21.13% against the USD in CYTD, as per data compiled by Mettis Global.

The currency lost 1.4 rupees to the Pound Sterling as the day's closing quote stood at PKR 266.06 per GBP, while the previous session closed at PKR 264.66 per GBP.

Similarly, PKR's value weakened by 1.8 rupees against EUR which closed at PKR 231.1 at the interbank today.

On another note, within the money market, the overnight repo rate towards the close of the session was 15.10/15.25%, whereas the 1-week rate was 15.05/15.15%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,412.25 167.69M | 0.32% 447.43 |

| ALLSHR | 85,702.96 423.92M | 0.15% 131.52 |

| KSE30 | 42,254.84 82.09M | 0.43% 180.24 |

| KMI30 | 194,109.59 84.37M | 0.15% 281.36 |

| KMIALLSHR | 56,713.67 217.03M | 0.03% 16.37 |

| BKTi | 37,831.34 13.04M | 1.62% 603.62 |

| OGTi | 27,440.63 3.93M | -0.09% -23.70 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,435.00 | 119,740.00 116,460.00 | -860.00 -0.73% |

| BRENT CRUDE | 73.39 | 73.63 71.75 | 0.88 1.21% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 70.27 | 70.51 68.45 | 1.06 1.53% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|